Amazon, Salesforce, and Vimeo have all announced workforce cuts. On top of that, a key labor indicator is due out tomorrow. None of the news looks good for tech workers but the question we want to know is how will the market react.

Wall Street could be optimistic that tech is reigning in costs and tightening up the ship to increase profitability as they weather this economic storm. As we discussed the other day, 2023 is lining up to be a year where quick grabs are more likely to win than buy and hold.

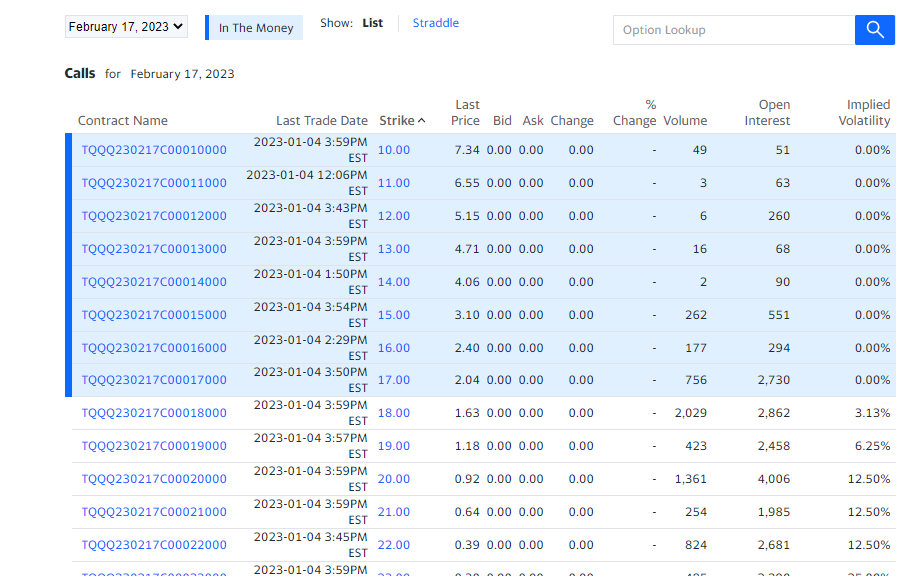

In this case, one way to play the possibility that traders will support the cuts is to look at a call option on TQQQ the leveraged ETF that track the tech heavy NASDAQ.

A move up toward 20, even for a brief period, is plausible. Grabbing a Feb 17 call option with a strike of 20 could position a trade for a nice move. Those calls are currently under $1. As with any trade the risk factor is always there but a low priced option helps keep that downside manageable.

This could be a pretty quick window for this trade so it is definitely one to set up when it can be watched closely.

We’ll keep an eye on it and update you as we see things play out.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments