From Keith Harwood, OptionHotline.com

Here.

We.

Go.

Or maybe not.

But maybe.

Last week, I highlighted my signal for buying into the market. If you didn’t try to see it before it happened, then you’re lucky – the signal waited 7 calendar days and triggered this week instead. If it had happened yesterday, you would have missed out. If it had happened tomorrow, then I suppose the same idea would be in place – you would have simply missed out if you didn’t choose to look at the charts. But, the indicator is there, and it’s there now, so let’s look at it now.

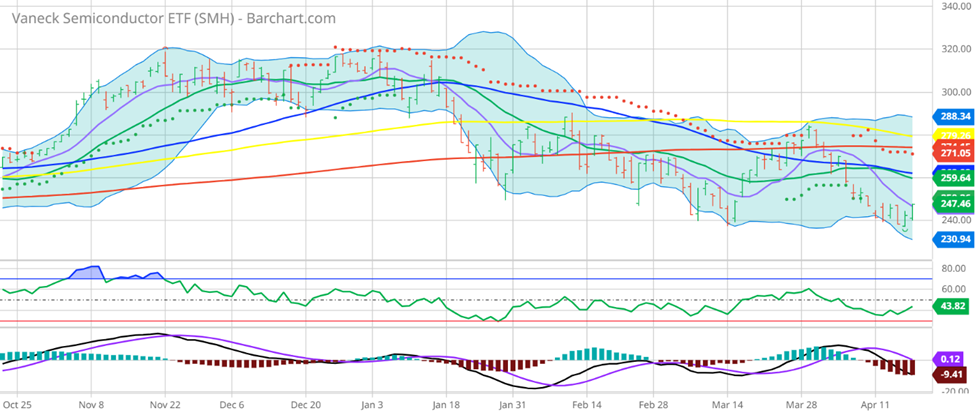

So, with all of this in mind, let’s evaluate the leading indicator that is getting me excited to buy into the markets. Let’s look at SMH (the ETF for semiconductors):

Today is finally the day that the semiconductor ETF has a higher high and a higher low than the previous day. It’s finally a signal that someone is willing to buy at a higher price than yesterday. And for those that bought all the way down, it’s a sign that we finally may have found a bottom, and maybe those that were buying on the way down have a little bit of relief…

I could have bought into tech on April 12th or April 14th, both of which days it looked like we could see a catastrophic failure in the markets, but today was finally the day that I saw a sign that the markets might finally have a buyer. Today was a better technical day than either of those days and I am more confident as a result.

There are a number of different signals that we can use that we are going to see SMH recover. Yesterday is the first day in weeks that SMH had a higher high and higher low than the prior day. Yesterday is the first day that SMH is closing above the 10-Day Moving Average. There are other signals that others will certainly point to.

For me, the key is that there is a feel to this market that the low is in. And if I can combine a bit of that human feel with a computational element, then I can increase the probability of my trades. That’s what I’m doing now. And I can add leverage thanks to options!

So, please go to http://optionhotline.com to review how I traditionally apply technical signals and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments