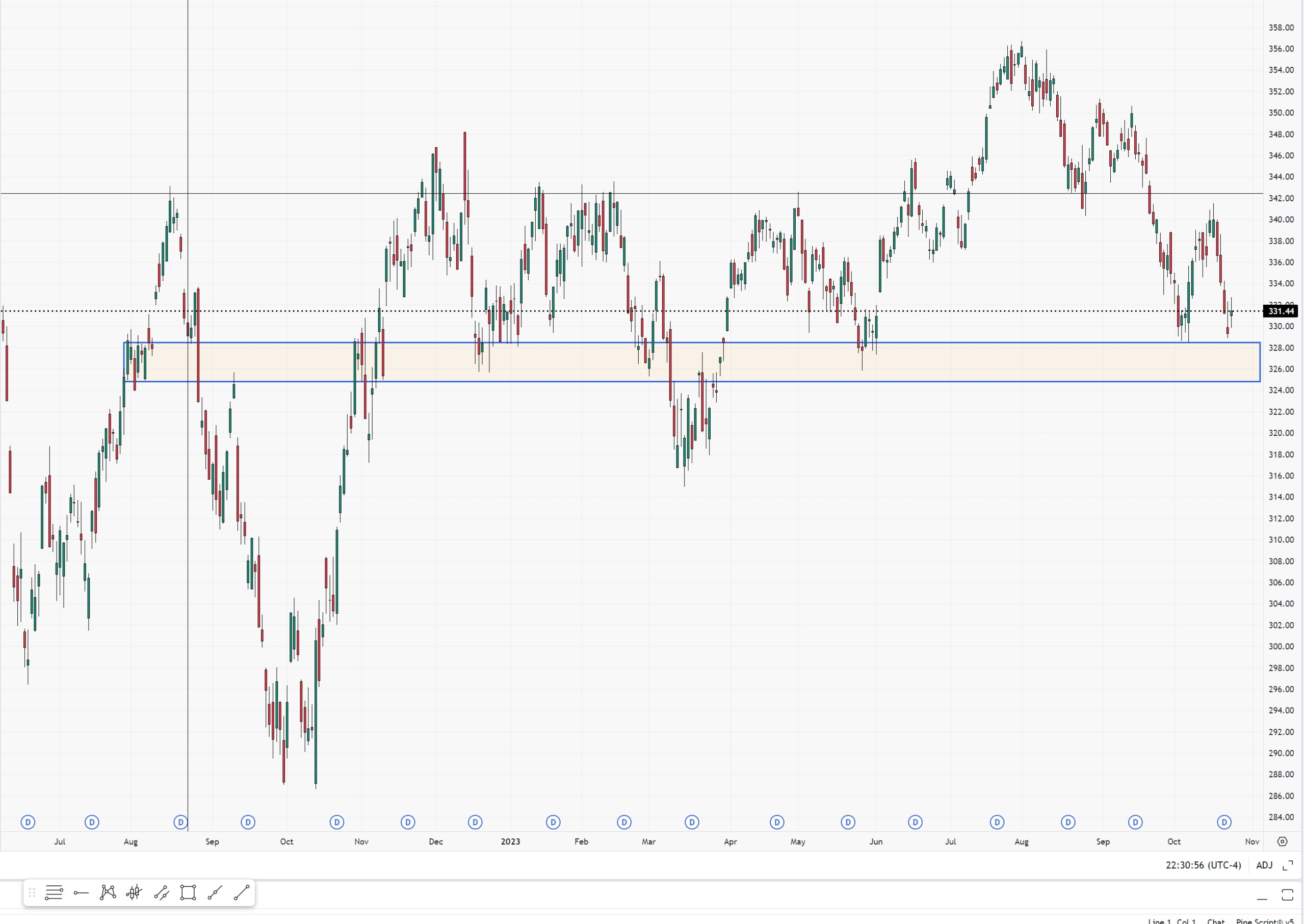

Last week I said I wanted to buy the DIA Dow Jones 30 ETF at 326.50 or less. That occurred on Friday afternoon and I am now long DIA December call options. Despite the general market weakness earnings AND forward guidance have mostly been very positive. Here are a few stocks I like; Intel, IBM, Meta. These 3 stocks all had very good earnings and very good guidance. I think the low for these stocks is in and any retracements from current levels are buying opportunities. One stock that has a chance at a strong rebound is JPM. The banks are generally hated right now, but JPM had excellent earnings, the daily chart is way stretched to the downside, while the weekly still looks constructive.

In another category are stocks that look attractive but have earnings coming up in the near future. Leading this group is UBER with earnings on Tuesday. Draft Kings has earnings on Thursday. Both of these stocks look attractive, fit my buy criteria, but earnings are obviously yet to come. Starbucks and Robolox are two stocks to monitor. Neither of these yet fit my buy criteria but they could soon, so keep them on your radar.

I often preach the value of patience. Trading is as much knowing when NOT to trade as it is when to trade. The other side of that is when my set ups appear I have to pull the trigger. I am very, very well aware things look terrible on many fronts right now. They almost always do when it is time to buy. While I generally try not to pay too much attention to “macro”, I do pay attention to earnings. And if anything the latter is confirming for me that this current decline is just passing stocks from weak hands to strong hands. Absent a black swan event this week any dips are buying opportunities.

Thanks,

Joe

Recent Comments