Dear Reader,

Yesterday, we looked at a Daily Price Chart of Deckers Outdoor Corp. noting the stock 50-Day EMA is trading above the 100-Day EMA signaling a ‘Buy’.

For today’s Trade of the Day we will be looking at a Daily Price chart for Eli Lilly & Co. stock symbol: LLY.

Before breaking down LLY’s daily price chart let’s first review which products and services are offered by the company.

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. It offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; and Jardiance, Trajenta, and Trulicity for type 2 diabetes.

Now, let’s begin to break down the Daily Price chart for LLY. Below is a Daily Price Chart with the price line displayed by an OHLC bar.

Buy LLY Stock

The Daily Price chart above shows that LLY stock has been hitting new 52-Week Highs regularly since mid-April.

Simply put, a stock does not just continually hit a series of new 52-Week Highs unless it is in a very strong bullish trend.

The Hughes Optioneering team looks for stocks that are making a series of 52-Week Highs as this is a good indicator that the stock is in a powerful uptrend.

You see, after a stock makes a series of two or more 52-Week Highs, the stock typically continues its price uptrend and should be purchased.

Our initial price target for LLY stock is 410.00 per share.

Profit if LLY is Up, Down or Flat

Now, since LLY is currently making a series of new 52-Week Highs and will likely rally from here, let’s use the Hughes Optioneering calculator to look at the potential returns for a LLY call option spread.

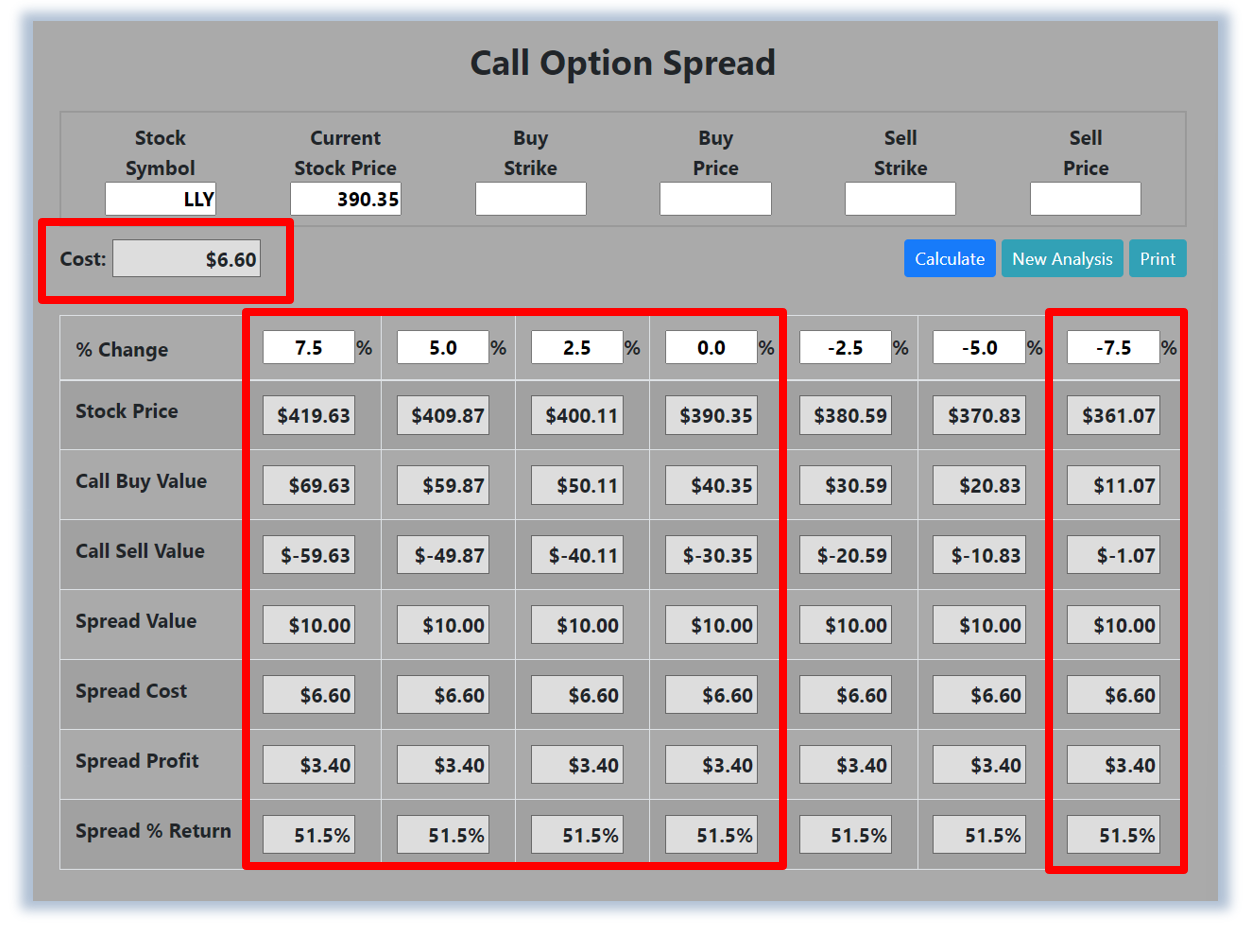

The Call Option Spread Calculator will calculate the profit/loss potential for a call option spread based on the price change of the underlying stock/ETF at option expiration in this example from a 7.5% increase to a 7.5% decrease in LLY stock at option expiration.

The goal of this example is to demonstrate the ‘built in’ profit potential for option spreads and the ability of spreads to profit if the underlying stock is up, down or flat at option expiration. Out of fairness to our paid option service subscribers we don’t list the option strike prices used in the profit/loss calculation.

The prices and returns represented below were calculated based on the current stock and option pricing for LLY on 4/27/2023 before commissions.

Built in Profit Potential

For this option spread, the calculator analysis below reveals the cost of the spread is $660 (circled). The maximum risk for an option spread is the cost of the spread.

The analysis reveals that if LLY stock is flat or up at all at expiration the spread will realize a 51.5% return (circled).

And if LLY stock decreases 7.5% at option expiration, the option spread would make a 51.5% return (circled).

Due to option pricing characteristics, this option spread has a ‘built in’ 51.5% profit potential when the trade was identified*.

Option spread trades can result in a higher percentage of winning trades compared to a directional option trade if you can profit when the underlying stock/ETF is up, down or flat.

A higher percentage of winning trades can give you the discipline needed to become a successful trader.

The Hughes Optioneering Team is here to help you identify profit opportunities just like this one.

Interested in accessing the Optioneering Calculators? Join one of Chuck’s Trading Services for unlimited access! The Optioneering Team has option calculators for six different option strategies that allow you to calculate the profit potential for an option trade before you take the trade.

Trade High Priced Stocks for $350 With Less Risk

One of the big advantages to trading option spreads is that spreads allow you to trade high price stocks like Amazon, Google, or Netflix for as little as $350. With an option spread you can control 100 shares of Netflix for $350. If you were to purchase 100 shares of Netflix at current prices it would cost about $33,000. With the stock purchase you are risking $33,000 but with a Netflix option spread that costs $350 your maximum risk is $350 so your dollar risk is lower with option spreads compared to stock purchases.

Average Portfolio Return of 115.7%

Below is a screenshot of the current open trade profit opportunities from Chuck’s Weekly Option Alert Trading Service. There are currently $142,271.34 in open trade profit opportunities with an average portfolio return of 115.7% demonstrating the ability of the Optioneering Strategy to deliver substantial returns with no losing portfolios**.

**Open trade profit results represent the open trade profit performance for the portfolio displayed on 4/28/23. Open trade profits may have increased or decreased when trades were closed out. Trading incurs risk and some people lose money trading. Past performance does not necessarily predict future results. Member profits and losses are not tracked. Profit potential is taken from results of signaled trades, not actual member results. Not all members make the trades.

Chuck’s $3,000 Trading Scholarship

I don’t want you to miss a single opportunity to potentially reach your goals. That’s why I’d like to offer you a scholarship of the full $3,000 Enrollment Fee of my exclusive Weekly Option Alert Trading Service***.

I want you to follow in my footsteps and succeed beyond your wildest dreams, so please call Brad in my office at 1-866-661-5664 or 1-310-647-5664 and get started today!

You can also click below to schedule a call now!

Wishing You the Best in Investing Success,

Chuck Hughes

Editor, Trade of the Day

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

*** Weekly Option Alert Trading Service program provides training package and specific trade signals for one year. The first 10 people to sign up each day this offer is valid, will get a waiver of the standard fee, which is the price charged to anyone signing up after the first 10 people per day.

Recent Comments