Happy Financial Freedom Friday!

Being thankful is one of the strongest and most energizing states of being. It shifts your perspective from lack to abundance and allows you to focus on the good in your life, which in turn pulls even more positivity into your reality.

I am thankful for you! Thank you, thank you!

Here’s What Is Covered Below:

- Option Chain’s Delta- what is it?

- What is the difference between them?

- Which one is best?

- Why does the number change?

Today, we are going to discuss Options and Deltas on an option chain and learn exactly what they are, how they work, and how they can be used to earn varying income amounts on the same equity. Let’s put the pieces together.

Delta is a measurement related to trading options. Traders can use this number to predict option price movements based on the change in the underlying asset. It can also be used to assess the probability that a given option will expire in the money. It’s useful to understand Delta, how it is calculated, and the ways option traders use Delta in their trading.

In simple terms, Delta is how much an option will move based on the price movement of the stock. Will it be $1 for $1 or 75% of the price move, 50% or 25% or zero (for a while)?

Delta is one of the variables used to describe the different dimensions of risk involved in selecting a strike price. Delta measures the sensitivity of an option’s price to movement in the underlying stock. Specifically, Delta designates the amount an option’s price is expected to move based on a $1 change in the underlying security.

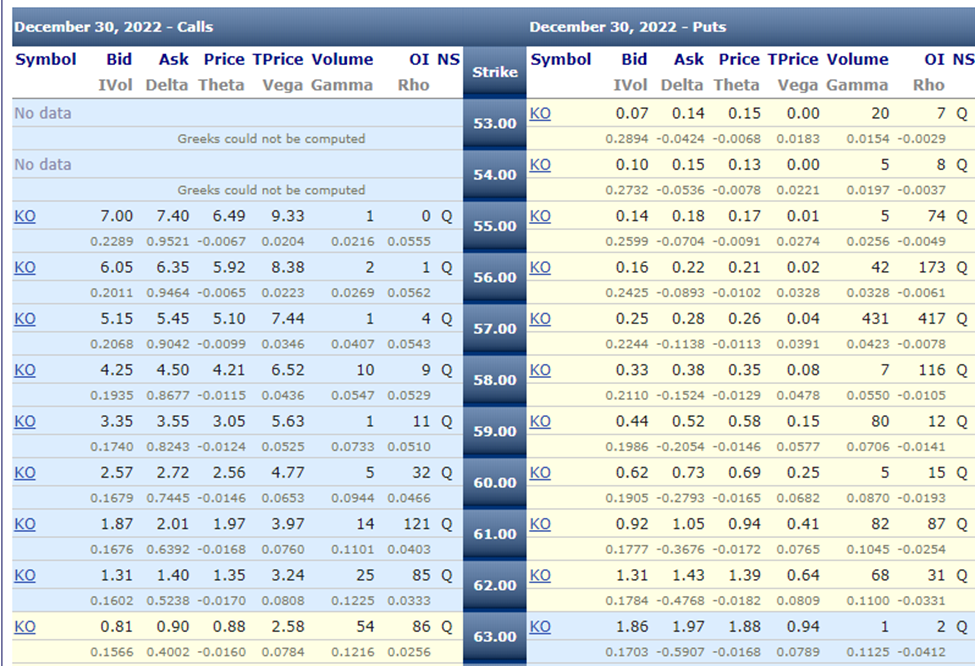

Let’s look at the chains we looked at last week for Coca Cola and analyze the Delta information that was on those chains.

You will note that Delta is a gray title and number listed under Ask.

The variables used to predict changes in option values are known as the “Greeks,” and it assists you to assess the opportunity and risk associated with a given option strike price. Delta is one of the key variables because it helps you determine how option prices are likely to change as the underlying stock price varies. The calculation of Delta is done in real-time by computer algorithms that continuously publish Delta values. The Delta value of an option is often used by traders to assess their option strategy. Which strike will they select?

What is Delta? Delta is the theoretical estimate of how much an option’s value may change given a $1 move UP or DOWN in the underlying security. The Delta values range from -1 to +1, with 0 representing an option where the premium barely moves relative to price changes in the underlying stock.

Option Delta behavior depends on the relative position of the strike price in comparison to the current price of the underlying asset. An in-the-money option, one that could be currently exercised for value, will have a higher Delta score than an out-of-the-money contract. An out-of-the-money option has no intrinsic value, meaning that it would make no financial sense to exercise an out-of-the-money option.

I think of options as the opportunity to gain from of stock’s price movement up or down for a set period of time. In a sense, it is like renting a stock for a specific period of time where you benefit from its move, if you own an option covering that period of time. The option’s Delta tells you how much it will likely move based on the stock’s price movement.

Look at the chart above, the Delta for the 55 strike is .9521. That means for every dollar move up for Coca Cola, the option will gain .95 cents. Now scroll down and look at the Delta for the 63 strike. The Delta is .40, so it is out-of-the-money, meaning Coke’s price hasn’t yet reached 63. The 63 strike Delta is .40, so if you purchased that strike, for a dollar move up in price, the option would gain .40 cents.

Having this basic understanding helps you to select the strike price you want to trade, but you also need to understand that as price rises and moves in the right direction, the Delta will increase as the strike price moves to be further in-the-money.

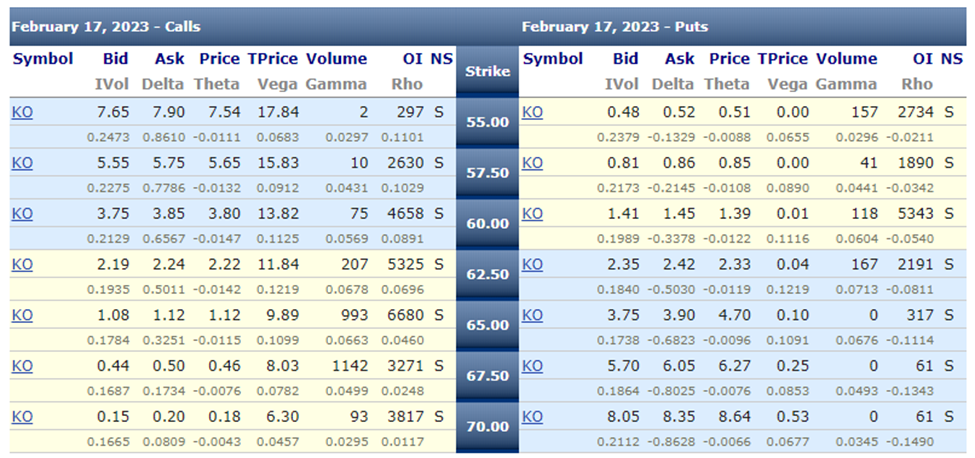

The next chart is out for a longer period of time. Time doesn’t affect the Deltas, they are based on their position compared to an equity’s price. The deeper in-the-money, the higher the Delta. Some strike prices are so far out-of-the-money that their Deltas are zero and it is only wise to consider them when you are day—trading or buying way out in in time. As an example, perhaps buying out a year from now, giving the equity time to rise in price.

A lower Delta makes the premium less expensive and allows you to buy more contracts. Selecting the proper Strike and Delta is like a two-sided scale, you have to weigh various elements. How long do you think you will hold the option, what is your price-move expectation based on patterns and time frame chart and how many contracts are you going to buy based on your investment amount budget?

The chain images are from this free site. https://www.optionistics.com/f/option_chains/ko

Compare a couple of the strike prices on each chart. Say, the 60 strike. The December 30th 60 strike would cost 2.72 per share or $272 for the contract of 100 shares and has a Delta of .7445 (.74 cents for every 1.00 rise in price) and the February 17th 60 strike is 3.85 or $385 with a Delta of .6567 (.66 cents for every 1.00 rise in price) but has a month and a half longer in time to make that move up in price.

Your broker will also have option chains on their site.

I hope you find this information useful.

Friday is education day. My goal is to teach everyday people (like me) to successfully trade options. I do my best to write in an understandable way as if we are talking while sitting on the deck of my house in a relaxed atmosphere.

The trading tools you select, and use are important, and can make your trading easier and more effective.

Have a great weekend.

Watch or pay attention to what you tell yourself. If you continually say, I can’t, you’ll prove yourself to be right. You can’t. Knowing this, confirm what you truly want to happen in your life.

Say, I expect the best!

And I wish you the very best,

Wendy

hello Wendy. I like your pricing option tool, it looks like it’s easy to use, i did belong to your options. I think news info i was getting from you has ended now im thinking what to do next . Thanks JOE