From Keith Harwood of OptionHotline…

When markets provide opportunities, one needs to pounce.

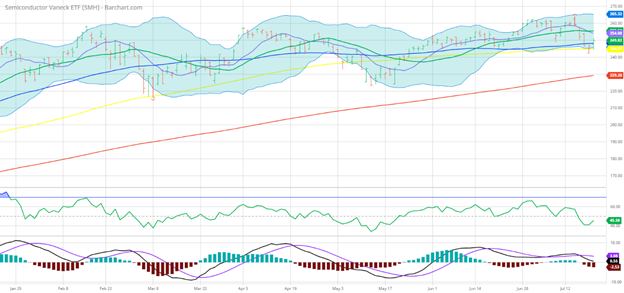

Today, the market provided an opportunity that I found particularly interesting and somewhat unique. The semi-conductor index (which has historically been a leader for tech) looks incredibly strong today as it has recovered many short-term moving averages.

Let’s look at SMH as our leading indicator:

(chart below)

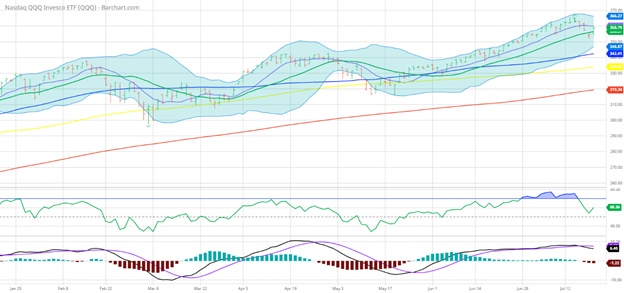

With the bull pennant in SMH today, I am that much more inclined to add in the tech sector. And when I look at QQQ, the technical formation is as good as SMH if not better:

Testing the waters below the 20-Day Moving Average but quickly finding support is crucial to markets. Frankly, I am looking to buy this dip. Many will say that this is an early warning sign for market liquidation, and I simply don’t see it. Adding to long positioning simply looks better than exiting or initiating short positions here. At the end of the day, I may be wrong, but if I can be right 60% of the time and be right with the addition of leverage via options, I’m going to be just fine.

Please take this chance to review how I apply technical signals to my options trades at https://optionhotline.com and if you have any questions, never hesitate to e-mail me.

Keith Harwood

Keith@optionhotline.com

PS-To see how I applied these strategies as a market maker to consistently make money, grab my free cheat sheet here.

Recent Comments