ORDER TYPES

Market Order:

The most common type of order is the Market Order. Market Orders are used primarily when immediate order execution is required. When entering a Market Order, you state the number of contracts you want to buy or sell.

You do not specify a price, since your objective is to have the order executed as soon as possible at the best possible price. Once a Market Order is placed, it is filled and cannot be canceled. As an example, in anticipation of a decline in tech stocks you want to implement a bearish trade on Microsoft.

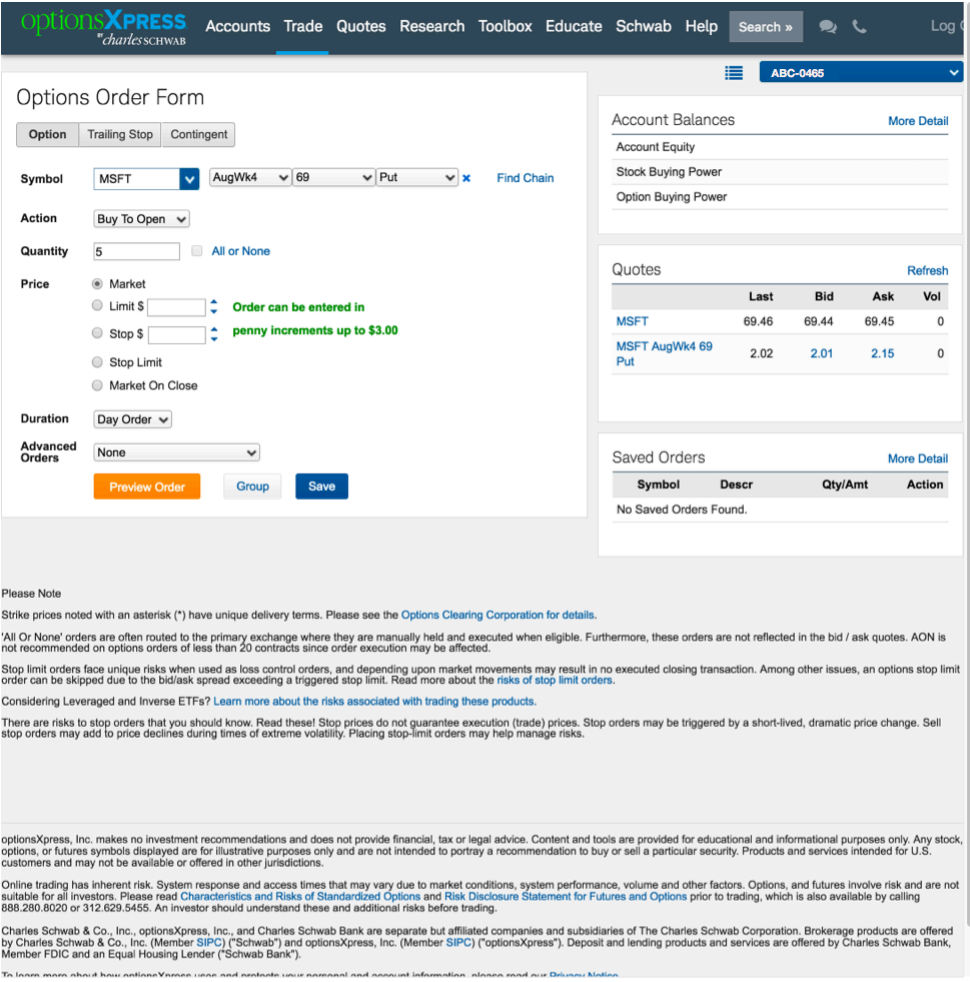

You enter an order to BUY TO OPEN 5 MICROSOFT AUGUST 25, 2017 69 PUTS AT THE MARKET

To enter a Market Order to buy 5 of the puts, you need to provide the following information:

- Account Number: 0465

- Underlying MSFT

- Expire August 25, 2017 (Week 4)

- Strike 69

- Type Put

- Market Action: Buy

- Open or Close: Open

- Quantity: 5

- Order Type: Market

The puts are 2.01 bid / 2.15 ask. Because you are using a market order, your order will be filled at the best possible price, which may be below, at or above 2.15. The key is, the order will be filled immediately. If conditions are normal, you should expect a fill somewhere near 2.15. If conditions are hectic, however, the fill could be drastically different.

Here’s what it looks like using my account at optionsXpress by Charles Schwab.

#

Notice in this example that the expiration date is different: AugWk4.

Schwab provides the month (August) and the week (Week 4). That means the option is a weekly option that expires on the 4th Friday of the month of August, which is August 25.

[NOTE: I have to say that I don’t really like using the Wk# style to designate the

expiration. I’ve seen too many people who use a system like this make too many

unforced errors. For those of you whose broker uses this type of expiration designation, you need to be extra vigilant.]

LIMIT ORDER

A Limit Order specifies a price limit at which the order must be executed. In other words, it must be filled at that price or at a better price.

The advantage is that you know the worst price you will get if the order is executed. The disadvantage is that you cannot be certain that the order will be filled because the market may not trade at your price.

BUY LIMIT

If you want to be sure that when you are buying that you pay no more than some

maximum price, then you use a Buy Limit order. Typically, the order price is lower than the current market price.

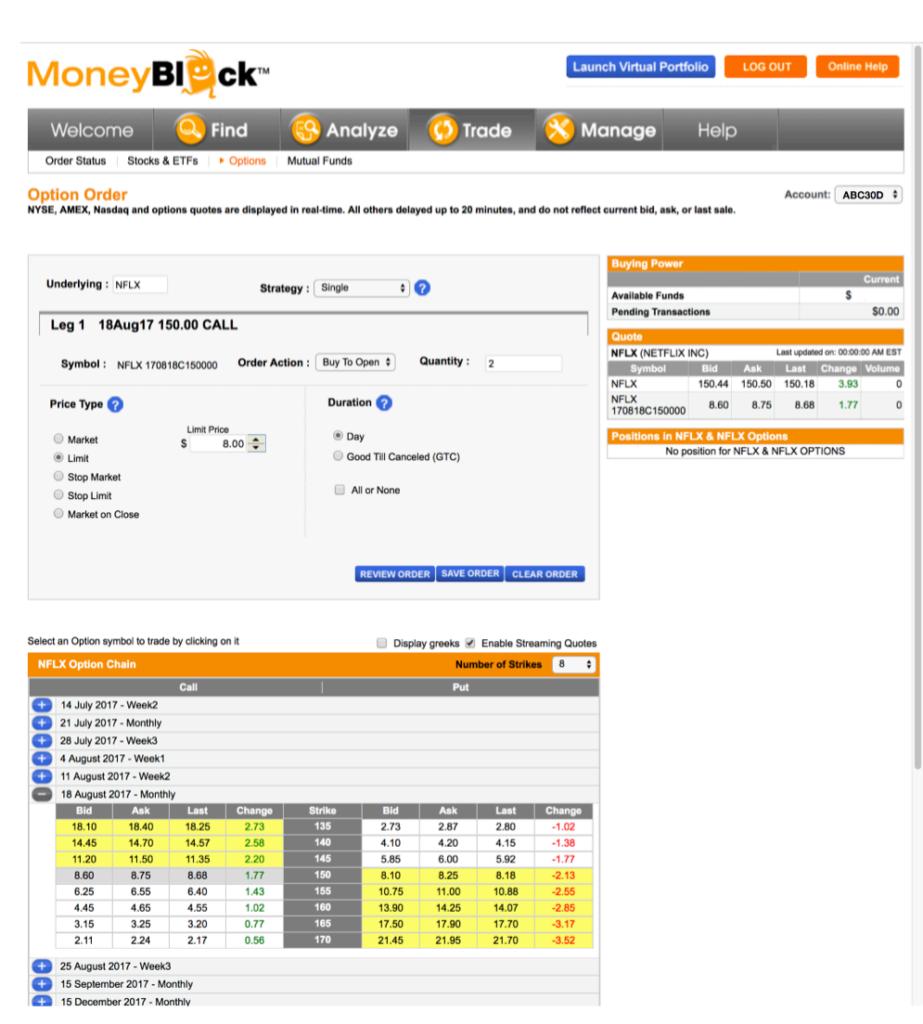

By way of example, the NETFLIX AUGUST 18, 2017 150 CALLS which are trading at 8.60 bid / 8.75 ask. Let’s say you would like to BUY TO OPEN 2 calls but not at the price shown.

