From Keith Harwood, OptionHotline.com

Is this the beginning of a major move to the upside, or is it the end of the recovery?

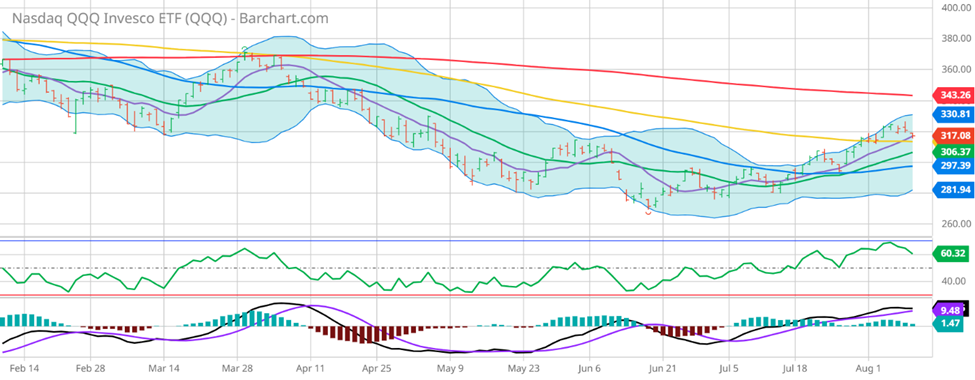

It seems everyone is asking the same question when looking at the major indexes. We’ve started to see a little bit of weakness in tech and the broad market, but not so much that we should be panicking to sell. Let’s look at ETF’s QQQ and SPY now to remind ourselves that today was just a dip, and the market isn’t anywhere close to a freefall:

When I look at the broad indexes, I see two very positive signs: the market is holding above the 10-Day Moving Average and continuing to hold above the 100-Day Moving Average. That means that for the market as a whole, momentum is holding for the short-term bull as well as the mid-to-long-term bull. We still have yet to get through the 200-Day Moving Average for the ultimate confirmation of a long-term bull, but the markets look pretty good.

But (there’s always a “but”), I’m seeing something very concerning in a leading indicator. Semi-conductors look bad, and semi-conductors are often a leading mover for the rest of tech. Let’s look at the ETF SMH:

SMH is below the 10-Day Moving Average. SMH is below the 100-Day Moving Average. SMH simply looks like it’s ready to re-test lows. That’s not what I want to see if I’m bullish for the market.

So, what does that mean for the markets? Is SMH right and predicting a bigger fall, or are the broader indexes right to hold onto key moving averages and continue a bull run off lows?

The market is a mixed bag right now. And with implied volatility low, that tells me that if I want to get into a directional position, I want to do so with options. That way, I get defined risk if I’m wrong, and I get leverage if I’m right. That’s a great combination for a directional trader when we could very easily see a major move to the upside or a repeat of our recent liquidations to the downside. But it’s important to remember that it’s equally important to make sure to select the right options trade for the directional strategy.

If you’d like to learn more, please go to http://optionhotline.com to review how I traditionally apply technical signals and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments