I suggest you take a few minutes a couple times during the week to look at chart for INDU, SPX and COMPQ (the indices) and check out what the market as a whole is doing. There are usually slight variations between the indices. Perhaps, the tech stocks are thriving and the COMPQ is up a higher percent. This will help you to have a good overall perspective of what is taking place in the market and which areas are thriving. This way you are in-the-know!

Here’s What Is Covered Below:

- What are options?

- What is an option chain?

- How do I read a chain?

- Where do I find a chain?

Today, we are going to discuss Options and learn exactly what they are, how they work, and how they can be used to earn extra income. Let’s put the pieces together.

I think of options as the opportunity to gain from of stock’s price movement up or down for a set period of time. In a sense, it is like renting a stock for a specific period of time where you benefit from its move, if you own an option covering that period of time.

Let’s discuss an example and compare an option to owning $300 worth of stock. If XYZ’s stock cost $50, and you wanted to spend $300, you could buy 6 shares and you would own those shares until you sold them. Now, we’ll say that over a 3-month period, XYZ’s shares when up $5 or 10%. Over the 3 months the stock went up a little and down a little, but overall, it went up $5. This is a nice gain over 3 months. So, when you decide to sell you have earned $30 profit over your original investment of $300 or $330 total.

Okay, now let’s discuss options. Let’s say you bought 1 option contract, which includes 100 shares of XYZ. Each option covers 100 shares. So, to purchase the option that covers XYZ for 3-months costs $2.50 a share or $250 for the 100 shares. You now will benefit or lose based on what takes place with XYZ’s price over the next 3 months.

As XYZ’s price goes up and down, your $2.50 premium will increase or decrease a percentage of the premium. The percentage it increases is called Delta. A high Delta is going to cost more, and a lower Delta is going to cost less. Let’s say we select 50% Delta. If the stock were to move up a $1, we would earn $.50 of that and that Delta % will increase as the price moves up and is deeper in-the-money.

Also, during this same 3-month period, our option will lose time value. The option is worth more when it has 3-months for its price to move up. When it only has two-months left it is less valuable, etc. So, a small amount drops off each day. Perhaps, a few pennies and then, later a nickel.

After a month, with 2 months remaining, XYZ’s price has gone up $4. Thirty cents has dropped in time decay and of the $4 price move, our option has gained 75% of that move based on the increased Delta. ($4 minus .30 plus $3 gain (75%) = $6.70). We paid $4.00 or $400 for the 100 share contract, and it is now worth $6.70 or a gain of $270 after holding the contract 30 or the 90 days.

This is a super trade, in the period of 30-days, your option contract went from $250 to $400 as compared to the stock purchase that only gained $50 over 3 months. Again, this is like renting the stocks and gaining from the equity’s price moves over a set period.

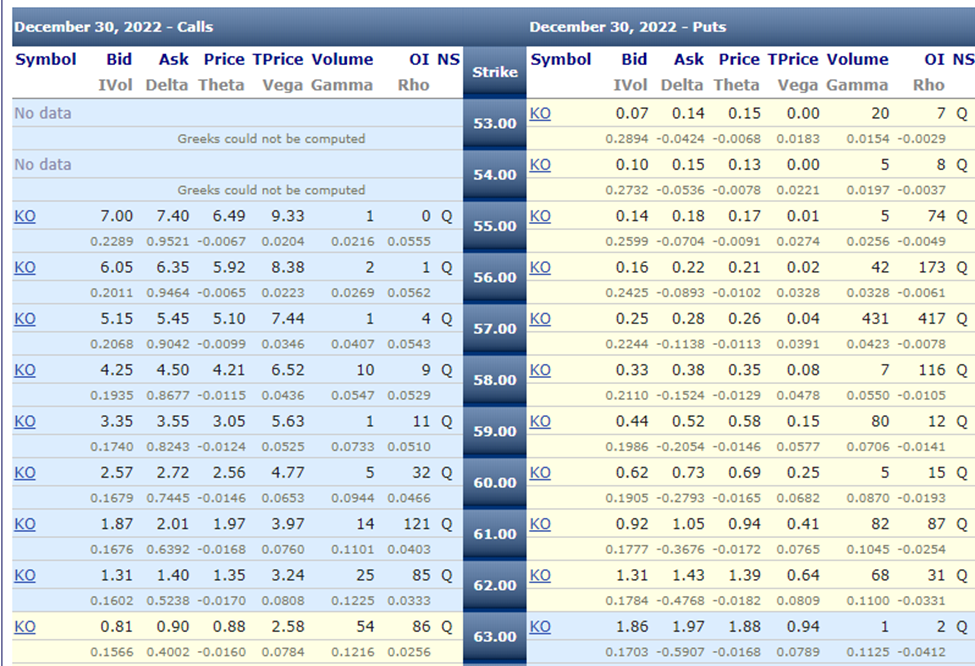

Below is an image of an option chain. Notice the date, showing how far out you will have to gain from its movement. Then, I will post a second option chain for Coca Cola, showing an expiration with more time.

To enter, you would pay the Ask price and receive the Bid when you sell. The difference is a commission fee to the broker. The expiration date on this chart is December 30,2022. Call options are on the right and puts on the left side. Strike prices run down the middle. The Blue strikes are in-the-month, meaning price is already higher than that strike. Yellow is out-of-the-money or higher than the current price on the calls and lower on the puts.

The next chart is out for a longer period of time. You would benefit or lose based on price movement during this period. You can sell and close anywhere along the line until its expiration date. More time of course, adds to the premium per share. Contracts each control 100 shares.

The chain images are from this free site. https://www.optionistics.com/f/option_chains/ko

Your broker will also have option chains on their site.

I hope you find this information useful.

Friday is education day. My goal is to teach everyday people (like me) to successfully trade options. I do my best to write in an understandable way as if we are talking while sitting on the deck of my house in a relaxed atmosphere.

The trading tools you select, and use are important, and can make your trading easier and more effective.

Have a great weekend.

Dwell on positivity. The reason you sometimes don’t see or recognize the miracles created on your behalf is because of the abundance of them. Like now, this moment.

And the next… and this one! You’re doing great!

I wish you the very best,

Wendy

Recent Comments