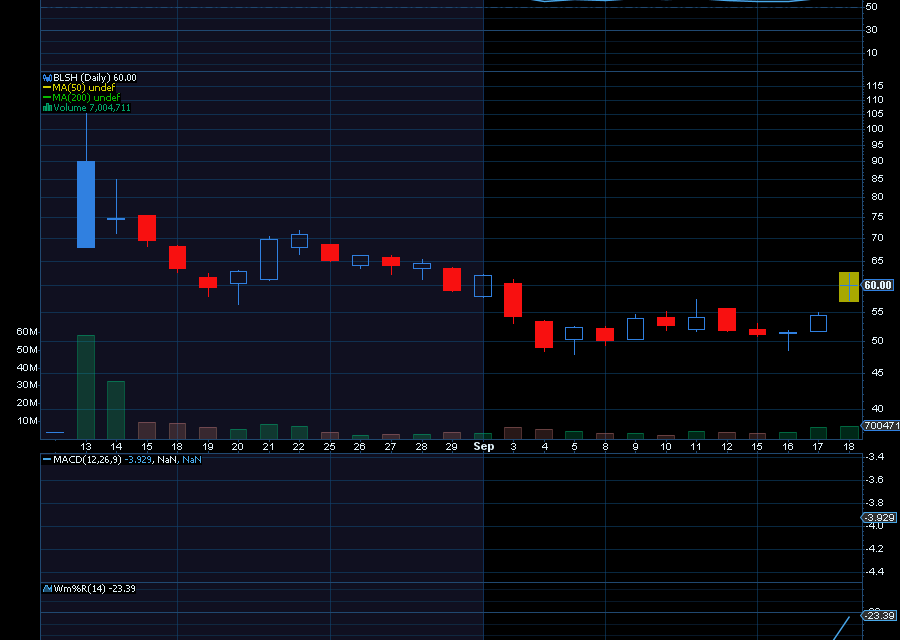

Crypto exchange stock Bullish (BLSH) is gaining momentum.

Last trading at $60.88, we’d like to see it closer to $70 initially.

Helping, not only did the company post better than expected second quarter earnings, but it also posted strong guidance for the third quarter.

In its second quarter, net income was $108.3 million, or 93 cents per share. That’s comparable to its year-earlier loss of $116.4 million, or $1.03 per diluted share.

Revenue of $57 million was above estimates of $55.8 million. Digital asset sales were $58.6 billion, up from $49.6 billion.

Moving forward, the company expects adjusted revenue of $69 million to $76 million, which is above the estimated $57.1 million.

Analysts Just Raised Their Price Targets

Analysts at Compass Point raised their price target on Bullish to $56 from $45 a share.

This was after earnings, and after the company’s news, it received approval from the New York Department of Financial Services (NYDFS), which will allow for faster U.S. expansion.

“Securing the New York BitLicense is a significant regulatory milestone for our growth in the U.S. and also signals our credibility to operate within the financial capital of the world,” said Chris Tyrer, President of Bullish Exchange, as quoted in a company press release.

“We believe that clear regulation drives responsible market evolution and institutional engagement. We look forward to offering New York’s institutions and advanced traders Bullish’s regulated, high-performance digital asset services.”

Analysts at Cantor Fitzgerald also raised their price target to $59 from $56 a share, with an overweight rating, thanks to earnings.

Sincerely,

Ian Cooper

Like ur analysis.