You are only willing to buy it if the price is $800 or less. If the price does not come down to what you are willing to pay, you are willing to risk not getting into the trade. To accomplish this, you use a limit order.

To enter a Limit Order to buy these options, which would be an opening transaction, you need to provide the following information:

- Account Number: ABC30D

- Underlying NFLX

- Expire August 18, 2017

- Strike 150

- Type Call

- Market Action: Buy

- Open or Close: Open

- Quantity: 2

- Order Type: Limit

- Price: 8.00

Here is how I enter this trade in my MoneyBlock account:

Notice in this image, there is a table at the bottom called an Option Chain. I simply click on the option I want to trade. That’s pretty easy. Also notice that this platform has the expiration date and the week of the month. It’s like a combination of Fidelity and optionsXpress. Above the chain is the trade itself. Because this is a limit order, the order can only be filled at the Limit Price of 8.00 or better. Because I am buying, the “better” price is lower. If the market never trades that low you will not be filled.

You may not be filled even if the market trades at 8.00 but not lower because there is no guarantee that enough contracts changed hands at that price to fill all orders. If the market trades below 8.00 you are filled at your price or lower.

Remember that the only time you can be certain your order was filled is if the market trades better than the stated price. When buying, a better price is lower than the stated price. When selling, a better price is higher than the stated price.

SELL LIMIT

If you want to be sure that when you are selling that you receive some minimum price, then you use a limit order. Typically, the order price is higher than the current market price.

