From Keith Harwood, OptionHotline.com

On Sunday, I was preparing to head to the airport. Before I left, I decided to check my flight status. And to my surprise, my flight was cancelled. I didn’t receive an e-mail nor a text notification. Had I not checked for myself, I would have gone to the airport only to find myself without a flight, just as many others did. The next available flight was for Wednesday, so I grabbed it before that went away, too.

I researched the problem, just as many others did – what went wrong with Southwest? They said it was due to weather and the FAA. But no other airline saw a comparable number of cancelled flights. It wasn’t even close. Southwest was clearly experiencing something internal, otherwise one would think that all airlines would have been impacted fairly equally. But Southwest continues to insist that they have no internal problems.

And yet, while Southwest was the outlier in terms of cancellations, and thus needing to give credits and/or rebook passengers on other flights, all airlines were treated fairly equally so far this week in the stock market. Southwest will suffer a massive opportunity cost in terms of having to rebook passengers in empty seats instead of selling them to the next buyer.

And the PR on this will likely damage their reputation for months. Fortunately for me, I was staying with family and would not incur an additional 3 nights of hotel cost, but many were not in that situation. There are stories of non-refundable vacations lost and rental cars being booked to go cross-country just to make up for this airline issue.

I often chose to fly Southwest Airlines due to their flexibility. But I’m not so sure going forward that I will after my most recent experience, and I imagine many others may feel the same. There seems to be a tail risk to the stock here that’s not being acknowledged.

If Southwest Airlines hasn’t been punished by the market for this mistake, but there’s a chance that they could be, then shouldn’t there be a bearish trade I can put on in Southwest Airlines stock? And shouldn’t I be able to leverage it with options?

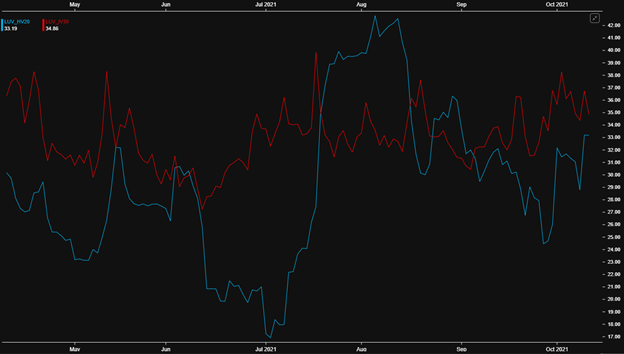

Let’s look at the chart of LUV first:

The stock fell a little bit, but nothing crazy. This is certainly not what I expected to see happen. The stock is basically in the middle of its recent range, which is certainly not a big move given the number of flight cancellations and lost revenue over the weekend. Let’s compare that to the JETS ETF:

This certainly looks awfully similar to the LUV chart, which seems a bit odd.

And the implied volatility really hasn’t gone up much in LUV, either:

*From CBOE LiveVol Pro

The range of that implied volatility is roughly 30-40%, and it’s at 35% now, so right in the middle of the range.

I normally focus my efforts on trading a technical input paired with options, but this opportunity seems ripe for me to look at a put position just in case the market decides to punish Southwest for being an outlier today and potentially damaging their reputation and revenue potential in the future.

Don’t forget to head over to https://optionhotline.com to review how I traditionally apply technical signals to my options trades and if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments