I am going to call Thursday “QQQ Day”. Each Thursday, I will focus on what the QQQ is doing, with the hope it will help give us a clue about the market’s upcoming moves.

QQQ, or the Invesco QQQ Trust, is an exchange-traded fund that trades on the Nasdaq under the symbol QQQ. It is designed to track the Nasdaq ETF stock market index. This fund is the second largest ETF in the world and gives a good overall picture of the market. QQQ includes shares from the top Nasdaq companies.

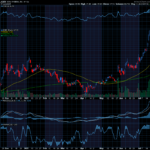

The chart of the QQQ below is a weekly chart with EMAs overlying the candles. The description coming up next explains how to use exponential averages.

The image below is Tuesday’s price activity.

This chart image is courtesy of FINVIZ.com a free website and gives a quick view of each day’s movement.

Fibonacci Exponential Moving Averages (EMA)

According to the definition at Stockcharts.com, exponential moving averages (EMAs) reduce the lag seen in simple moving averages by applying more weight to recent prices. The weighting applied to the most recent price depends on the number of periods in the moving average. We are applying 8, 21, and 55 weekly periods for our entry signals.

EMAs differ from simple moving averages in that a given day’s EMA calculation depends on the EMA calculations for all the days prior to that day. You need far more than 10 days of data to calculate a reasonably accurate 10-day EMA.

There are three steps to calculating an exponential moving average (EMA). First, calculate the simple moving average for the initial EMA value. An exponential moving average (EMA) must start somewhere, so a simple moving average is used as the previous period’s EMA in the first calculation. Second, calculate the weighting multiplier. Third, calculate the exponential moving average for each day between the initial EMA value and today, using the price, the multiplier, and the previous period’s EMA value.

Charting services or your broker’s chart service figure these calculations for you.

As mentioned, entry signals are based on the use of 8, 21, and 55 weekly averages. (8, 21 and 55 are Fibonacci numbers that are a special sequence of numbers that I prefer.) As mentioned, we are zeroing in on 8 EMA (short term), 21 EMA (medium term) and 55 EMA (long term).

EMA Buy Signal

Each candle on the chart represents price movement over one week. The EMA’s are in down trending order and looked to be starting to curl up but have changed direction again.

QQQ’s Potential Trade

If price fell to $288, you could consider a Put trade. $280.00 is the short-term target.

Check Out How an Option Trade Could Pay Out Big Time

To buy stock shares of QQQ today would cost approximately $288.73 per share (as I write this on Tuesday). You would wait until it found a bottom before buying stock.

Let’s discuss a Put options trade for our example. If you bought one Put option that covered 100 shares of QQQ for the 270 strike, it would cost about $4.22 for the October 21st expiration date. This would be an investment of $422. If price fell the expected $8, you could expect to make approximately $4.00. This would be a $400 profit on your $422 investment, or 95% profit.

Option trading is truly unique in its ability to give traders the opportunity to trade an equity’s price move in either direction.

I want to stress, when you trade options, you can close the trade anywhere along the line to take profit (or loss). You don’t have to wait until it hits the target or until expiration day. You also want to wait for the indicator confirmation and don’t jump-the-gun with an early entry.

Trading options can be a win, win, win opportunity. Options often offer a smaller overall investment, covering more shares of stock and potential for greater profits.

What’s Next? I Can Hardly Wait!

For updates on previous potential trades we have discussed, scroll to the bottom of this message.

I love teaching and write my strategy books as clear as I write these emails. I try to think of the questions you’ll ask before you ask them.

Our lives should be filled with joy. As many minutes throughout the day as possible, we should be happy. Figure out what you love and do it. Love what you do, and with all your heart give yourself to that love. Enjoy your life and the people in it.

I wish you the very best,

Wendy

Past potential trade update:

Last week we talked about buying QQQ 290 puts with an Oct 21st expiration date. The premium was $8.87 on 9-14. On 9-16 you could have sold for $11.34, a 29% profit.

Recent Comments