Uranium stocks, like Cameco Corp. (CCJ) have been explosive. All thanks to the energy-intensive demands of data centers and artificial intelligence.

Microsoft, for example, reached a deal with Constellation Energy to reopen Three Mile Island to power its data centers for the next two decades. Amazon Web Services recently bought a data center campus that will receive power from a nearby nuclear plant. Even Google signed a deal to buy small nuclear reactors from Kairos Power to fuel its artificial intelligence plans.

In addition, we have to consider that “Around 90 nuclear power plants are being planned, 61 are under construction and decommissioned nuclear reactors are being revived,” says Swiss Resource Capital. Also, as noted by Carbon Credits, “BMO Capital Markets projects a strong outlook for uranium demand. The investment banking subsidiary of BMO projected it to grow at an annual rate of 2.9% through 2035. This increase is largely driven by China’s aggressive push to build new nuclear reactors and the potential for reactor restarts in North America.”

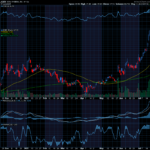

Technically, after pulling back from about $58.72 to a recent low of $50.16, CCJ is starting to pivot higher again. Near term, we’d like to see CCJ initially retest $58.72. From there, we’d like to see it closer to $65 – which could easily happen with the uranium bull market heating up.

Sincerely,

Ian Cooper

Recent Comments