Dear Reader,

Yesterday, we looked at a Daily Price Chart of National Storage Affiliates Trust noting the stock had pulled back in the Keltner Channel ‘Buy Zone’.

For today’s Trade of the Day we will be looking at a Daily Price chart for Berkshire Hathaway, Inc. stock symbol: BRKB.

Before breaking down BRKB’s daily price chart let’s first review which products and services are offered by the company.

Berkshire Hathaway Inc., through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses worldwide. It provides property, casualty, life, accident, and health insurance and reinsurance; and operates railroad systems in North America. The company also generates, transmits, stores, and distributes electricity from natural gas, coal, wind, solar, hydro, nuclear, and geothermal sources; operates natural gas distribution and storage facilities, interstate pipelines, liquefied natural gas facilities, and compressor and meter stations; and holds interest in coal mining assets.

Now, let’s begin to break down the Daily Price chart for BRKB. Below is a Daily Price Chart with the price line displayed by an OHLC bar.

Buy BRKB Stock

The Daily Price chart above shows that BRKB stock has been hitting new 52-Week Highs regularly since early January.

Simply put, a stock does not just continually hit a series of new 52-Week Highs unless it is in a very strong bullish trend.

The Hughes Optioneering team looks for stocks that are making a series of 52-Week Highs as this is a good indicator that the stock is in a powerful uptrend.

You see, after a stock makes a series of two or more 52-Week Highs, the stock typically continues its price uptrend and should be purchased.

Our initial price target for BRKB stock is 335.00 per share.

Profit if BRKB is Up, Down or Flat

Now, since BRKB stock is currently making a series of 52-Week Highs and will likely rally from here, let’s use the Hughes Optioneering calculator to look at the potential returns for a BRKB call option spread.

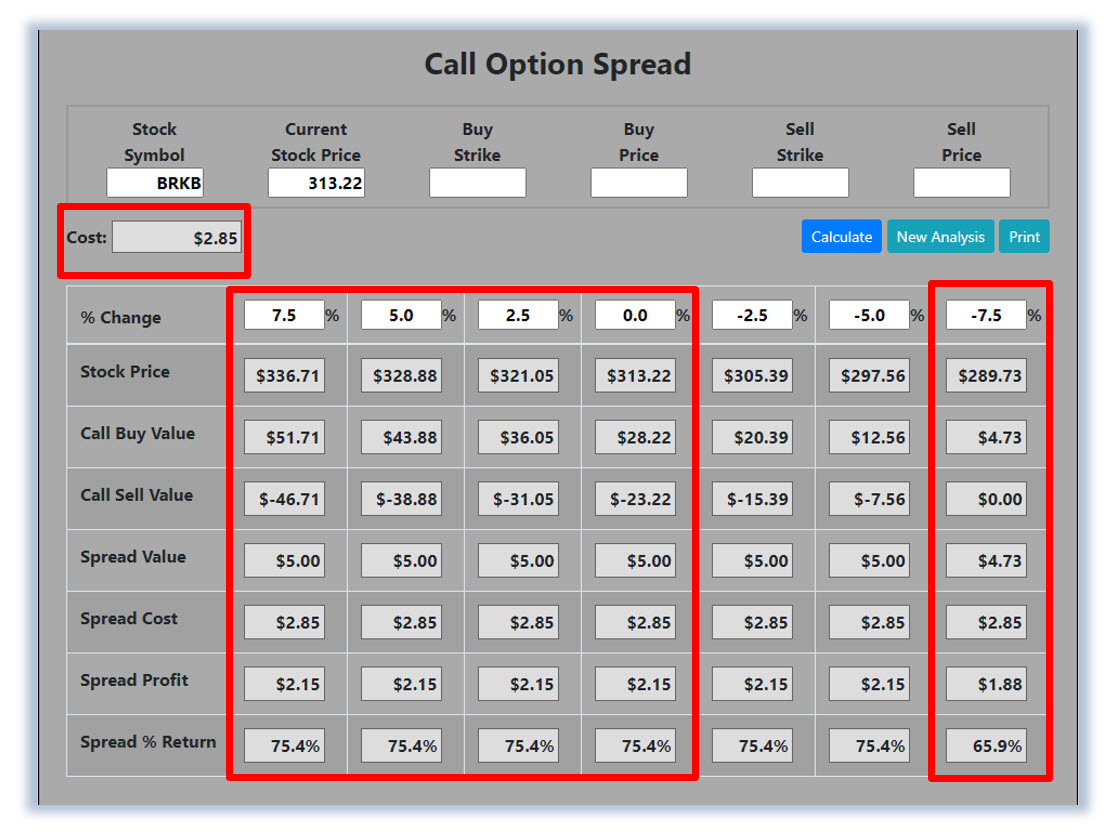

The Call Option Spread Calculator will calculate the profit/loss potential for a call option spread based on the price change of the underlying stock/ETF at option expiration in this example from a 7.5% increase to a 7.5% decrease in BRKB stock at option expiration.

The goal of this example is to demonstrate the ‘built in’ profit potential for option spreads and the ability of spreads to profit if the underlying stock is up, down or flat at option expiration. Out of fairness to our paid option service subscribers we don’t list the option strike prices used in the profit/loss calculation.

The prices and returns represented below were calculated based on the current stock and option pricing for BRKB on 1/6/2022 before commissions.

Built in Profit Potential

For this option spread, the calculator analysis below reveals the cost of the spread is $285 (circled). The maximum risk for an option spread is the cost of the spread.

The analysis reveals that if BRKB stock is flat or up at all at expiration the spread will realize a 75.4% return (circled).

And if BRKB stock decreases 7.5% at option expiration, the option spread would make a 65.9% return (circled).

Due to option pricing characteristics, this option spread has a ‘built in’ 75.4% profit potential when the trade was initiated.

Option spread trades can result in a higher percentage of winning trades compared to a directional option trade if you can profit when the underlying stock/ETF is up, down or flat.

A higher percentage of winning trades can give you the discipline needed to become a successful trader

The Hughes Optioneering Team is here to help you identify winning trades just like this one.

Average Portfolio Return of 325.5%

Below is a screenshot of the current open trade profit results from Chuck’s Weekly Option Alert trading service. There are currently $610,670.91 in open trade profits with an average portfolio return of 325.5% demonstrating the ability of the Optioneering Strategy to deliver substantial returns with no losing portfolios.

Best Regards,

Chuck Hughes

Editor, Trade of the Day

Recent Comments