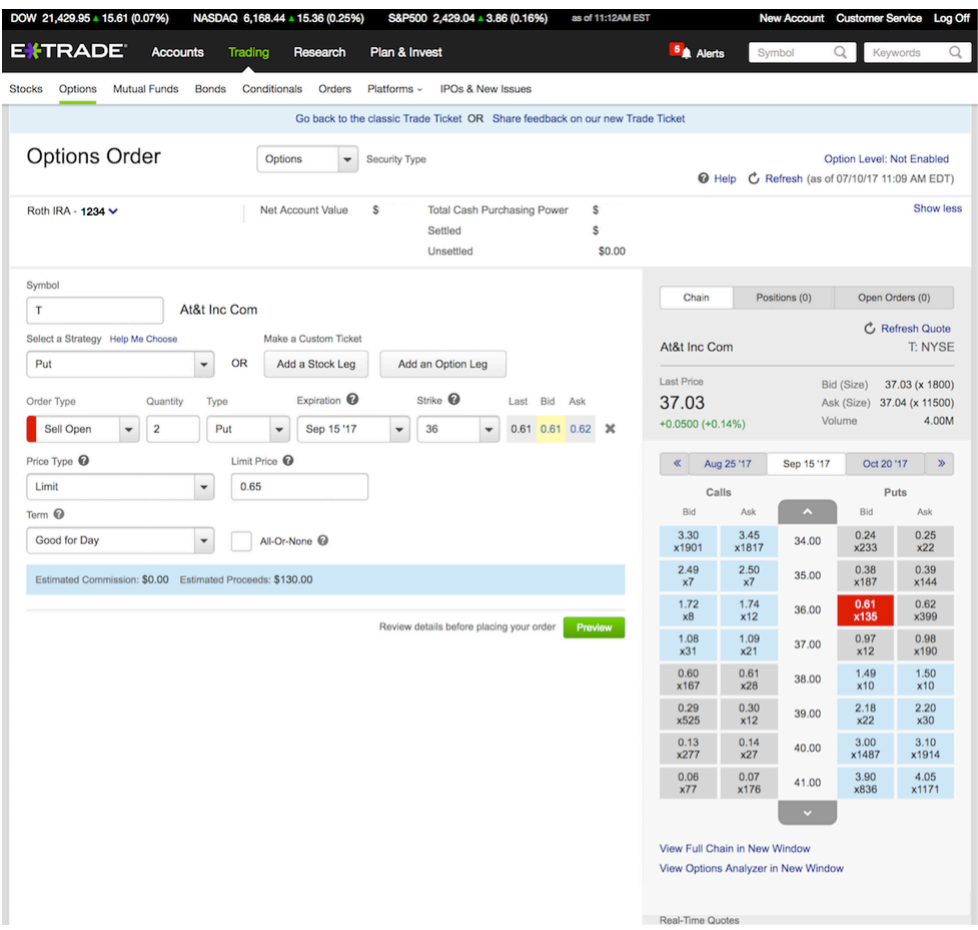

By way of example, the AT&T SEPTEMBER 15, 2017 36 PUT which is trading at 0.61 bid / 0.62 ask. Let’s say you would like to SELL TO OPEN 2 puts (instead of

implementing a covered call), but you want a better price than 0.61.

You are only willing to sell the option if the price is at least 0.65, or $65 per option. If the price of the puts does not rise up to what you are willing to accept as payment for selling the put, you are willing to risk not getting into the trade. To accomplish this, you use a limit order.

To enter a Limit Order to sell this option, which would be an opening transaction, you need to provide the following information:

- Account Number: Roth IRA-1234

- Underlying T

- Expire September 15, 2017

- Strike 36

- Type Put

- Market Action: Sell

- Open or Close: Open

- Quantity: 2

- Order Type: Limit

- Price: 0.65

Here is how one of my employees would enter this trade in his ETrade account:

#

The order can only be filled at the stated price of 0.65 or higher (better). You will not be filled if the market does not trade at 0.65 and may not be filled even if it does. The market must trade higher than 0.65 for you to be sure that the order was filled.

NOTE: There are conditions where the price shown on your screen is above your minimum price, but you still want to use a limit order. In this case, the market is experiencing substantial volatility and you want to be sure that you get a minimum price. So, you use a limit order to make sure that by the time your order is directed to a market maker, the price hasn’t dropped below your minimum price.

I typically always use a limit order to prevent such an occurrence, thereby avoiding a bad fill on my trade.

STOP ORDER

A Stop Order specifies a price that, when reached, converts the Stop Order into a Market Order. By placing a Stop Order you are saying that you want to buy or sell on a Market Order, but not at the current market price level. You want the market to trade at a certain price before your order is executed.

BUY STOP

When using a Buy Stop, you are specifying a certain price where you want the option to trade, before a buy order is executed at a price that is higher than the current option price.

As an example, assume your technical analysis indicates that if the market moves

higher, it is exhibiting strength, and you want to profit from further strength.

Right now, SPY is trading at 242.64. The current at-the-money strike is 243. The 243 call for the September 15, 2017 expiration is 3.97 bid / 3.98 ask.

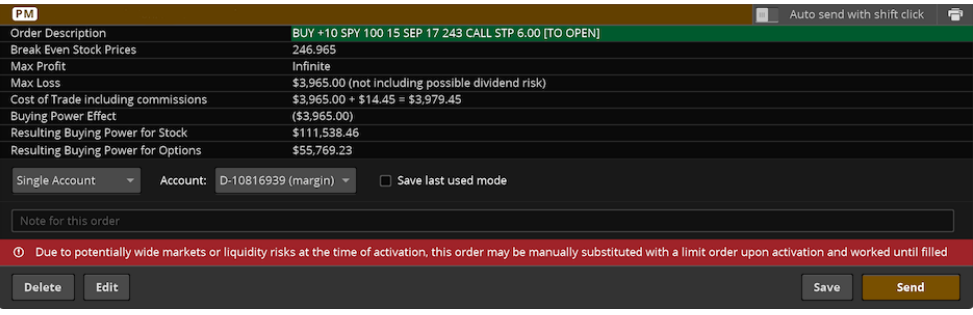

You believe that if SPY breaks out such that the SPY SEPTEMBER 15, 2017 243 CALL trades above 6.00, SPY will have broken out to the upside and you want to be long those calls. You place an order to BUY TO OPEN 10 of the calls on a stop should the calls trade at 6.00.

