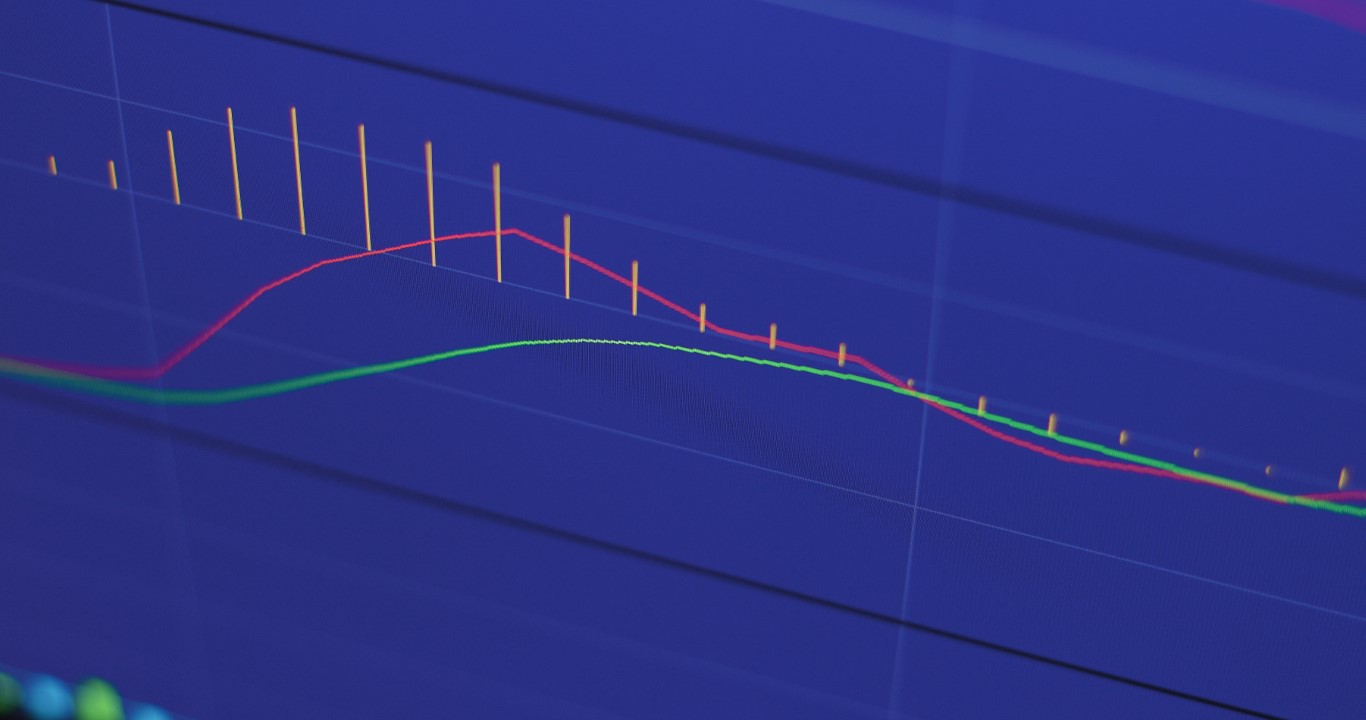

Prices continue to climb but wages are not keeping pace. In fact, news of massive layoffs at Amazon and Meta are capturing the headlines. Everyone is feeling the pinch and it has consumers looking for ways to save on the staples they need to get by. Dollar General (DG), one of the most ubiquitous stores for cheap deals has been riding the wave of rising prices all year. While the rest of the market is in a broad decline, DG has been climbing.

It recently tested resistance at its high and is likely to push through even higher. The MACD is barely into overbought territory and definitely has room to run.

Grabbing DG for a quick 10 point move isn’t bad but if you look at the call options the leverage is pretty compelling. The May 19 2023 300 calls are at 6 and if the move continues up it is plausible to see that premium move up 2, 3 or even double.

There is a risk that DG pulls back but using a call option allows you to reduce the risk from 255 per share to just 6 per share. Plus, by looking at a longer term option like the May call, you get more time for the move to play out. Andy Chambers has put together an approach that exploits the additional time longer term options offer and has made it easier for real working people to learn to trade. Check out his Market Propulsion approach here.

Keep learning and trade wisely.

John Boyer

Editor

Market Wealth Daily

Recent Comments