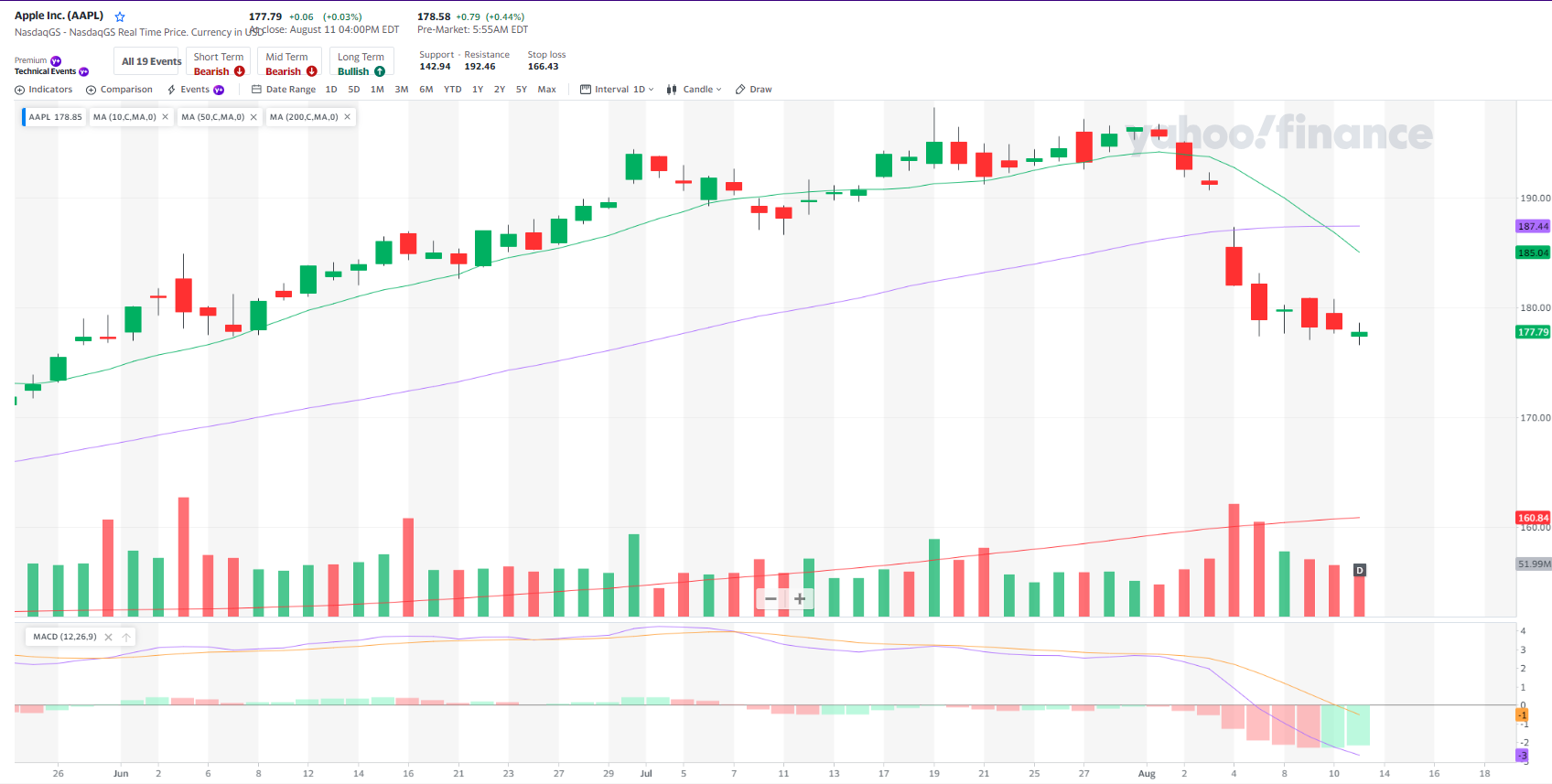

The stock market spent the latter part of last week “jamming” traders both on the short side and the long side. A few attempts to break important support in AAPL have lacked any conviction. Additionally in AAPL, seven of the last 9 daily candlesticks are red and the two green ones are tiny. That may be enough to see a rally… not because there are really fresh buyers, but solely because the bears used quite a few bullets and didn’t do a lot of damage at least the last few days. Additionally, MSFT, GOOG, AMZN have really shrugged off the market decline so far. That doesn’t make me bullish as much as it sends me back into my default mode, which you may know is ….. PATIENCE!

On Friday I exited the MU spread after exiting the puts earlier the week. I got in the spread for Target Zone subscribers at $1.70, out at $4.05. Still in the NIKE spread which pretty much ignores the general market anyway. Almost exactly even on that spread which is set up for lower prices in NIKE. I don’t have any fresh opportunities for Monday.

The bear’s best hope here is a long shot to open the market under Friday’s lows and hold it there. I don’t see a catalyst for this though, and absent that the market seems sufficiently “sold out” to try and move higher again. Bears would also need to see more weakness in MSFT, GOOG, MSFT, which may come but we aren’t seeing yet. What the bears do have is a lot of second tier stocks gapping lower on earnings as we highlighted early last week. Late last week, Upstart and Robolox among others joined the earning disappointment parade. So that leaves me definitely not bullush, but not wanting to chase shorts here either. So it’s wait and see and be patient until we get a higher probability environment then we reside in right now.

Thanks,

Joe

Recent Comments