Dear Reader,

On Friday, we looked at a Daily Price Chart of Berkshire Hathaway, Inc., noting that the stock has been making a series of 52-Week Highs.

For today’s Trade of the Day e-letter we will be looking at a monthly chart for Raymond James Financial Inc. stock symbol: RJF.

Before breaking down RJF’s monthly chart let’s first review what products and services the company offers.

Raymond James Financial, Inc., a diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe. The Private Client Group segment offers investment services, portfolio management services, insurance and annuity products, and mutual funds; support to third-party product partners, including sales and marketing support, as well as distribution and accounting, and administrative services; margin loans; and securities borrowing and lending services.

Now, let’s begin to break down the monthly chart for RJF stock.

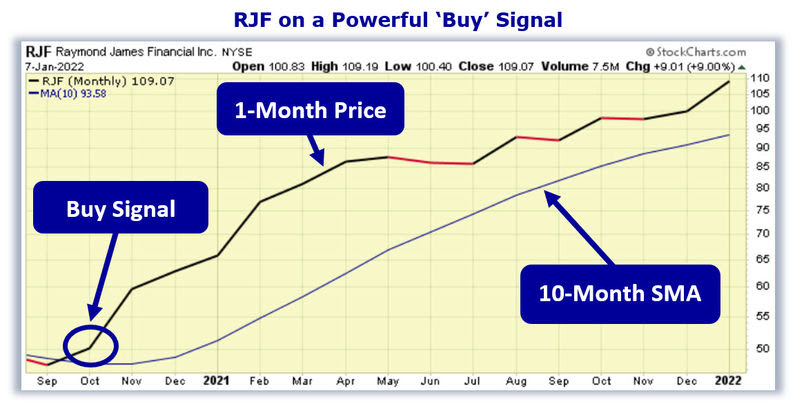

Below is a 10-Month Simple Moving Average chart for RJF shares.

Buy RJF Stock

As the chart shows, in October 2020, the RJF 1-Month Price, crossed above the 10-Month simple moving average (SMA).

This crossover indicated the buying pressure for RJF stock exceeded the selling pressure. For this kind of crossover to occur, a stock has to be in a strong bullish uptrend.

Now, as you can see, the 1-Month Price is still above the 10-Month SMA. That means the bullish trend is still in play!

As long as the 1-Month price remains above the 10-Month SMA, the stock is more likely to keep trading at new highs and should be purchased.

Our initial price target for RJF is 117.00 per share.

75.3% Profit Potential for RJF Option

Now, since RJF’s 1-Month Price is trading above the 10-Month SMA this means the stock’s bullish rally will likely continue. Let’s use the Hughes Optioneering calculator to look at the potential returns for a RJF call option purchase.

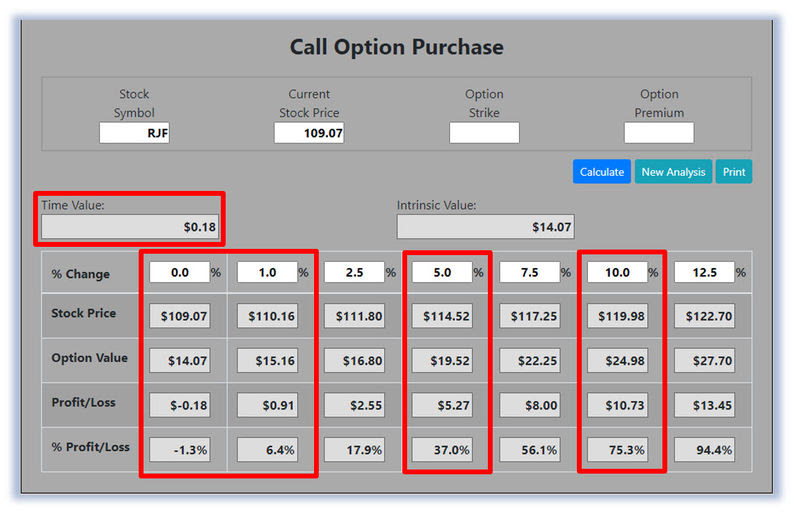

The Call Option Calculator will calculate the profit/loss potential for a call option trade based on the price change of the underlying stock/ETF at option expiration in this example from a flat RJF price to a 12.5% increase.

The Optioneering Team uses the 1% Rule to select an option strike price with a higher percentage of winning trades. In the following RJF option example, we used the 1% Rule to select the RJF option strike price but out of fairness to our paid option service subscribers we don’t list the strike price used in the profit/loss calculation.

Trade with Higher Accuracy

When you use the 1% Rule to select a RJF in-the-money option strike price, RJF stock only has to increase 1% for the option to breakeven and start profiting! Remember, if you purchase an at-the-money or out-of-the-money call option and the underlying stock closes flat at option expiration it will result in a 100% loss for your option trade! In this example, if RJF stock is flat at 109.07 at option expiration, it will only result in a 1.3% loss for the RJF option compared to a 100% loss for an at-the-money or out-of-the-money call option.

Using the 1% Rule to select an option strike price can result in a higher percentage of winning trades compared to at-the-money or out-of-the-money call options. This higher accuracy can give you the discipline needed to become a successful option trader and can help avoid 100% losses when trading options.

The goal of this example is to demonstrate the powerful profit potential available from trading options compared to stocks.

The prices and returns represented below were calculated based on the current stock and option pricing for RJF on 1/7/2022 before commissions.

When you purchase a call option, there is no limit on the profit potential of the call if the underlying stock continues to move up in price.

For this specific call option, the calculator analysis below reveals if RJF stock increases 5.0% at option expiration to 114.52 (circled), the call option would make 37.0% before commission.

If RJF stock increases 10.0% at option expiration to 119.98 (circled), the call option would make 75.3% before commission and outperform the stock return more than 7 to 1.

The leverage provided by call options allows you to maximize potential returns on bullish stocks.

The Hughes Optioneering Team is here to help you identify winning trades just like this one.

Interested in accessing the Optioneering Calculators? Join one of Chuck’s Trading Services for unlimited access! The Optioneering Team has option calculators for six different option strategies that allow you to calculate the profit potential for an option trade before you take the trade.

Get Chuck’s Trades Sent to You!

Do you want to start receiving hand-picked trades from 10-Time Trading Champion, Chuck Hughes?

As a Trade of the Day subscriber, Chuck is offering you a special discount on his Weekly Option Alert Trading Service.

Just call Brad at 1-866-661-5664 or 1-310-647-5664 to join and use the code “Optioneering VIP” to receive special pricing!

Wishing You the Best in Investing Success,

Chuck Hughes

Chuck Hughes

Editor, Trade of the Day

Have any questions? Email us at dailytrade@chuckstod.com

© 2021 Tradewins Publishing. All rights reserved. | Privacy Policy | Terms and Conditions | Contact Us

If you didn’t create an account using this email address, please ignore this email or unsubscribe.

To ensure delivery of this email to your inbox and to enable images to load in future mailings, please add todaystrade@chuckstod.com to your e-mail address book or safe senders list.

© 2021 Tradewins Publishing. All rights reserved. The information provided by the newsletters, trading, training and educational products related to various markets (collectively referred to as the “Services”) is not customized or personalized to any particular risk profile or tolerance. Nor is the information published by Legacy Publishing, LLC (“Legacy”) a customized or personalized recommendation to buy, sell, hold, or invest in particular financial products. Past performance is not necessarily indicative of future results. Trading and investing involve substantial risk and is not appropriate for everyone. The actual profit results presented here may vary with the actual profit results presented in other Legacy Publishing LLC publications due to the different strategies and time frames presented in other publications. Trading on margin carries a high level of risk and may not be suitable for all investors. Other than the refund policy detailed elsewhere, Legacy does not make any guarantee or other promise as to any results that may be obtained from using the Services. Legacy disclaims any and all liability for any investment or trading loss sustained by a subscriber. You should trade or invest only ‘risk capital’ – money you can afford to lose. Trading stocks and stock options involves high risk and you can lose the entire principal amount invested or more. There is no guarantee that systems, indicators, or trading signals will result in profits or that they will not produce losses. Some profit examples are based on hypothetical or simulated trading. This means the trades are not actual trades and instead are hypothetical trades based on real market prices at the time the recommendation is disseminated. No actual money is invested, nor are any trades executed. Hypothetical or simulated performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below. Also, the hypothetical results do not include the costs of subscriptions, commissions, or other fees. Because the trades underlying these examples have not actually been executed, the results may understate or overstate the impact of certain market factors, such as lack of liquidity. Legacy makes no representations or warranties that any account will or is likely to achieve profits similar to those shown. No representation is being made that you will achieve profits or the same results as any person providing a testimonial. No representation is being made that any person providing a testimonial is likely to continue to experience profitable trading after the date on which the testimonial was provided, and in fact the person providing the testimonial may have subsequently experienced losses. The cost basis for some of the options in a portfolio may be reduced by rolling over profits at option expiration which is one of the Hughes Optioneering Trade Management Rules. Some income figures presented represent the total amount of option premium collected during the referenced period. Actual profits were less. Open trade profit results may have increased or decreased when the trades were closed out. Chuck Hughes’ experiences are not typical. Chuck Hughes is an experienced investor and your results will vary depending on risk tolerance, amount of risk capital utilized, size of trading position, willingness to follow the rules and other factors.

Recent Comments