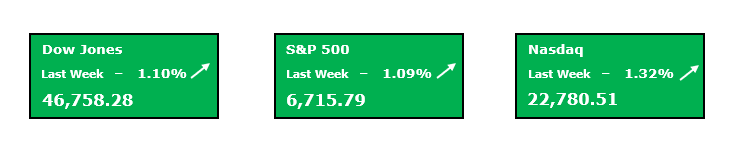

Headed into last week, seemingly the biggest story was set up to be the market’s reaction to the September Job’s report. However, sometimes you can be thrown a bit of curve ball and that’s exactly what we got. As we had mentioned, there was the risk of a government shutdown occurring last week, but most had hoped the shutdown and any related disruptions would be avoided. Investors were hoping to get the Job’s report on time last Friday morning and to get a result that would help to confirm an additional rate cut at the upcoming meeting. This of course is not how the events of last week played out. We ended up getting the shutdown, delaying the crucial Job’s report release, and as of writing this newsletter, still no deal has been reached to end it. Now, credit to the market, investors took the shutdown news in stride as they largely looked through it. Following the official beginning of the shutdown, markets almost across the board marched to new all-time highs, continuing the powerful buying trend that began the week prior. Even though we raised the potential market risks of this jobs data being delayed, in an odd way, I think this may have even been a catalyst for the market to rally last week. This market is still acutely focused on the Fed cutting rates and getting them lower. Right now, the overwhelming trajectory of labor market data is clear, it is steadily moving lower signaling real softening. This was only further confirmed in the ADP employment data that we actually did get last week. The Fed was already highly likely to be on the path towards another rate cut at this month’s meeting, but this data point being delayed likely removed any doubt. In a backdrop of a clearly weakening labor market, with the uncertainty of not having this data point, the thought is that it only will make the Fed more cautious and actually lean more dovish in the event the labor market is weakening faster than they may realize. It was largely this belief that powered all four major U.S. stock indexes to multiple new highs last week. The shutdown, for this reason and several others, likely only served to cement that the Fed will act again later this month and move rates lower once again. This is exactly what the market wants to see, and it is now beginning to be priced in.

The technicals for this market overall remain stellar quite frankly. After another week filled with new all-time highs, it is hard to try and poke holes in the narrative strictly from a technical perspective. Sure, there are valuation questions that linger, but strictly looking at the charts, we continue to see impressive strength unfold as this market keeps climbing to new highs. In addition to seeing the S&P 500 index itself climb to several new highs, we also saw the equal weighted version also make several consecutive highs last week. This was significant because the headline index has made numerous new highs in the past two months, while the equal weight counterpart has largely remained rangebound in sideways trading, failing to break through resistance on many occasions. However, as stocks rallied broadly last week on the belief that another rate cut is on the way in a few weeks, we saw a healthy improvement in market breadth and participation to the upside. Seeing the equal weighted S&P begin to now break out once again is a welcome sight as we begin the final quarter of the year. Certainly, the market will be due for a correction at some point in the future but this strong and improving technical picture for stocks is a nice tailwind for the next few months.

✨ Unlock the power of precision trading with my WPO Newsletter—recent picks hit 52.4% & 117.4% peak gains in just weeks (past performance is not indicative of future results). Your first month is just $1—sign up now and seize your edge! 🏆

Key Events to Watch For

- Fed Member Speeches

- Federal Government Shutdown Updates

Last week we were watching for any potentially market-moving headlines from the litany of Fed members that had speaking events. Fortunately for markets, these events were pretty tame, providing few ‘fireworks’. The main theme of these speeches was that Fed members are going to remain dependent on the data and some continued to express hesitation about lowering rates too quickly unless the data deems it necessary. This week there are even more Fed member speaking events, in fact there is at least one speaking event each day and some days have several. So we are in for another week that will feature another heavy dose of Fed speak as we approach the Fed’s quiet period leading into their meeting later this month. It is likely that we will get messaging very similar to what we saw last week but it would be wise for investors to loosely watch for any potential headlines from these events that could move prices.

Just like we mentioned in last week’s newsletter, there was a risk of a government shutdown and that is precisely how events played out. Even as markets have all but looked past the drama in D.C. up until this point, we still are missing some crucial labor market data that was unable to be produced with some government agencies temporarily shuttered. In the absence of this data, from all recent government data and private sector data that we have gotten, it all points to the same thing, a slowing labor market. With the uncertainty surrounding these delayed reports, combined with other recent data, seemingly this would push the Fed toward an even more dovish stance given the downside risks to the labor market. Generally, in the past Federal government shutdowns have had little negative effect on markets. In the last 25 years, there have been only three government shutdowns lasting on average 18 days, with the longest being 35 days. In each of the three instances, the S&P 500 had a positive net return. So, in the last 25 years, oddly enough, stocks have generally rallied when we have gotten a federal government shutdown. Of course, this is a small data sample, and it’s hard to extrapolate causation or say how long this current shutdown may last, nonetheless I thought this was an interesting stat to share. Now, with this occurrence, we have seen much of the same so far, since the shutdown began, stocks have rallied quite nicely. Where this time could end up diverging from history is if this shutdown remains deadlocked for an extended period of time. Investors are now acutely aware of the softening that is occurring in the U.S. labor market as this is the catalyst for the recent Fed cut. If a result of this shutdown is further weakening in the labor market and then factoring in the knock-on effects of lower consumer spending, etc., the risk here is that this could expedite some more significant economic weakness. While this would almost certainly tilt the Fed towards more rate cuts, in this case they would be cutting rates because they needed to, rather than cutting rates because they can. The market will continue to cheer rate cuts if the Fed is cutting because it can. However, if we shift to a scenario where the Fed is cutting rates quickly because economic conditions are deteriorating rapidly and they have to, the market will not like this one bit, and it could cause some volatility in equity markets. I think this is the primary thing that investors should be watching for as long as this shutdown continues.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments