What to Watch for This Week

Key Job’s Market Data Queued Up

On Wednesday, two important U.S. job market reports will be made available. In the morning, both the latest ADP employment & U.S. Job Openings reports will be revealed. The labor market has remained quite resilient in the face of the Fed rapidly raising their Fed Funds rate to tame inflation.Any sign from these reports that the labor market is beginning to soften, despite being negative economic news, would likely be welcomed news for the stock market as it could be a prelude to relief from high treasury yields.

- ADP Employment Report – Before the market opens, on Wednesday morning investors will get the latest ADP employment report for the month of October. The ADP employment report measures the net change month-over-month in private employment in the U.S.

- October’s job gains are forecasted to come in at 150,000, which is significantly higher than the previous month’s add of 89,000.

- Job Openings and Labor Turnover Summary (JOLTS) – The Bureau of Labor Statistics’ September JOLTS report will follow the ADP report and will be released shortly after the market opens. The JOLTS report tracks the number of job openings & various metrics on the number of workers who left the workplace during the respective period.

- September’s job openings are expected to come in at 9.3 million, a month-over-month decrease of 3.1%.

Federal Reserve Decision

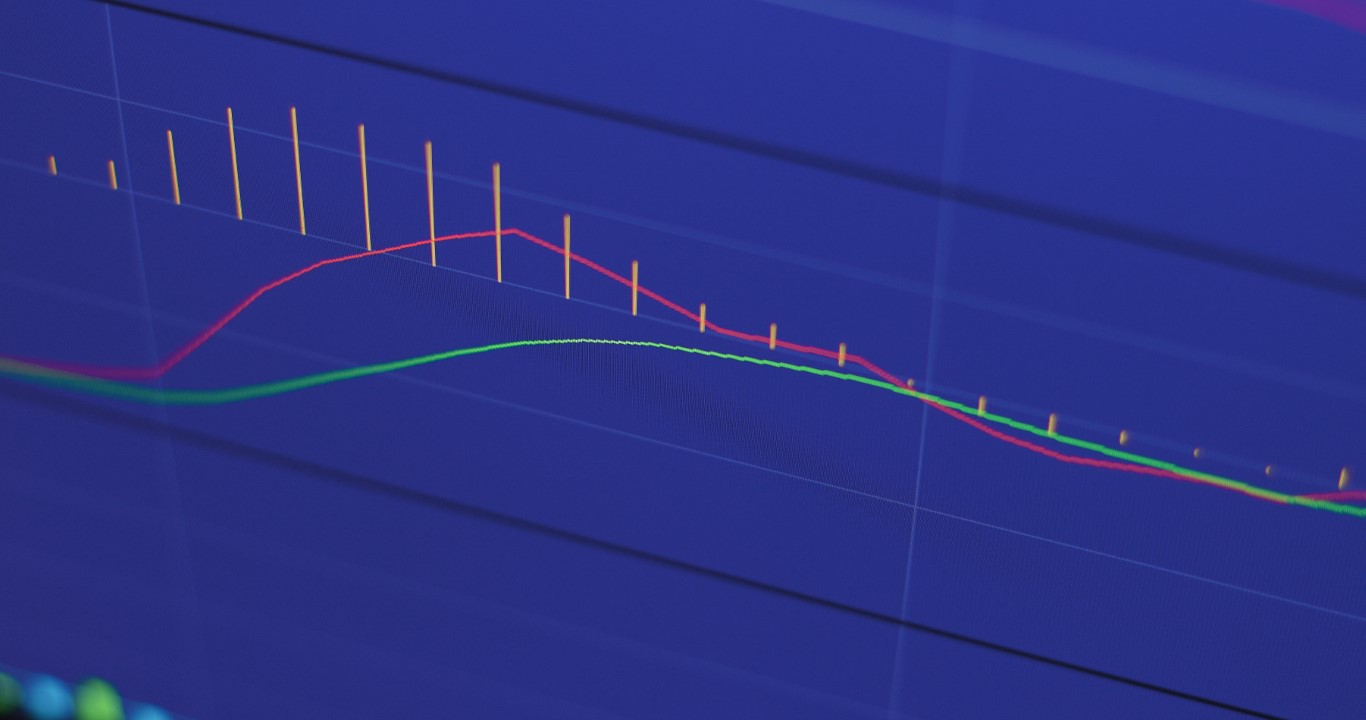

On Wednesday, investors will finally get the Fed’s next policy decision as the upcoming FOMC meeting will conclude. Possibly even more important than this meeting’s policy decision will be Fed Chairman Powell’s tone and messaging regarding upcoming meetings and potential policy moves by the FOMC. His messaging regarding future hikes to the Fed Funds rate or any potential plans to cut will have market watchers tuned in.

- Currently, Fed Funds Futures indicate that investors believe that the Fed’s policy rate will remain paused through the end of the year. Additionally, the CME Group projects a 99.9% probability that at this week’s FOMC meeting the committee will opt to maintain the current target range between 5.25%-5.50%. However, for the meeting set to take place in mid-December, the CME Group places a 19.8% probability that the committee will opt to hike rates by 25 basis points. Investors will be looking for any clarity regarding the Fed’s next potential moves.

All About the Earnings

Following the most important earnings week of this season, there is no rest for the weary as there are a number of crucial companies set to deliver their Q3 results this week. On Thursday, investors will be tuned in to hear Q3 numbers from Apple Inc. Also, on deck this week are drug-makers Eli Lilly & Co. & Novo Nordisk. Finally, Advanced Micro Devices, Inc. & QUALCOMM Inc. are due to report their earnings during the middle of the week.

- In what will likely be the most pivotal earnings report this week for the broader market, Apple Inc. is set to report after market close on Thursday. AAPL shares currently account for over 7% of the entire weighting of the S&P 500 index. Their post earnings reaction is sure to have an effect on the broader markets.

- AAPL earnings are expected to come in at $1.39 EPS.

- Additionally on Thursday, prior to market open, we will get to see the Q3 results for both Eli Lilly & Co. & Novo Nordisk. Each of these companies have been standout strong points in the market this year, fueled by investors’ enthusiasm behind their new GLP-1 drugs. Wall St. will be anxiously awaiting to see if each of these companies can deliver on the recent hype.

- LLY earnings are expected to come in at -$0.11 EPS.

- NVO earnings are expected to come in at $0.60 EPS.

- This week we will also hear from chipmakers, Advanced Micro Devices, Inc. & QUALCOMM Inc. as investors digest their earnings from the previous quarter. AMD is set up to report after the bell on Tuesday and QCOM will report the following day in aftermarket hours. QCOM earnings could potentially provide a read-through to AAPL earnings as QCOM is AAPL’s main supplier of iPhone chips.

- AMD earnings are expected to come in at $0.49 EPS.

- QCOM earnings are expected to come in at $1.45 EPS.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments