I am going to focus on the S&P on Mondays and call it “Momentum Monday”. I will focus on SPY, which is the ETF covering companies traded within the SPX Exchange Traded Fund.

Before analyzing SPY’s charts, let’s take a closer look at the ETF and its services.

SPY, or the SPDR S&P 500 trust, is an exchange-traded fund that trades on the NYSE Arca under the symbol SPY. SPDR is an acronym for the Standard & Poor’s Depositary Receipts, the former name of the ETF. It is designed to track the S&P 500 stock market index. This fund is the largest ETF in the world and gives a good overall picture of the market. SPY includes shares from the top 500 companies.

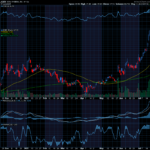

The chart of the S&P below is a weekly chart with a PPO indicator at the bottom. The description coming up next explains how to use the PPO.

The image below is Friday’s price activity.

This chart image is courtesy of FINVIZ.com a free website and gives a quick view of each day’s movement.

Percentage Price Oscillator or PPO

Stockcharts.com provides a great definition of the Percentage Price Oscillator (PPO), which “is a momentum oscillator that measures the difference between two moving averages as a percentage of the larger moving average”. The Percentage Price Oscillator is shown with a signal line, a histogram, and a centerline. Signals are generated with signal line crossovers, center line crossovers, and divergences, or surprising differences.

The PPO reflects the convergence and divergence of two moving averages. PPO is positive when the shorter moving average is above the longer moving average. The indicator moves further into positive territory as the shorter moving average distances itself from the longer moving average. This reflects strong upside momentum.

The PPO is negative when the shorter moving average is below the longer moving average. Negative readings grow when the shorter moving average distances itself from the longer moving average (goes further negative). This reflects strong downside momentum.

The histogram represents the difference between PPO and its EMA, the signal line. The histogram is positive when PPO is above its EMA and negative when PPO is below its EMA. The PPO-Histogram can be used to anticipate signal line crossovers in the PPO.

I am setting the PPO at 13,21,8.

Let’s See Why This Signal Could Offer Potential Trade Info

Each candle on the chart represents price movement over a 5-day (week) period. Next week’s candle will start with Monday’s price movement and then each consecutive day of the week will be added or subtracted to Monday’s number to create the weekly candle.

Options often offer a smaller overall investment, covering more shares of stock and potential for greater profits, as well as making money when the price of a stock drops.

Potential SPY trade:

I am typing this on Saturday. If price continues to rise you could consider a Call trade if it moves above 403. The short-term target is $410.

Check Out How an Option Trade Could Pay Out Big Time

The stock price as of today (Saturday) is $402.33. If price rose to $410 you would make $7.67.

If you were trading options and selected a 410 Call option strike, you would pay a premium of around $4.04 for the Dec 16th expiration, or $404 for the 100-share option contract. If price moves to 410, the premium is apt to go up about $3. Your premium of $404 plus $300= $704. That is a profit of 74% over a short period of time.

Remember, you can take profit anywhere along the line, you don’t have to wait for the expiration date to sell. It is often wise to take profit when it is earned, especially in a volatile market.

For updates on previous potential trades we have discussed, scroll to the bottom of this message.

I love teaching and sharing. It is my “thing”.

Stay positive and know you can do this. Knowing creates positive results! A part of the abundance process is letting go of anything negative, which creates space to receive.

I wish you the very best,

Wendy

Previous Trades:

Last week we looked at buying SPY 410 calls. On 11-21 the premium for the Dec 16th expiration date was $2.86. On 11-23 the premium was $ 4.36 which is a 52% profit.

Recent Comments