From Trigger Point Trade Alert Playbook

Efficient Market Theory argues that news is already factored into prices. By the time you hear about a news event, EMT claims, all of the effect that information will have on the market is already priced into the stock.

The challenge with that is that it only measures an initial reaction. In reality, it is more like the ripple effect where the immediate response to the price is just the beginning. The ripples that follow are moves that can be recognized and traded

for big money. COVID 19 was a great example of this.

Technically, the news of COVID hit in December of 2019 with the WHO releasing an alert. It can be argued that the scope of the potential impact of the virus was not yet known. On January 21st the first case was reported in Washington State in

the US. By January 31st, there were already 213 deaths in China and nearly 10,000 cases globally with 19 countries impacted.

Yet the markets continued to rally and pushed to all-time highs. For nearly a month after the virus hit the US markets stayed near their highs. It is clear that the news had already hit but it was the context and evolution of the story that triggered the crash. The gravity of the news was what sent prices dropping.

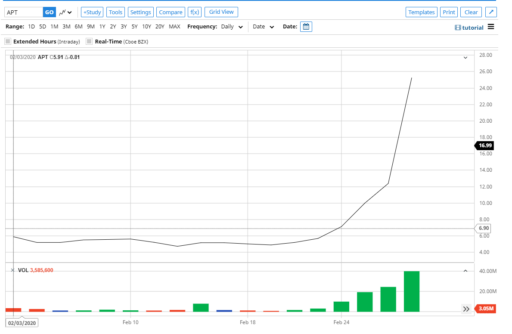

But the news did provide a spot light on key stocks that skyrocketed during the crisis. In fact, as the market tanked at an unprecedented pace, certain COVID related stocks saw huge gains. Alpha Pro Tech (APT), makers of masks and PPE

shot from $5 to nearly $40 in just weeks.

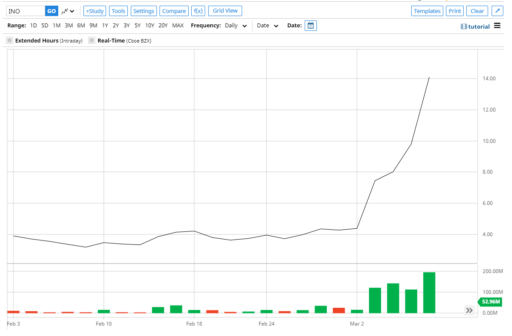

Another stock that launched as the market crashed was pharmaceutical company, Inovio (INO).

Clearly, the news impacts the markets in waves and is not completely factored in instantly. Both of these stocks were companies that had the potential to provide value in the midst of the crisis. As the news stories about COVID unfolded, it

made it clear that there would be a need for PPE and a focus on treatments and vaccines.

Of course, these weren’t the only companies producing these types of products, but by honing in the search to just companies in these areas and then using technical analysis to pinpoint which of those handful were really positioned to

take off, there was significant money to be made.

These type of opportunities happen as often as the news over reacts to a current event. Be sure to make sure you are on the right side of the media madness.

Sincerely,

Ian Cooper

Recent Comments