Where do we go from here? We have some interesting movement going on in the market with tech testing a breakout, while the overall market is testing a break down. Financials are in terrible position after multiple bank failures, while numerous tech firms look a lot better with lower interest rates. So now what?

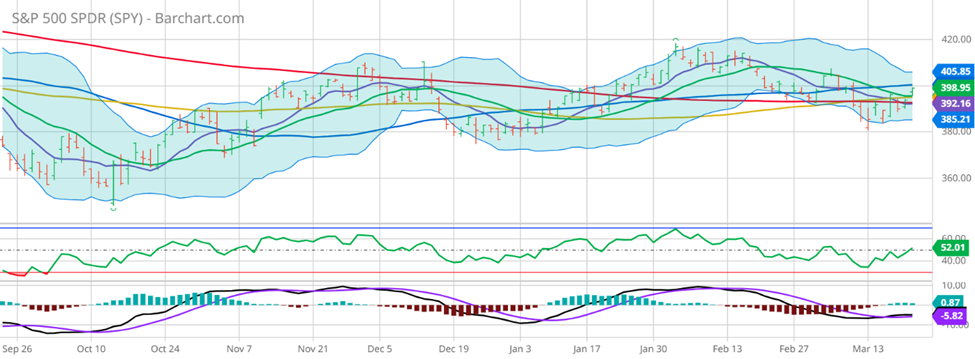

Let’s just take a look at the most important market elements to see if we can get a signal. First, we should look at SPY, the S&P 500 ETF:

It’s evident that the market is testing a recent low point, but will it recover on the heels of the Tech rally? A week ago, I’d have told you we might be in for a rough run to test the lows of 2022, but just as the market looked on the brink of disaster, it started to recover.

Let’s look next at QQQ, the NASDAQ 100 ETF:

Testing a breakout is key, but it has to confirm that breakout to get me truly excited. For that, we need to get above the February high, which we are very close to.

Finally, let’s look at the VIX for an indication of the market fear:

The VIX seems to be telling us that in spite of the tech rally and overall market recovery, we should be afraid. That’s not necessarily a good sign. So, for now, I’ll monitor the market and get into the stocks that aren’t fear-driven. We are in a stock-picker’s market, and that’s not a bad place to be if you have a good system for picking stocks. I outline my favorite stocks in my Outlier Watch List – the stocks listed have explosive potential with cheap options leverage, so they can be a great bargain if you use options. Plus, when you use options, the risk is defined – so you know exactly what you can lose if it all goes wrong and the market really is setting up for an economic recession!

Sincerely,

Keith Harwood

OptionHotline.com

Recent Comments