Happy Wonderful Wednesday!

Last week, the Dow Jones was up 3 out of 5 days, but close of the week was lower than its opening price on Monday. The market seems to have formed a bottom from the decline The last two weeks it was mostly bullish. We will look at calls.

In fact, a call we looked at two weeks ago offered a 214% profit. Keep reading to show a similar opportunity we just spotted.

To review past equity candidates, scroll down.

For today’s Trade of the Day, we will be looking at Apple, Inc. symbol (AAPL). Before analyzing AAPL’s chart, let’s take a closer look at the stock and its services.

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. It also sells various related services. In addition, the company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; AirPods Max, an over-ear wireless headphone; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, HomePod, and iPod touch.

The company serves consumers, and small and mid-sized businesses, and the education, enterprise, and government markets. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California.

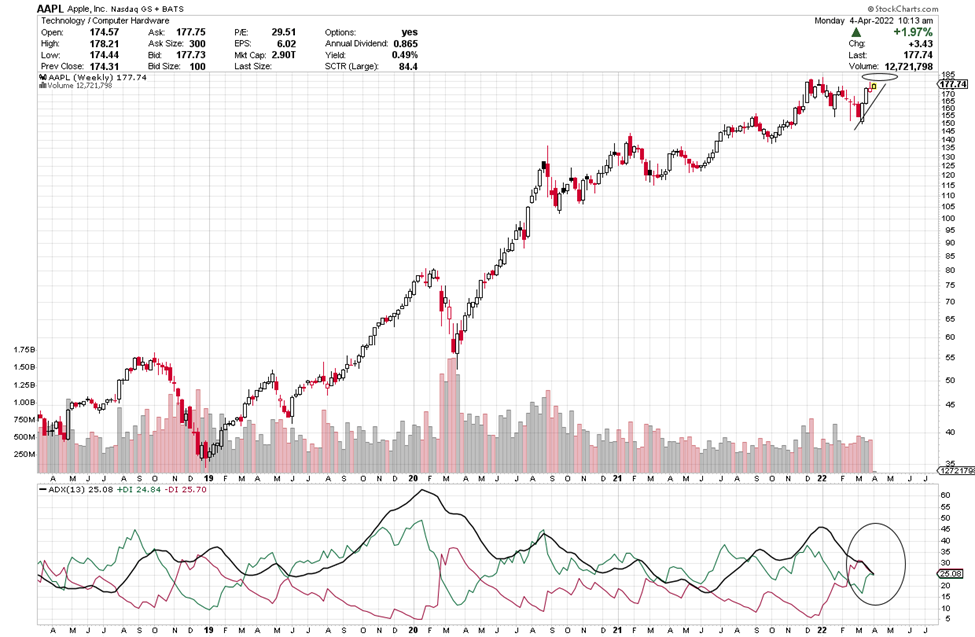

On the ADX indicator below the chart, notice how the green +DI line is ready to cross the -DI line (red). This signals bullish moves with the thought that price may move up.

For those who want more info on ADX, I give more details in the section below, or scroll down to the trade info.

Average Directional Index (ADX) Points to Direction and Strength

ADX is an easy indicator to interpret. The +DI line (green) is bullish and when it is on top, it suggests price is going to head up. When the -DI line (red) is on top, it suggests price is going to drop.

The black line is the strength line and when it heads up, it is telling you strength is moving into the DI line that is on top and in control. When the ADX line has been heading down, the DI line on top has been weakening and is ready for a change.

When the DI lines swap places and cross up and the ADX heads up, it suggests strength is moving into the new DI direction.

ADX signal = Profit Payout

Each candle on the chart represents price movement of a week. As the +DI heads up and moves further above the black line and both rise above the red line, it suggests there is bullish strength that could continue to grow, especially once the black line starts to turn up. If price continues to rise, the ADX line (black) will continue to turn to head up to imply that strength will continue to support the trade. If the ADX is heading up, it means it is supporting the bullish- up direction. The opposite is true if the -DI line heads up to cross the +DI line – this suggests bearish strength and a climb in price. If the ADX line heads up while the red line -DI is on top, is it saying strength is building into the downward direction.

I am looking at its chart and possible trade on Monday. The pattern looks to be in a bullish direction. The +DI may continue heading up if price keeps rising. You don’t want to consider entry if the current candle doesn’t move above 30 or if the +DI line were to turn down.

AAPL’s Potential Trade

Please note and remember that I am typing this on Monday, two days before you receive it and the information I am sharing could change over those two days and is intended to share the opportunities that options offer us.

Apple (AAPL) has been heading up for a couple weeks. We want the +DI to stay above the -DI (green line above red) to consider a Call trade. Then, we’ll hope the ADX will turn up to show upward strength.

The first target is $185. We will keep an eye on AAPL over the next couple weeks.

To buy shares AAPL today, price would be approximately $178. If you bought one share and the price went up to the expected $185, you would make $7.

This said, option trading offers the potential of a smaller initial investment and higher percentage gain even when price is expected to rise or fall. Let’s take a look.

If you bought one Call option contract covering 100 shares of AAPL’s stock with an April 29th expiration date for the $185 strike premium would be approximately $1.85 today or a total of $185 per contract. If price rose the expected $7, the premium might increase approximately $4.00 to $5.85 per share on your 100-share contract. This is a gain of $4.00 on your $1.85 investment or $400 profit, a 216% gain over a couple weeks.

Remember you can close an option trade anywhere along the line before expiration to take gains or stop a loss.

Options can offer a win, win, win trade opportunity. They often offer a smaller overall investment, covering more shares of stock and potentially offer greater profits.

If you are having any kind of trouble taking advantage of these trades, I don’t want you to miss out. I have put together programs that help traders just like you access the potential profits that options provide. I write like we are having a conversation, so the information is easy to understand and apply. Be sure to check out the programs shared in this email, and we will make it easy for you to get your share.

I love to trade, and I love to teach. It is my thing.

Yours for a prosperous future,

Wendy Kirkland

PS-I have created this daily letter to help you see the great potential you can realize by trading options. Being able to recognize these set ups are a key first step in generating wealth with options. Once you are in a trade, there is a huge range of tools that can be used to manage the many possibilities that can present themselves. If you are interested in learning how to apply these tools and increase the potential of each trade, click here to learn more.

Review of Past Candidates:

Two weeks ago, we discussed buying NVDA April 14th Calls. On 3/23 the premium was $5.40. On 3/24 the premium rose to $16.95 or a 214% profit. Last week, price went up and down, but ended about the same as the week before. This week on Monday, it is heading up again.

Last week, we looked at AMC April 29th expiration on a 30-strike call. The premium was $6.65. Price started dropping on Tuesday and continued to drop throughout the week. There would have been no trade.

Recent Comments