To enter a Stop Order, provide the following information:

- Account Number: ABC2468

- Underlying SPY

- Expire September 15, 2017

- Strike 243

- Type Call

- Market Action: Buy

- Open or Close: Open

- Quantity: 10

- Order Type: Stop

- Price: 6.00

Here is how one of my employees would enter this trade in his Think or Swim account:

In a textbook situation, if the market trades (or is “offered”) at 6.00 or higher, your StopOrder will become a Market Order and your order will be filled. Your fill may be 6.00, but it may be higher or lower.

If you had entered the Limit Order to BUY 10 SPY SEPTEMBER 15, 2017 243 CALLS, when the ask price was 3.98, you would have been filled immediately because 3.98 is a better price than 6.00. Your Stop Order tells the broker to wait until the market reached 6.00 before doing anything.

SELL STOP

When using a Sell Stop, the price you want the option to trade at is below the current price. It is often used to protect an existing position from further loss.

Here’s an example using USO, which is the United States Oil Fund, an ETF (exchange traded fund). Let’s assume that you were bullish on Oil and had previously purchased 10 of the USO AUGUST 18, 2017 9 CALL at a price of 0.46.

Now that you are long those calls, you want to try to protect the position against a loss that is worse than 50%, in case you are wrong and USO shares fall. To do that, you would use a SELL TO CLOSE stop, with the price set at half of what you paid.

To enter a Stop Order, provide the following information:

- Account Number: ABC2468

- Underlying USO

- Expire August 18, 2017

- Strike 9

- Type Call

- Market Action: Sell

- Open or Close: Close

- Quantity: 10

- Order Type: Stop

- Price: 0.23

Here’s what it looks like in Think or Swim:

#

If the market trades (or is “bid”) at 0.23 or lower, your Stop Order will become a Market Order and will be filled. Your fill may be 0.23, but it also may be higher or lower. If the market does not trade as low as 0.23, your order will not be executed and you will still be long the 10 options at the end of the day.

NOTE: You need to be very careful using stop orders on options. If the options are illiquid, there can be extended periods where the options do not trade even while the stock price fluctuates. This can cause large gap moves in the options when an order is placed and filled. As a result, stops can be triggered and your option is at a price that is nowhere near where you placed your stop.

Some brokers realize this, and may modify your stop order such that when triggered, the broker will convert the trade into a limit order instead of a market order. The section in red in this confirmation from Think or Swim illustrates this.

GTC ORDER

In nearly every trading platform, the order you entered is good for that particular day only. If the order is not filled by the end of the day, the order expires unfilled.

Good Till Canceled Orders (also known as Open Orders, or GTC) do not cancel until the option expires. By designating a Limit Order or a Stop Order as Good Till Cancelled, the Limit Order or Stop Order will remain valid and working until it you cancel the order, or it is filled, or the option expires.

