Happy Financial Freedom Friday!

Option trading is such a trip. Sure, there is lots to learn, but your expectation changes anything and everything. Know with a certainty you are going to grasp it all and do well. True success is not just a function of understanding trading and finding order, logic, and synchronicity in it. True success is understanding that your viewpoint, your knowing, your expectations of order, logic, and synchronicity is what creates your success, creates your world.

Here’s What Is Covered Below:

- What are Pivot Points?

- Why are They Important?

- Learn to Use the Indicator

- Pivot Points into Your Charts

Friday is education day. My goal is to teach everyday people (like me) to successfully trade options. I do my best to write in an understandable way as if we are talking while sitting on my deck in a relaxed atmosphere.

The trading tools you select and use are important, and can make your trading easier and more effective. Today, I am discussing Pivot Points.

Last week, we discussed Fibonacci Numbers and the information they provide on a stock’s chart when incorporated into indicators. We will also use them within the Pivot Point information, too.

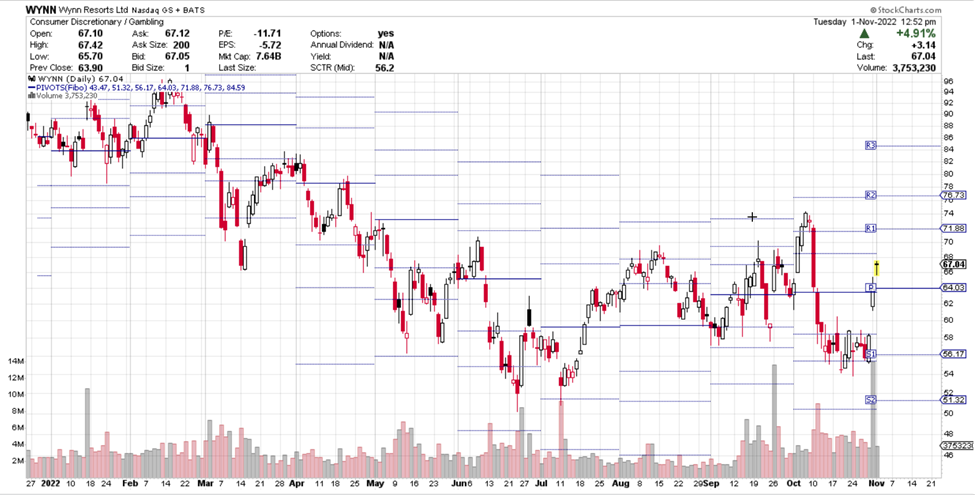

I am going to post images further below of a couple charts, but first I want to discuss the concept of Pivot Points, so you understand what this means and how to use the information.

Last week, in addition to discussing Fibonacci numbers, we also discussed applying those number to the EMA (Exponential Moving Averages) on the charts. Today we are going to apply them to Pivot Points.

Pivot Points are significant levels you can use to determine directional movement and potential support/resistance levels on your charts. Pivot Points use the prior period’s high, low and close to estimate future support and resistance levels. In this regard, Pivot Points are predictive or leading indicators. There are at least five different versions of Pivot Points. This article will focus on Standard Pivot Points and Fibonacci Pivot Points.

Pivot Points were originally used by floor traders to set key levels. Like modern-era day traders, floor traders dealt in a very fast-moving environment with a short-term focus. At the beginning of the trading day, floor traders would look at the previous day’s high, low and close to calculate a Pivot Point for the current trading day. With this Pivot Point as the base, further calculations were used to set support 1, support 2, resistance 1, and resistance 2. These levels would then be used to assist their trading throughout the day. (Stockcharts.com)

I think of these lines as ceilings and floors. The ceiling is apt to add a level of restraint from price going higher. It may not stop the price’s move entirely but is likely to cause a slowdown. If it pops through, then price is apt to come back down to test the level and now it has become a new floor offering support. If price drops, then the level becomes a floor. It may stop there and drop no further, but if it drops through it, as it comes back up that level will now be a ceiling.

It is as if price has a memory and recalls where it has been before and will slow down or stop for a while at that level.

I discussed Fibonacci numbers last week and their spiritual significance to me. The market has incorporated those numbers as an option, so if you select Fibonacci as your number choice by inserting an “F” it adds a third lines and calculates support and resistance using those numbers.

Again, these are Fibonacci numbers are 1 + 2 = 3, 2 + 3 = 5, 3 + 5 = 8, and so on- so, we have 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233…

I am going to insert an “F” into the Pivot Point indicator so that it inserts Fibonacci numbers into the Pivot Points. Again, think of these numbers as ceilings and floors and notice how often price in its moves stops there or if it breaks through, it then tests that area as the opposite.

Stockcharts.com set-up:

On the charts below, you will see that the Pivot Point lines. There is the darker line which is a middle point Pivot (P). The upper lines are Resistance lines (R1, R2, R3) and the lower Support lines (S1, S2, S3).

Stockcharts.com

Notice how often price stops at the ceilings and floors and will sit there until it eventually drops or rises further. Using these lines helps to anticipate what will happen to price next.

The wisest thing you can do every moment of the day is to be on your own side. Know you are a great trader, that you follow your trade rules and have awesome trade results. Wow, look at you!

I wish you the very best,

Wendy

Recent Comments