From Keith Harwood, OptionHotline.com

How Do Calls Work?

The normal rule of thumb that people argue is that long calls are used if you are bullish. But, you have to remember that being long a call doesn’t always pay if the market rallies. If implied volatility is high and the rally is small or takes time, the call will not pay off the way you expect.

Focusing purely on the directional element, long calls have a long directional component that is known as long Delta. I will fully define Delta shortly, but the key here is that long Delta is a proxy for long the underlying. Normally, you would buy a call if you are bullish or looking to hedge a bearish bet. I want to re-iterate that because options have other Greek risk than Delta, the long call position does not always work on a rallying market.

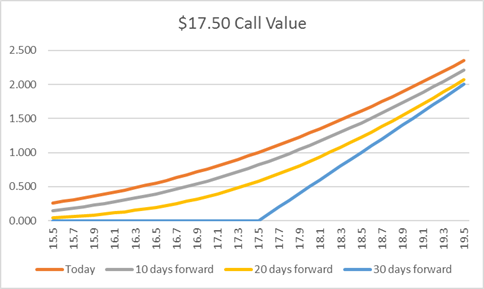

An example of a long $17.50 call payout with 50% Implied Volatility level and 30 days to expiration over time will look as follows:

One can see clearly that at expiration or for calls where the current stock price is far above the strike, the option acts like a stock position. At or below the strike price on expiration, the call owner will lose the premium paid but no more. So, on a large break, the long call will act as a stop to your position – this is a nice feature. That is one of the first and most important strengths of long option positions. When you enter the trade, you have defined risk that tells you exactly how much money you can lose if you are wrong.

(continued below)

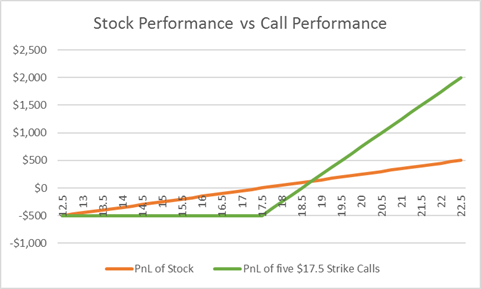

Hypothetically, you may have a situation where you are willing to lose $500, but the premium of the call is only $100. If you are willing to lose more than the premium of 1 call, you can buy multiple options and add leverage to the upside. This is the second key benefit of long option positions. See below for a graph of the Profit and Loss (“PnL”) for 5 calls at expiration compared to the PnL of 100 shares of stock:

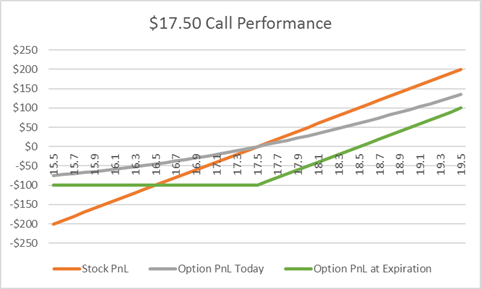

But, there are big risks. Remember what happens if the stock does not move much. Let’s focus in on a tight window around the current stock price to see why long options is not always preferred to a stock position:

As you can see, there are scenarios where a stock can go higher, but because that move takes time, the call owner is worse off from being long options instead of the underlying. Every trade construction will have trade-offs. To get defined risk and leverage, one has to sacrifice the returns from smaller moves in the equity.

So, as you look at the risk/reward profile of the trade, the key here is that as you add options, you can’t just look at the reward if you reach your price target. You have to also factor in the risk associated with small price moves that could result in an erosion of your option value.

To get more info on how I apply technical signals to my options trades at https://optionhotline.com and if you have any questions, never hesitate to e-mail me.

Keith Harwood

Keith@optionhotline.com

Recent Comments