I’m giving you all a head start. You all can get into the markets before me…if you want.

I’m not going to race you to get started, because this isn’t a sprint, this is a marathon, and this signal isn’t a signal of a quick change and exit, it’s a signal of a major turn that could create massive leveraged returns and has created those kinds of returns before for me and many others in the past.

This all sounds too good to be true, but the signals that professional traders look for every day are there – and how not one, not two, but three of my favorite signals are lining up at the same time. So, let’s take a quick look at why I’m excited about buying the market today (but haven’t yet, but plan to do so):

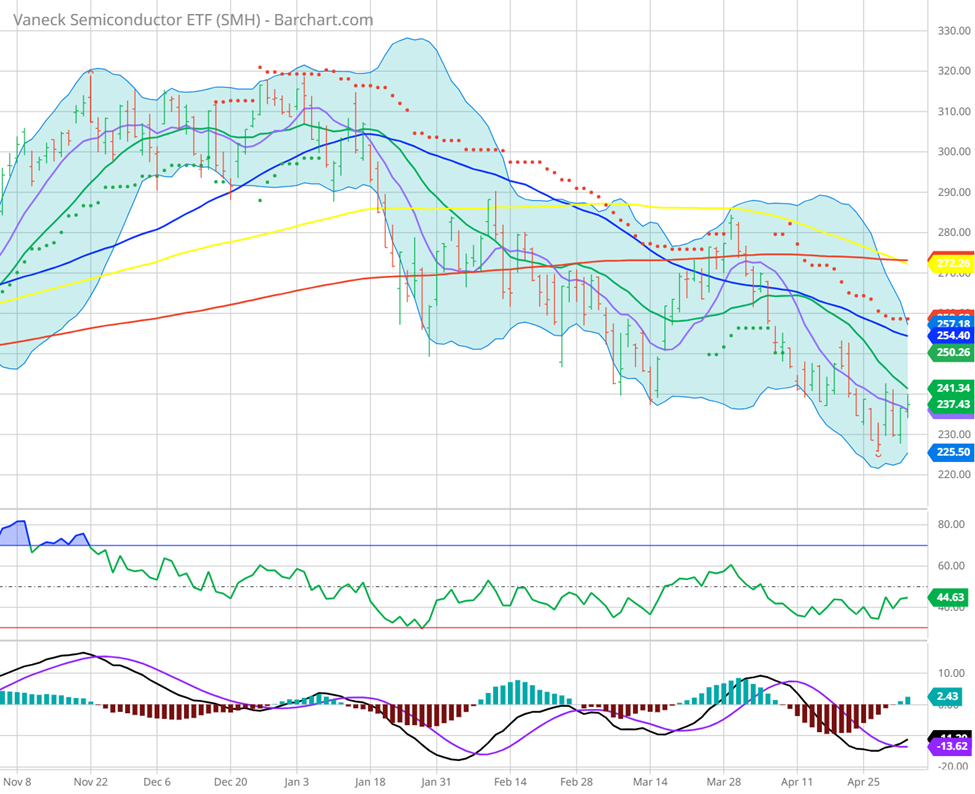

As you can see, in SMH, the semi-conductor index, we have both a higher high and a higher low (I’ll explain more on why this matters next week). This is a great indication of a reversal in this sector. On top of this, we have a move above the 10-Day Moving Average in this leading sector for tech. This is a great example of why I want to buy into the market.

And now, let’s dive even further into the same chart and look at the MACD:

As you can see, we had a bullish divergence that gives us another reason to buy into semiconductors. This is another indication that SMH is looking to change from a bearish trend to bullish, and if SMH can change to a bullish trend, then QQQ is likely to follow.

This is a potential game changer that the market is currently ignoring, which is why I’m paying attention to it.

At the same time, there are very few early indicators that the market is ready to buy into this early momentum shift, so I certainly need to define my risk, and that’s why options are a crucial tool in my toolbox.

So, please go to http://optionhotline.com to review how I traditionally apply technical signals and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments