Stocks have been pushed down into what could seem like some really attractive price ranges. Basically since January 1 of this current year rising interest rates, rising oil prices, a job market and supply chain that is still hungover from COVID, have all pushed market down, albeit in a fall that was more like a tumble down a jagged cliff.

The last couple weeks of the year are basically a scramble of traders trying to sell positions to lock in losses for tax purposes and buyer sitting in the wings waiting to scoop up great deals on stocks that have been pushed lower than they really deserve to be.

From the looks of the last couple days, the bears are still winning this wrestling match. This sets up some opportunities to exploit this in the next couple weeks.

We can see the VIX curling up which typically indicates more drops.

Since we learned last year that the beginning of the year can be the gun going off in a race (to sell last year), we would want to focus on the next couple weeks and be ready to exit before the next level of madness begins.

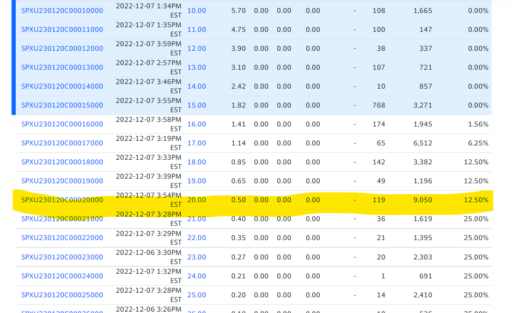

Using an inverse ETF like SPXU allows us to grab the move down. Call options on that drop have the potential to boost the power of this last hurrah.

The Jan 20 Calls with a strike of 20 are at just .50. This could be a nice stocking stuffer for the end of the year.

If you are looking for other ways options have the potential to generate consistent income, check out Wendy Kirkland’s Golden Retirement approach. You can get the details here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

PS–Don’t miss Wendy’s webinar TODAY @ 4:30PM EST

Wendy Kirkland’s Ultimate Options System:

How hidden price patterns create exceptional opportunities that most traders never see

Recent Comments