by Dan Keen

At-The-Money Plays

Sometimes an option’s premium is high enough that it would be worthwhile to buy the stock and write an at-the-money call with a strike price at the same price you bought the stock. The reason for doing this is because the premium paid will be greater. You will almost assuredly be called out, unless the stock drops below the strike price. When doing this type of play, it’s extremely important to take commission fees into consideration. You must be sure a profit will be made when you are called out. Remember that if you are called out there will be another commission fee for exercising the option. This fee will be charged at the rate of an option transaction, which is higher than an equity transaction fee.

For example, let’s say that the stock of Ames Department Store is at exactly $15. The option for June, four weeks away, with a $15 strike price, is paying $1.81. That’s a nice premium. If you buy the stock, sell the call, and get called out, your return on investment would be:

$15.00 x 100 = $1,500.00 + $8.00 commission = $1,508.00 cost

$1.81 x 100 = $181.00 – $15.00 commission = $166.00 profit from writing a covered call

If called out, another $15.00 commission is charged, so final profit = $151.00

(profit / cost) x 100 = ($151.00 / $1,508.00) x 100 = 10% in four weeks

As long as you are not interested in holding on to the stock, and you believe the price will remain stable or increase slightly, this play which makes 10% in four weeks, is a very good covered call play. As always, the risk is that the stock could drop. However, you have some downside protection. Even if it drops from $15 to $13.50, you would still just about break even! As long as the fundamentals look good for the company in the near term, and the market as a whole looks promising, the risk for this play appears to be acceptable.

Here’s another example of an at-the-money play, one we found in the newspaper. It showed that the stock for Ocular Sciences (OCLR) appeared to be in a trading range, with a support level of $15. At this time, we discovered it by reading Barron’s, which had a write up on the stock. The article said OCLR had a low forward P/E, had potential for upside surprise with minimum downside risk, and was a value stock with a target price of $37. Using the Internet, we checked the fundamentals of the stock: its beta was 1.2; average daily volume was 276,000 shares. Zacks analysts showed four strong buy recommendations and four moderate buys. Last quarter earnings were up. The 52-week range was a low of $13.25 and a high of $35.25, so there was plenty of upside potential. The option premium for one month out with a strike price of $15 was paying $1.6875, which would be $168.75 for 1 contract. That is an 11% return in four weeks (not taking commissions into account). However, we had to assume we would be called out, since the option was already at-the-money. That would mean another commission fee would be encountered. Assuming $8 to buy the stock, $15 to sell the call, and $15 when the option was exercised, our profit would be about 9%… still a great deal!

In-The-Money Plays

Generally, in-the-money plays, that is, when the current price of the stock is above the strike price, are not real profitable, unless you purchased the stock earlier at a much lower price.

Consider this in-the-money play we did several years ago. The stock of General Nutrition was at $18. The $17.50 strike price going six weeks out was paying $1.375. The stock was strong and analysts predicted the price would go into the $20s over the next year. But at this time the stock market was in the summer doldrums, and many stock prices were fairly stagnant, only moving up or down in a very tight range. Would a covered call play on this stock be profitable? After all, you are selling the right to have the stock purchased from you at a lower price than you paid for it.

Let’s do the math. If the commissions are too expensive, they will kill the play. Our online broker charges $8 to buy the stock, $15 for up to eight option contracts, and $15 when an option is assigned (called out).

We bought 200 shares of the stock at $18 for $3,600 plus $8 commission, for a total cost of $3,608. Next we wrote two contracts at the 17.50 strike price at 1.375.

$1.375 x 200 = $275.00

A commission of $15 reduces our income to $260.00

Assume the option will be exercised, and we will be called out. If that happens, we would receive $17.50 times 200 shares, or $3,500. An option commission fee of $15 would be taken from that, giving us an income of $3,485.00 (when you are called out, an option transaction commission fee is charged).

Did we make any money? Our total income from the deal was $3,485 plus the initial premium we received, $260, for a total of $3,745.

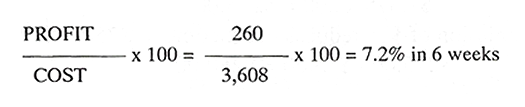

Our cost was $3,608, so it looks like we made a profit. Was it a decent profit? Calculate the return on your money by dividing the profit by the cost, and multiplying by 100 to give percent.

At first, a 3.8% return may not sound like a good return, but remember it only took six weeks to achieve that yield. That’s the equivalent of 32.9% annually if you could do this play every six weeks! So, this in-the-money play would be profitable, although it may not be the most efficient use of your covered call money.

If we are lucky and we don’t get called out, we will do even better, making 7.2% in only six weeks.

Barely Out-of-the-Money Plays

The bulk of covered call plays that generate quick cash will be those that are just barely out-of-the-money plays, where the stock price is only a few cents under the next higher option strike price.

Here’s an example, let’s say that in December of 2010 we bought 100 shares of Galileo Technologies (GALT) at $22.375, and immediately wrote a covered call for January $22.50 because it had a very high premium, paying $1.9375. You don’t even have to do the math to see that there would be a decent profit on this “slightly out-of-the-money” play.

If we don’t get called out, we would have an 8% return on our money in four weeks! However, the stock was in an uptrend and we expected to get called out. If called out, there would be a slightly lower return, even though we bought the stock at $22.375 and are selling it for $22.50, because commission fees come into play. Whether we get called out or not, it’s still a good play. We can’t loose, unless the stock takes a terrible unforeseen dip. Even then, we still own the stock and could hold onto it until it eventually rises, and even do covered call plays on it as it slowly works its way back up.

Recent Comments