Insiders know their companies better than anyone else.

And if they’re willing to put their money where their mouths are, the better. That’s because insiders – CEOs, CFOs, Board members – see what’s happening and have a better understanding of their company than you and I. It’s even better if insiders step in after a stock pullback.

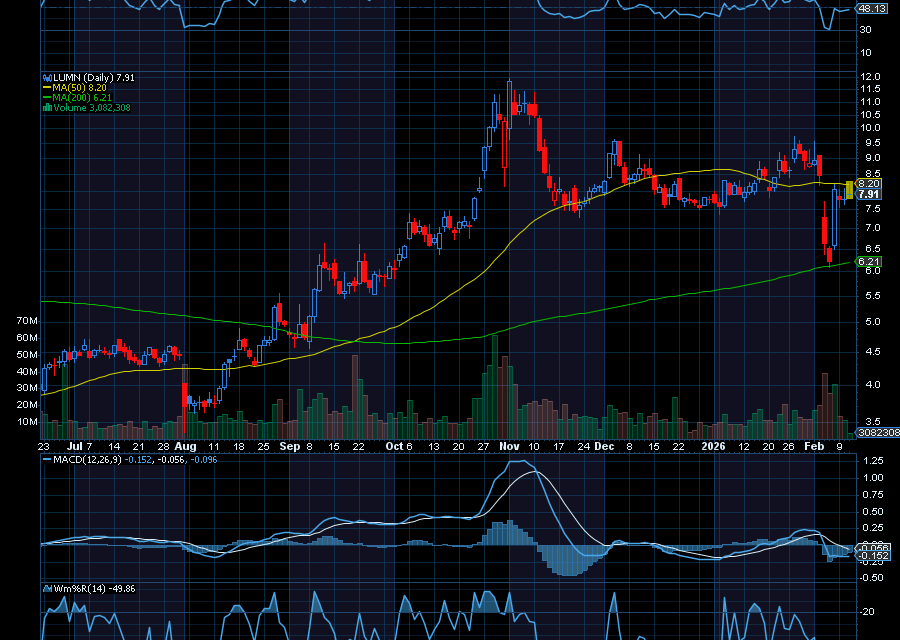

Look at Lumen Technologies.

Over at Lumen Technologies (LUMN), CEO Kathleen Johnson just bought about $500,000 worth of stock, picking up 76,685 shares. “Kate Johnson’s recent open-market stock purchase reflects her continued confidence in Lumen’s long-term strategy and the value the company is creating through its transformation,” said the company, as quoted by Barron’s.

“This is not the first time Kate has personally invested in Lumen shares, underscoring her strong belief in the company’s future as a digital networking services leader driving enterprise growth and innovation for a multi-cloud, AI economy,” they added.

While investors should always do their own due diligence and manage risk accordingly, tracking insider activity like this can help identify opportunities that the broader market may be overlooking.

Sincerely,

Ian Cooper

P.S. I have been tracking a way to exploit the rising volatility we are seeing and it has been working better than I expected. If you want to see how I am doing it, join me on Wed. Feb 18 at noon EST.

Recent Comments