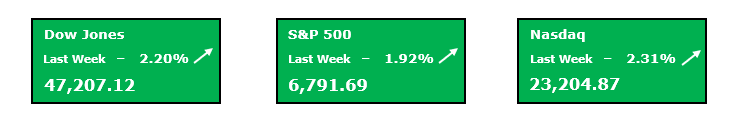

Building on the encouraging technical strength from the prior week, the market opened this past week with a decidedly bullish momentum. The narrative quickly shifted away from trade uncertainty and focused squarely on the promise of the burgeoning earnings season, which was moving into full swing. As investors anticipated the reports from the major technology and growth companies, they were met throughout the week with a steady stream of strong results that consistently cleared the Street’s lowered expectations. This positive drumbeat of corporate performance was already enough to propel markets higher, but the final, massive catalyst arrived on Friday with the release of the latest Consumer Price Index (CPI) report. This key inflation metric came in cooler than analysts had generally forecasted, providing immediate relief as it cleared the way for the Federal Reserve to cut rates at the upcoming meeting. The combination of resilient corporate profits and milder inflation pressures was the perfect fuel for a historic rally, powering all three major indexes to new all-time highs. Most significantly, this massive surge saw the S&P 500 Index finally break through its technical resistance level and trade convincingly above the psychological 6800 mark for the first time ever, cementing the week as a major leap forward for this bull market.

Last week’s jump higher, marked the second consecutive week higher for the market and perhaps the start of a new significant leg higher. There is certainly a lot of the line this week for the market but as earnings continue to come in well, the Fed looks poised to keep cutting rates, & inflation is remaining contained, there are plenty of reasons to believe that this current run could continue until the end of the year. Looking at the charts and technicals, they suggest the same with each of the three major averages closing at new all-time highs in Friday’s session. Friday’s bullish surge pushed each of the three indexes past a clear level of resistance which should now serve as a new support level for the market. Despite last week’s surge, each of the indexes are also signaling that they are not yet overbought either as each of them are still remaining below the upper Keltner Channel. One additional piece of good information is that we saw a nice improvement in breadth last week as well. The equal weighed S&P 500 is sitting on the verge of fresh all-time highs and the Advance/Decline index for the S&P is also hovering just below its previous high. Seeing this strong technical advance coupled with improving breadth is encouraging because it clearly shows that there is broad participation to the upside in this rally. Last week’s surge set the stage for this big week ahead for the market. Should the major events of this week fall in the favor of stocks, expect the market to continue to build on these strong technicals.

✨ Unlock the power of precision trading with my WPO Newsletter—recent picks hit 52.4% & 117.4% peak gains in just weeks (past performance is not indicative of future results). Your first month is just $1—sign up now and seize your edge! 🏆

Key Events to Watch For

- The most important week of Q3 Earnings Season awaits, as this week many major companies are set to report their quarterly results. Earnings season really ramped up last week with several significant reports and thus far it has been a strong reporting season with 87% of reporting companies having beat EPS estimates. But if you want more earnings clarity, you will get it this week. There are numerous critical reports due this week as MSFT, GOOGL, META, AAPL, AMZN, & V, amongst others, are all going to report their Q3 numbers. As earnings weeks go, this is about as big as it gets, and it will certainly be a market moving event.

- Fed meeting on deck- the FOMC will conclude their October meeting on Wednesday when they will release their updated policy decision where they are widely expected to opt to cut rates once again. In fact, the Fed Funds Futures markets are pricing in a near 97% probability that this will be the result. Markets have already moved higher, pricing in the expected Fed rate cut so it will be important to get this box checked off mid-week. More importantly though will likely be the press conference from Fed Chair Powell. Investors will be listening to this presser closely to see if Powell drops any hints about the FOMC’s current attitude about the economy. Any potential clues could be used to confirm whether the market should be expecting a third consecutive rate cut at the December meeting, the final one of the year.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments