I like to have an unhedged opinion on the market direction as much as is feasible. It’s not always possible, because sometimes the evidence doesn’t lend itself to a strong conviction either way. However, right now I do believe we are at or nearing a pivot in the stock market. I have been a bear for a couple weeks and in the SPX that was too early. In the IWM chart I pointed to last week, and attached again, it’s been better.

The IWM just continues to grind sideways in what I believe will prove to be the consolidation before the next leg lower. Sentiment has slowly shifted with each passing day. I look for the stock market to move lower from here, and I think IWM will be the weakest index. As well as a poor looking chart, 40% of the companies in the index are barely or not at all profitable, and a credit crunch will hit these companies to a greater extent than larger more capitalized companies. Markets may bottom before a recession is over, but not before it starts, is my unhedged view!

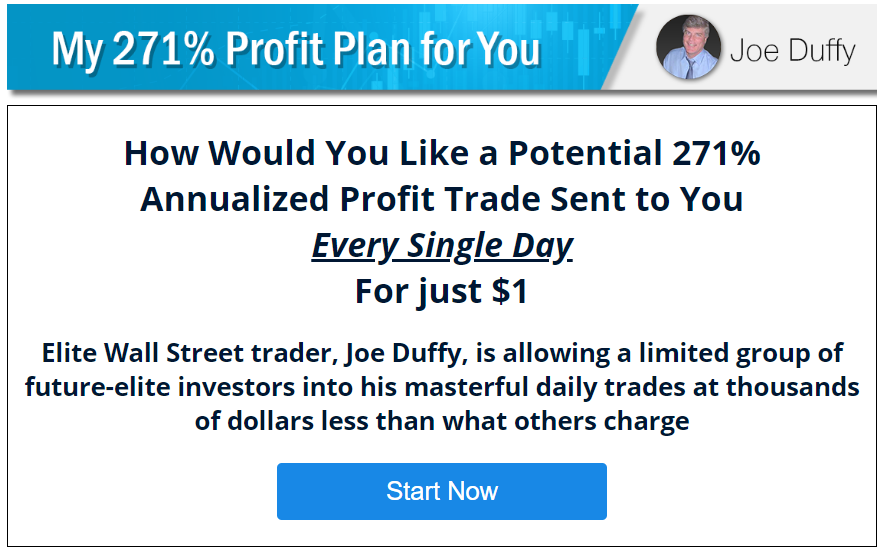

Thanks,

Joe

Recent Comments