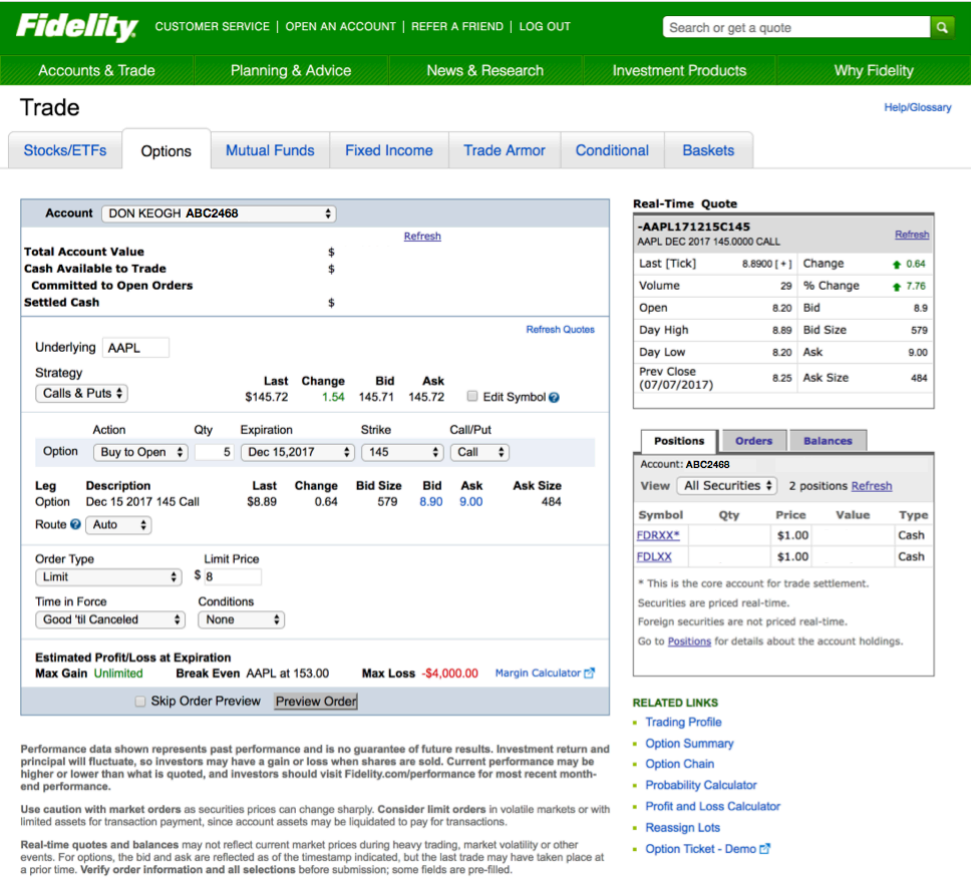

Here’s an example using Apple. Let’s say you want to BUY TO OPEN 5 near-the-money call options on Apple that expire on December 15, 2017. The APPLE DECEMBER 15, 2017 145 CALL is 8.90 bid / 9.00 ask. At 9.00, 5 of those calls would cost $4,500. You determine that is too high. But if the price drops to 8.00, 5 calls would cost $4,000.

That is within your price range. You decide that if the price drops to 8.00, you want to buy 5 of those options. As noted before, we can use a limit order to accomplish that. But because option orders expire at the end of the trading session, if you’re not filled at the limit, you need to reenter the limit order every morning until you are filled, or the option expires.

By using a Good Till Canceled order, however, we do not need to re-enter the order. Instead, the order remains “open” and active, until you cancel the order, your order is filled, or the option expires.

To enter a GTC Limit Order to buy the 5 Apple call options, you need to provide the following information:

- Account Number: ABC2468

- Underlying AAPL

- Expire December 15, 2017

- Strike 145

- Type Call

- Market Action: Buy

- Open or Close: Open

- Quantity: 5

- Order Type: Limit

- Price: 8.00

- Time in Force Good Till Canceled

Here’s what it looks like in Fidelity:

As noted before, the order will remain valid and working until it is filled, until you cancel it, or until the option expires.

NOTE: Don’t make this mistake. If you go on vacation and come back and decide to just buy the call at a higher price, and you do so by entering an all new order, realize that your existing order is NOT canceled. Buying the option via a different order does not automatically cancel the earlier GTC Order.

GTC ORDERS DO NOT CANCEL AUTOMATICALLY! YOU MUST ALWAYS CANCEL A GTC ORDER IF YOU NO LONGER WANT IT WORKING!

From Your Quick Start Guide to Options Success, Want the full e-Book?

Recent Comments