For today’s potential Trade of the Day, we will be looking at Salesforce.com, Inc. (CRM).

In this article:

-How Salesforce’s chart caught our eye for a possibly lucrative trade,

-What the TSI is and why it is so useful in option trading,

-A potential trade that could offer 108% gain,

-A trading trigger that could make you much happier when you look at your account.

Before analyzing CRM’s chart, let’s take a closer look at the company and its services.

Salesforce, Inc. provides customer relationship management technology that brings companies and customers together worldwide. Its Customer 360 platform empowers its customers to work together to deliver connected experiences for their customers. The company’s service offerings include Sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and relationship intelligence, and deliver quotes, contracts, and invoices; and Service that enables companies to deliver trusted and highly personalized customer service and support at scale. Salesforce, Inc. was incorporated in 1999 and is headquartered in San Francisco, California.

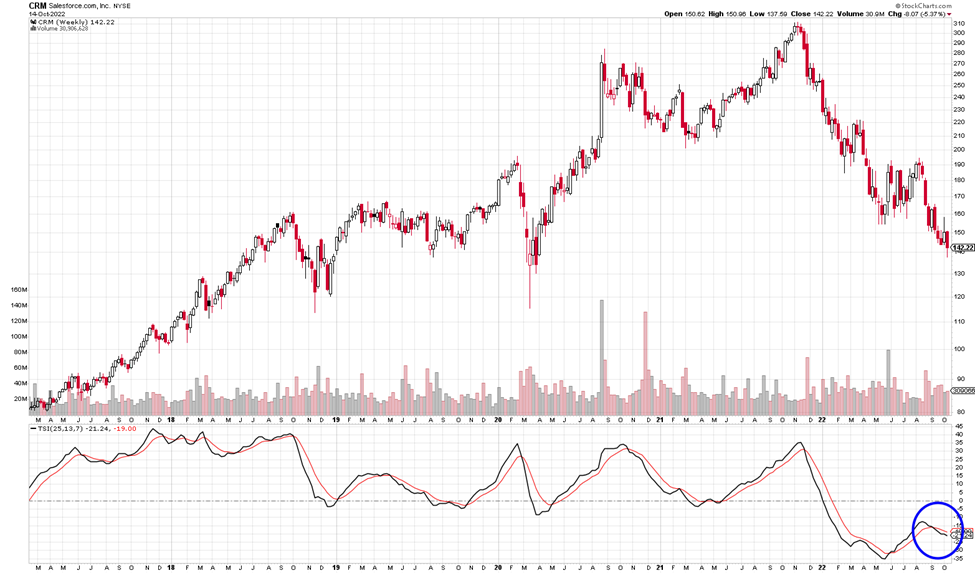

Each candle on the weekly chart represents price movement over a 5-day (week) period. The indicator at the bottom of the chart is a True Strength Indicator (TSI). The description coming up next explains how to use the TSI.

A cross up through the TSI red signal is bullish, in that it is suggesting price has gone from bearish to bullish. A cross down through the red line suggests price is bearish. If you want to learn more about the TSI, you can read through the short section below, or you can scroll down to the alert signal.

True Strength Indicator

Stockcharts.com provides a great definition of the True Strength Index (TSI), which is an oscillator that fluctuates between positive and negative territory. As with many momentum oscillators, the centerline defines the overall bias. The bulls have the momentum edge when TSI is positive, and the bears have the edge when it’s negative.

As with PPO, a signal line can be applied to identify upturns and downturns. Signal line crossovers are, however, quite frequent and require further filtering with other techniques. Chart readers can also look for bullish and bearish divergences to anticipate trend reversals; however, keep in mind that divergences can be misleading in a strong trend.

TSI is somewhat unique because it tracks the underlying price quite well. In other words, the oscillator can capture a sustained move in one direction or the other. The peaks and troughs in the oscillator often match the peaks and troughs in price. In this regard, chart readers can draw trend lines and mark support/resistance levels using TSI. Line breaks as well as line crosses can then be used to generate signals.

Potential CRM’s Trade:

If CRM’s price continues to move down, you could consider a Put trade. I am writing this on Sunday, if price continues to move to $142 when you receive this on Tuesday, you could consider a put option trade. We are expecting the TSI indicator to continue to head down.

CRM’s is bearish as the signal line crosses. The short-term target is $130 and then lower.

Check Out How an Option Trade Could Pay Out Big Time

These examples are provided to show how options work and the advantages they offer. To buy shares of CRM stock today, it would cost approximately $142.22 per share. You would wait until price found a bottom before buying stock.

Option trading offers the potential of a lower initial investment and higher percentage gain. It is like renting stock versus buying out right. Let’s take a look.

If you bought one Put option contract covering 100 shares of CRM’s stock with an Nov 18th expiration date for the 130 strike, the premium would be approximately $3.70 per share, or a total of $370 for the contract of 100 shares. If price fell the expected $8 over the next few weeks, the premium would likely increase approximately $4.00 to $7.70. This is a gain of 108% profit. That would be a nice trade over a short period of time!

It is exciting to make money if price rises or falls.

I want to remind you that you can sell to close and take profit any time along the line before the expiration date. You don’t have to hold the contract until expiration.

Options often offer a smaller overall investment, covering more shares of stock and potential for greater profits. This is like renting stocks versus having to pay full price to buy.

For updates on previous potential trades we have discussed, scroll to the bottom of this message.

I love to trade, and I love to teach. It is my thing. I am truly thankful for you and your efforts.

Being thankful is one of the strongest and most transforming states of being. It shifts your perspective from lack to abundance and allows you to focus on the good in your life, which in turn pulls more blessings into your reality.

I send you wishes for the very best,

Wendy

Past potential trade update:

Last week we discussed UNP puts. On 10-11 the premium was $5.60 for the Nov 18th 185 put. On 10-14 the premium was $4.90. This is a 13% loss. We will continue to monitor this trade.

Recent Comments