Even when the market is going down it is possible to find breakout stocks that are going to really pop. Finding pick that have a greater likelihood of taking off can be possible even in crazy markets.

While dropping prices are a sign that value is going out of a stock, big money doesn’t just go away when the market drops, it moves. When you can start to figure out where it is going you can find stocks that have upside potential even when it contradicts the broader trend.

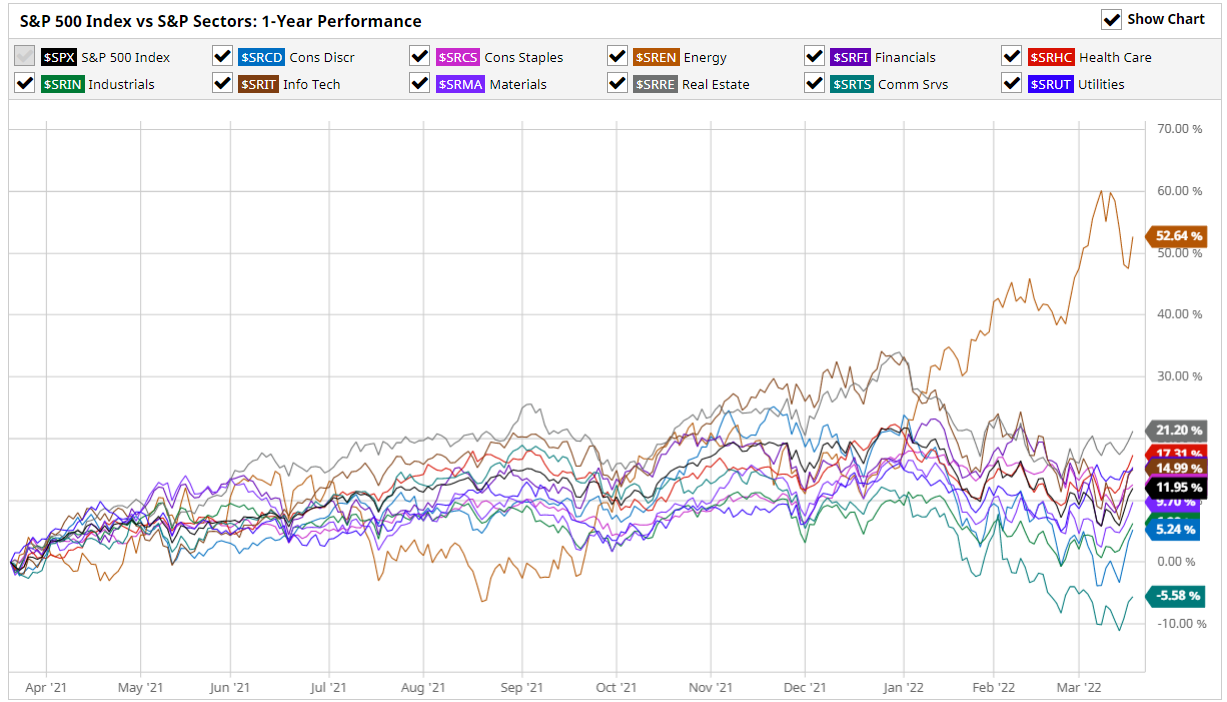

The chart above from StockCharts.com makes it easy to see which sectors are on the rise. Energy has been leading all other sectors this year by a huge margin. Once you have identified that you can start to drill down into any of the parts of that sector that have the most room for more growth.

When you pick apart the energy sector Oil is one of the first we see that has pushed things through the roof. But it is not clear if that will continue or if it has gotten close to a top. Another element of energy that we have looked at a few times that does have more room to go is clean energy. The spike in oil and gas may go away but the drive to be energy independent is not going away.

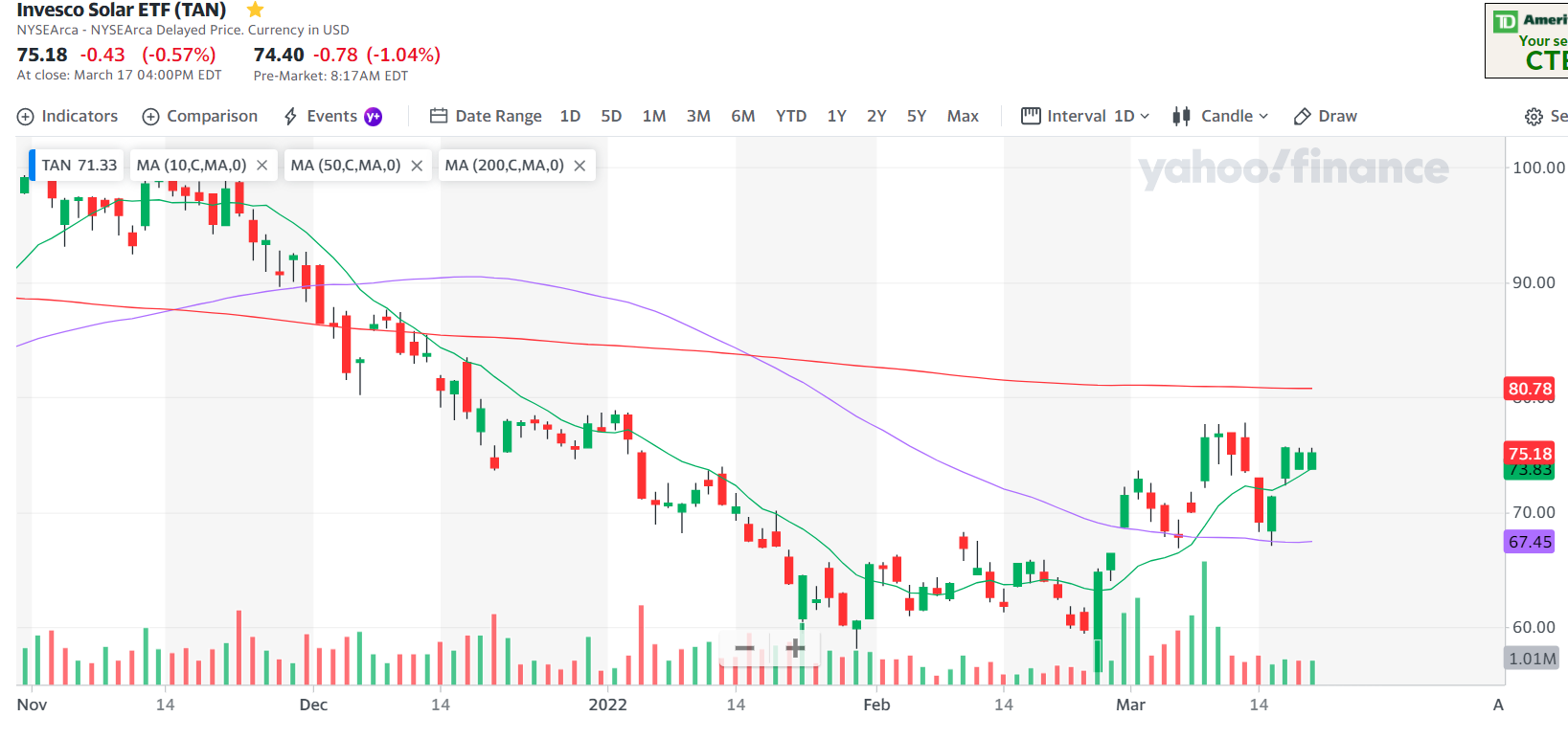

If we zoom into the energy sector and take a look at a couple of the ETFs that track clean energy, we can see they are just starting to turn up.

Both TAN and ICLN have broken above their 50 day moving average and also have room to go to get to a previous high. This is confirmation that clean energy related stocks are a good pick to go higher within this sector.

There are many lists that will come up when you search clean energy stocks. This makes it easy to start looking at the handful in this market segment and picking out the one with the best opportunity. FSLR has started its uphill climb and is looking strong.

It also has moved above it’s 50 day moving average giving a confirmation signal that it is heading up. But this stock was pretty beaten down in Q4 and it has the potential to run back up to its Oct high. That would be a nice 50% grab. Grab a couple call options as it moves up and it could easily be a 200% or more winner.

Be aware it might bounce around a bit on its way up but the probability is high that it will take off. If you want to see how to set up a trade that gives you the most time to be right with the least amount of work, check out Andy Chamber’s Market Propulsion guide. He created it for people with real lives who want the income trading offers but can’t be tied to a computer or phone all day long. Check it out here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments