Just when it looking like the market might have a fighting chance, Capitol Hill throws water on the fire with the struggle to navigate the limits it placed on debt. We have seen this before where big news creates fear in markets and the selling starts. Now we are looking at another potential sell off to follow on yesterday’s drop. When these broader markets moves are very pronounced, using the index ETFs can be an effective way to simplify trading a big swing.

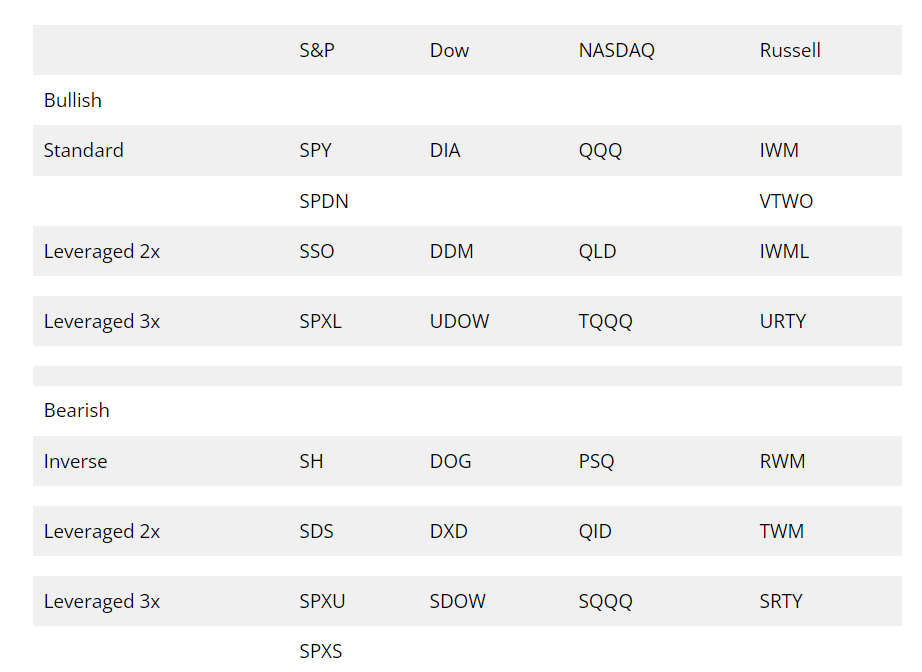

Here is a list of ETFS to consider as tools for exploiting these market wide moves . We shared it in a list of past articles on bear market trading you can read here.

The index that is one to really keep an eye on is the NASDAQ (represented in the QQQ and SQQQ ETFs). As we head into earnings announcements it is going to be interesting to see if the market cuts big tech some slack on what is expected to be poor earnings since they are slashing jobs as a gesture of trying to turn things around. Using SQQQ allows you to simplify taking a short position in this move. All of the headache of traditional short selling is replaced with and ETF you can trade just like a stock. If the NASDAQ goes down, SQQQ goes up since it is an inverse ETF.

Joe Duffy has helped many others take advantage of big moves in the markets in the past and now he is showing how he did it in is Little Black Book of Wall Street Bets. To grab these secrets, click here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments