Its earnings week for the big banks and the impact on stocks could create some nice trades. We have had our eye on the financial stocks for a couple weeks as the environment for them to pop is ideal. You can check out that article here.

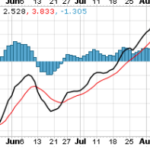

The support we were looking for is setting up nicely and the positive news from earnings could be the spark to light the fire. A simple way to trade this news is to look at XLF the ETF that tracks the financial sector.

It has broken through its 10 day moving average and with the tailwind of a strong previous quarter it is poised to bounce back up to its previous high above 35. These signs of a downtrend getting exhausted and a reversal starting to form are easier to recognize than you might think. Lee Gettess has really outlined the strongest signs that a trend is worn out and creating and ideal set up.

Be sure to check it out here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

BONUS