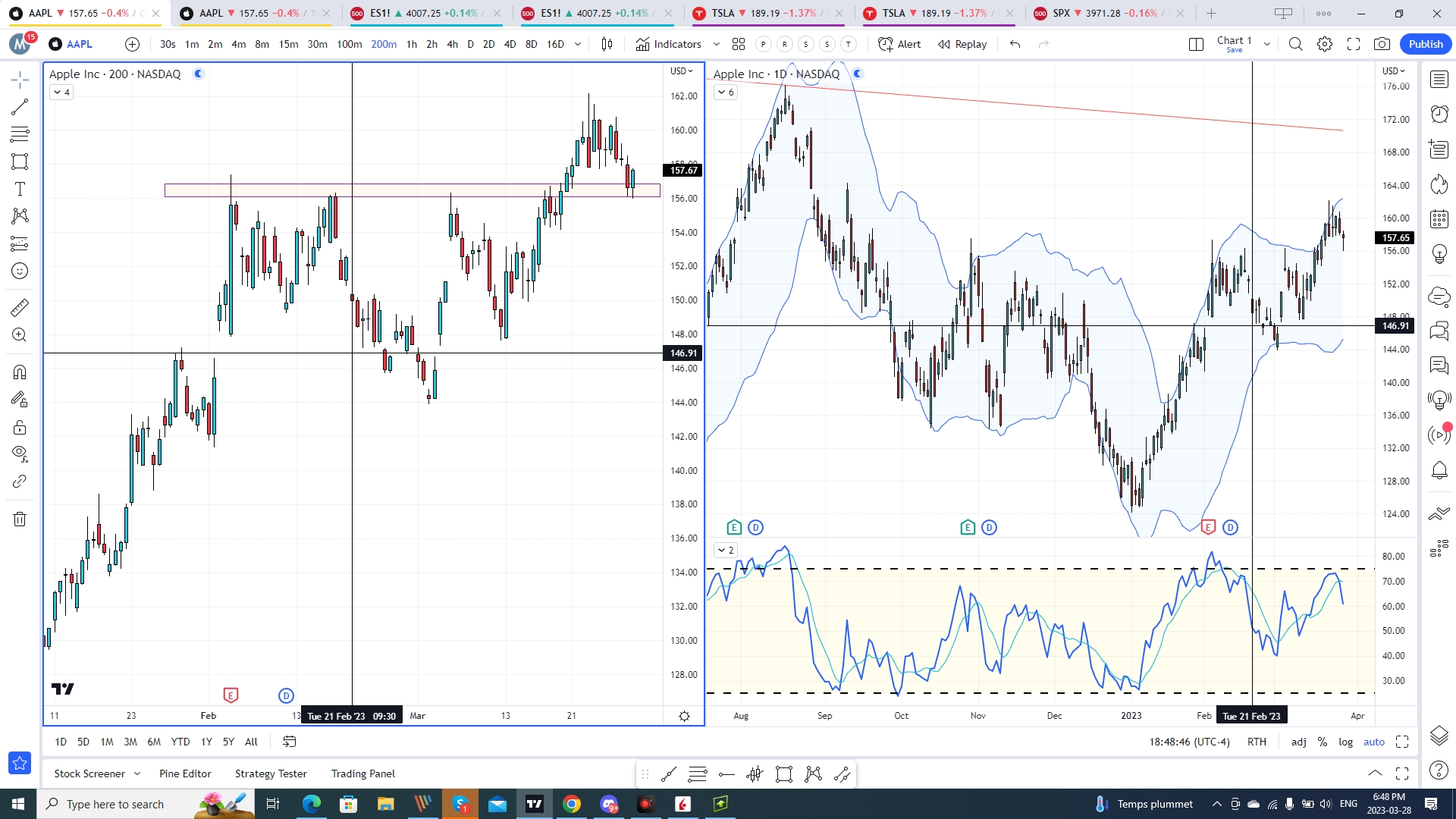

We are at a decisive juncture in the market. I have signals for continued strength. Apple in the attached chart has fallen into support and would usually stage a rally in similar situations. Likewise MSFT and TSLA. HOWEVER, I am on the lookout for failure. Not expecting failure, cautious of it. But if it does fail I expect nasty. Of concern is LIBOR hitting multi month highs, as well as 2 year note auction on Monday. What these two events are telling us is, there is no liquidity QE 4 starting, as was speculated last week, and the interest rate picture points to higher rates. So the market may hold on into the end of the first quarter, but the picture is bleak further out.

Last weekend I had Las Vegas Sands as a stock I liked on a dip. We did get a small dip to start the week, and we are higher than last week’s close as of Tuesday close. I would take the profit presented if in this, just because the overall market makes me a tad nervous here.

For Target Zone Trading I am short a couple of SPY spreads that will need the market to decline sometime between now and May from current levels. They are structured with a very miniscule time premium paid, so I participate almost dollar for dollar with the SPY movement while enjoying a worst case $10 risk for potential $20 gain.

Thanks

Joe

Recent Comments