UPDATE–Unusual market conditions are creating an urgent opportunity. This climate is ripe for crushing surprises and also account boosting swings. I am updating my webinar tomorrow to show how you can be in the best position for exploiting this climate. Sign up here to make sure you don’t miss it.

Geopolitics are the focus of the news, but they’re not having a major impact on the main market indexes. There are, however, some interesting technical setups forming that could greatly impact market movement and create some explosive return profiles.

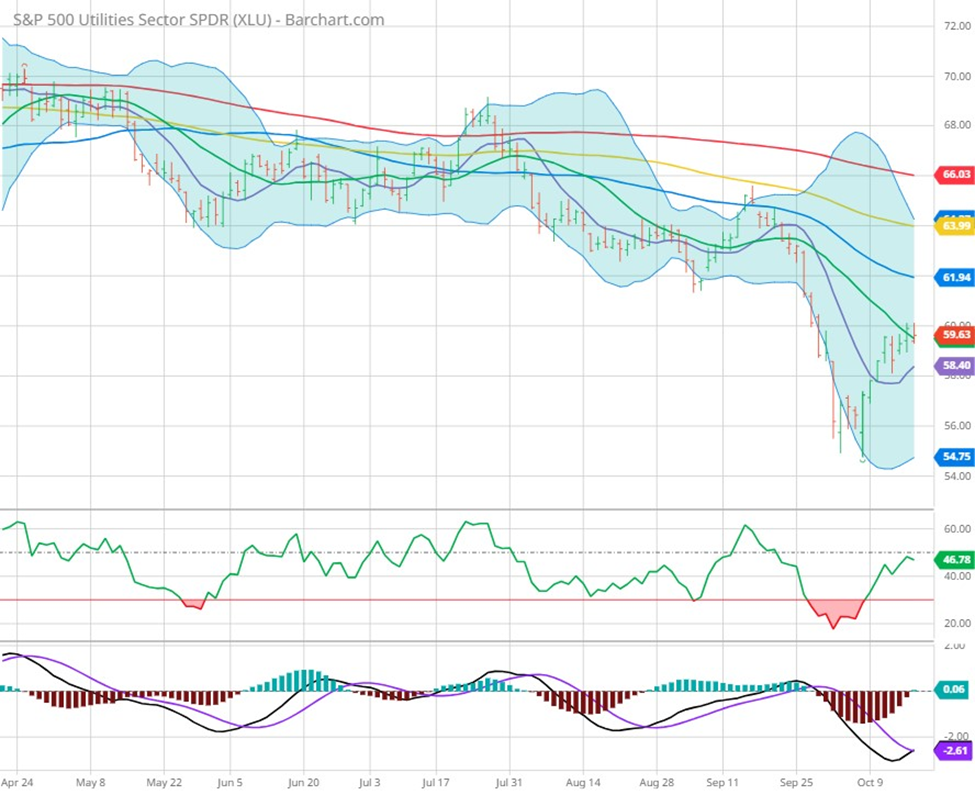

Before I get into a new trade idea, I’d like to check in on the XLU idea from last week.

XLU is firm with more upside showing. This has worked out with a slow grind higher that appears ready to continue. As always, I have to let winners ride and would be looking at a stop loss on a break of the 10-Day Moving Average, as that was the trigger for the bullish thesis.

There’s a sector of interest to me now because it’s been beaten down so badly. It’s not necessarily a high probability trade, but if timed right, it could get a short-squeeze and really help the options leverage pay off nicely.

That sector is the airlines, via the ETF JETS:

The downward trend has been consistent and aggressive, but I’m starting to see signs of a reversal. The MACD is showing flat and has been for over a month, showing a lack of momentum to the downside – it’s simply a grind. Additionally, the RSI has been sitting under 30 for a long while, and that simply doesn’t normally happen. Finally, implied volatility is starting to drop, which gives a leveraged opportunity with defined risk to the upside.

Overall, there are a handful of interesting setups coming out right now, but it’s still a slow dull market without a major trend. However, doing the homework to find the setups that do exist can catch an unsuspecting market off-guard and give a very nice return.

As always, please go to http://optionhotline.com to review how I traditionally apply technical signals, volatility analysis, and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments