Things are looking good for small cap stocks.

The Russell 2000 just closed at a record high, topping its previous high in 2021. And it’s also on track for its seventh straight week of gains, which hasn’t happened since 2020.

All thanks to interest rate cuts, and the potential for another two this year.

In fact, history shows that rate cuts often give small caps a boost. Part of the reason for that is these companies often rely on debt, and will therefore benefit from lower borrowing costs. Plus, they’ll have easier access to capital, boosting potential profitability. Some argue that small caps are some of the strongest beneficiaries of rate cuts.

Seeing that we may get another two cuts this year, investors may want to jump into hot small cap stocks, or even jump into exchange traded funds (ETFs) such as:

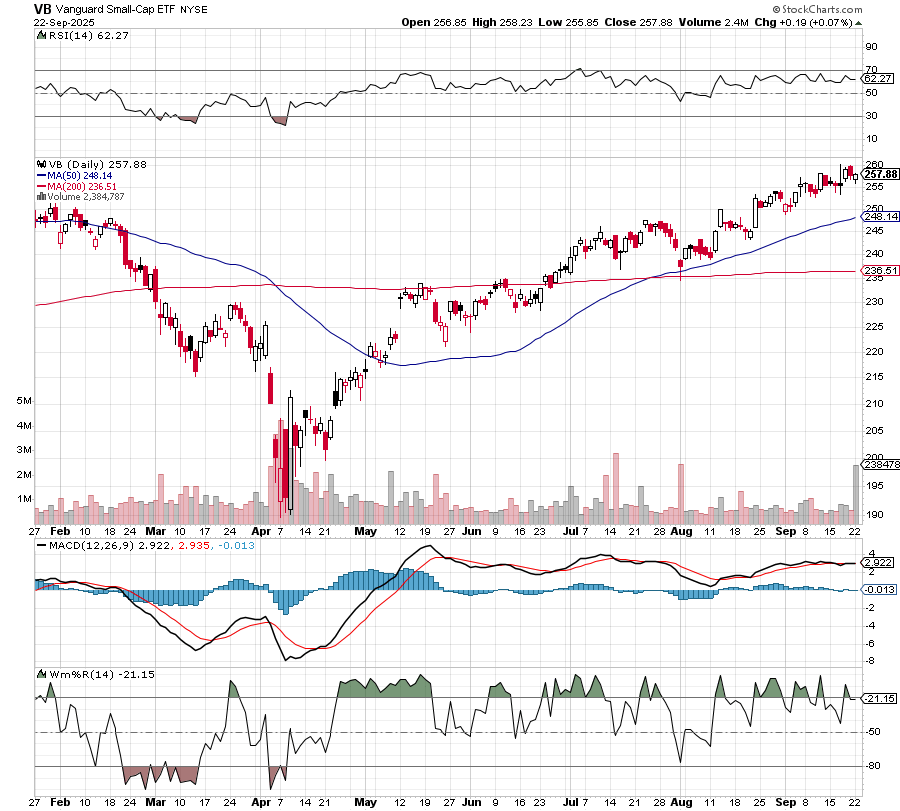

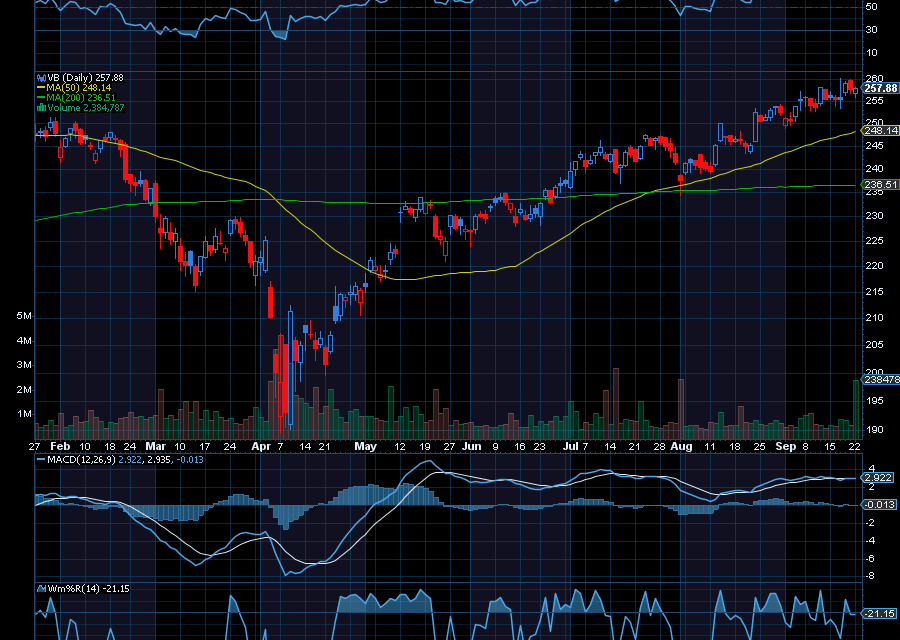

Vanguard Small-Cap ETF (VB)

With an expense ratio of 0.05%, the Vanguard Small-Cap ETF tracks the performance of the CRSP US Small Cap Index. It also holds 1,336 stocks, some of which include SoFi Technologies, NRG Energy, Atmos Energy, Reddit Inc., and Pure Storage.

Even better, it pays a quarterly dividend. On July 2, it paid a dividend of just over 78 cents. Before that, it paid a dividend of just over 91 cents on March 31.

Granted, the ETF did just rocket from about $190 to $258.56, but with more interest rate cuts on the way, it could test higher highs.

Sincerely,

Ian Cooper

Recent Comments