From Keith Harwood, OptionHotline.com

“Edge” is the advantage that you have over the rest of the marketplace. When I was a market-maker, the primary “edge” was the fact that I could buy on the bid and sell on the offer – I could capture the market spread. Certainly, I didn’t capture the market spread every time, but that was the expected positive return that I had. If a market is $0.20 wide and I am on the bid, and buy the option, then I would assume that I would make ½ of the market spread – $0.10 on the market price, which is $10 per contract.

But markets are tighter now. Spreads are often $0.01 or $0.02 wide. The “edge” for the market-maker relies on making $0.005 over and over all day. OR, for those of us that aren’t spending millions of dollars to have the fastest data feeds and best execution strategies as the market-makers and the high frequency traders, we can go out and find a way to have a different “edge.”

We will never get the “edge” of a market-maker. The spread is something that we simply pay to the market-maker to get the position that we want to hold. We will never buy quantities of tomatoes at the same price as the local grocery store, and thus we pay that grocer to hold an inventory of fresh tomatoes so that we can buy 1 or 2 at a reasonable price. And the grocer will make a little bit of money for taking the risk of holding that inventory. To get our “edge,” we must understand that if we see something else that causes a mis-pricing, we can and should take advantage.

The two “edges” I focus on are technical trading and options trading. If I think that there’s an inconsistent pricing of expected future movement relative to current market prices, then I have an “edge.”

I want to buy options when I think the market is underpricing potential future movement – hence why I do options analysis.

I want to buy calls when I think the market is underpricing the probability of a move to the upside, and I want to buy puts when I think the market is underpricing the probability of a move to the downside. This is why I do my technical analysis – to improve my odds of success relative to what the market is pricing.

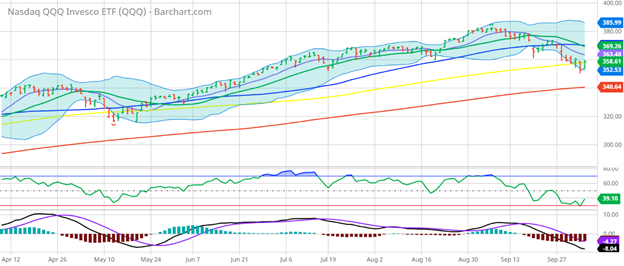

Right now, the directional move is working on ways to give me an “edge”, but I may not have that “edge” for a few days. Looking at QQQ, one can see that the market is chopping down after a very long bull trend, and so may not have a clear technical signal at this precise moment in time:

Options are getting cheaper than they were on Monday, but I believe that options can get even cheaper than they are right now. Looking at the VIX, we can see that implied volatility is falling but has more downside if the market becomes bullish and more upside if the market becomes bearish:

Patience is certainly a virtue, and cash is a position. But, if we can identify our “edge” and leverage it when the timing is right, then there is a good potential for long-term profitability.

Please take this chance to review how I apply technical signals to my options trades at https://optionhotline.com and if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments