Is it time for Small Caps to shine? If so, what’s the main signal for such a shift in the marketplace?

I’ve looked at this before, and frankly, it’s been a bit baffling how tech can continue to lead the market with small caps never seeming to want to catch up. And yet, I’m starting to see some of those signs that it’s finally time for that to occur.

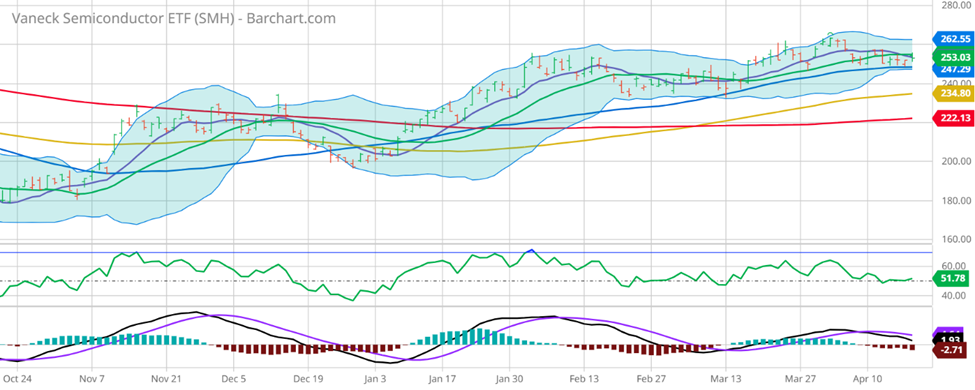

First, I’ll look at a somewhat concerning trend in semiconductors, which tend to be a leading indicator of tech stocks. Let’s look at the chart for SMH (the Market Vectors Semiconductor ETF):

As you can see, this index has gone virtually nowhere for about 3 months, and perhaps more concerning, it’s starting to pull back over the last 2 weeks after failing to set a new trend when attempting to break out. It’s not necessarily a bad chart, but there’s certainly no indication here that tech needs to go higher.

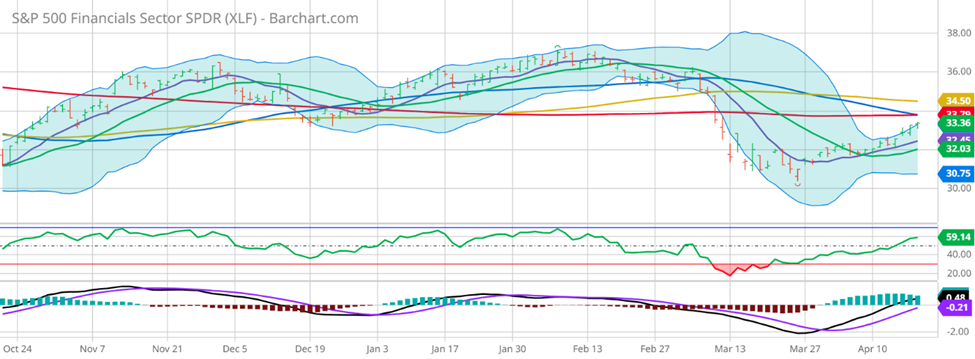

However, there’s a better chart out there, and it’s in a sector that’s already had some good earnings results, and that’s in XLF (the Financial Select Sector SPDR Fund ETF):

Over the last 3 days, this ETF is looking like it wants to settle into a new uptrend. That seems positive if the earnings are good enough to set this up, and the market is telling me that the earnings are good enough.

So, why am I interested in small caps? Well, let’s look at the sector breakdown of IWM, the iShares Russell 2000 Index ETF):

As you can see, almost 16% of that ETF is financials. That sounds like a pretty good tailwind. Let’s also look at the IWM chart itself:

Pressing near the 50, 100, and 200-Day Moving Averages, this could get explosive with a little push higher.

Once we get a tailwind to a big ETF or simply to a sector like XLF, I start looking that much closer at those names that are big components of those ETFs in my Outlier Watch List. And that’s what I’m doing now! If these sectors continue to firm, there will be many opportunities to capitalize using the leverage of options, and I’ll be looking at the best ways to do so.

So please go to http://optionhotline.com to review how I traditionally apply technical signals, volatility analysis, and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments