I keep a close eye on QQQ and just spotted an example of a great potential trade. Below I show what my indicator revealed, the trade example to consider and an update on a previous trade.

QQQ, which tracks the tech heavy NASDAQ index, is one of the most active ETFs in the market. Since it trades in such high volume it offers unique characteristics that make it more ideal for options trading.

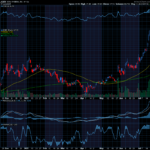

When I look for a potential trade in QQQ I start with the recent activity in the NASDAQ. Here is an image that makes it easy to see.

This chart image is courtesy of FINVIZ.com a free website and gives a quick view of each day’s movement.

The next step for me is to look at a chart of QQQ that includes Fibonacci Exponential Moving Averages (EMA). This is an indicator that appears on the chart in colored lines and gives us a sense of the strength and direction of the current price movement. To learn more about EMAs, click here.

Since EMA’s weigh recent price activity greater than older price activity, it can block out some of the noise and provide a signal based on more current activity. The most recent EMA on this chart (8) is heading down indicating a bearish move so we can look at Puts.

EMAs are also helpful in providing actionable price targets to help build trades.

In this example, if price fell to $354 you could consider a put trade. $350 is the short-term target.

I mentioned earlier that the higher volume of QQQ lends itself to options trades. Options also provide another advantage in that they offer leverage and risk control. To buy stock shares of QQQ today would cost approximately $354.92 per share (as I write this on Tuesday). You would wait until it found a bottom before buying stock.

Let’s discuss a Put option trade for our example. If you bought one Put option that covered 100 shares of QQQ for the 350 strike, it would cost about $4.77 for the October 20th expiration date. This would be an investment of $477. If the price fell the expected $4, you could expect to make approximately $2.00. This would be a $200 profit on your $477 investment, or 42% profit.

Option trading is truly unique in its ability to give traders the opportunity to trade an equity’s price move in either direction.

You don’t have to wait until it hits the target or until expiration day. Once in a trade, options allow you to exit and take a profit (or limit a loss) at any time. You also want to wait for the indicator confirmation and don’t jump-the-gun with an early entry.

I love teaching and writing my strategy books as clear as I write these emails. I try to think of the questions you’ll ask before you ask them.

I wish you the very best,

Wendy

Past potential trade update:

Last week we discussed buying QQQ. On 9-28 the Oct 20th 350 put was $ 3.10. You could have sold on 10-3 for $4.30, a 39% profit.

Recent Comments