As earnings, inauguration, and inflation data are digested by the market, we are continuing to find new trends in many sectors and many individual names. Identifying those that seem likely to continue is a key driver of success in the coming week.

Before we get into the new names, I want to touch on a name discussed last week – MRVL:

Marvell has accelerated its rally and is trading at highs. With the push to a new high possible, we are certainly at an inflection point here – will the market reject higher prices than were seen on December 15th, or will investors and traders continue to allocate capital to push the stock to a new high and a breakout in the technical formation? Last week’s entry timing on the bull side has worked to this point, but the next leg higher isn’t as clear to me, so I will need to look for a new sector and a new stock for a higher probability upside move.

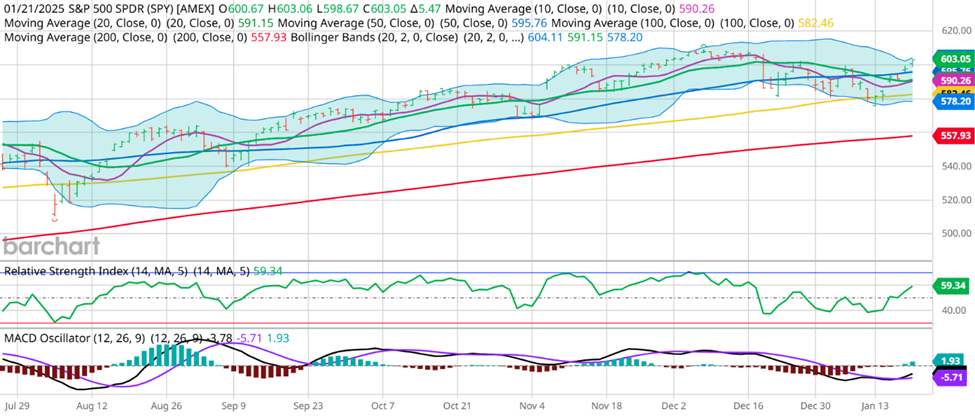

It’s back to the drawing board, with a top-down evaluation of the market’s investment flow. First off, I want to review the broad market behavior with SPY:

The S&P 500 is pressing through recent highs and looks to target a test of the December 6th high. The flow is bullish and providing a tailwind for the market bulls.

Within the S&P 500, I like the idea of reviewing a sector that has a lot of earnings information supporting increased prices, and that’s financials:

Financials have had a great response to the earnings information from last week and are continuing to press higher. With that backdrop, I’m looking for names that have a great technical setup within the sector that also have the benefit of artificial intelligence predictive analytics looking for another leg higher.

And that gets me focused on a name that just did what MRVL hasn’t done (yet), V:

Visa made a new high on Tuesday, showing that the prior high was not able to provide significant resistance. Earnings are next Thursday, so this would be a short holding period for me, but I can certainly get a leveraged return by trading off an expected continuation prior to the earnings announcement. The leverage in the options is still significant, and if the leadup to earnings follows the current money flow, I can generate a great return from even a small move.

The key is to know the inputs that prevent me from holding this trade for too long – it’s a trade, not an investment. And trades with options can generate returns that are multiples of a stock’s move while also defining my risk, so I can sleep comfortably with a bullish call position.

If you want to learn more about utilizing AI for predicting dynamic markets and the incredible opportunities that can be captured utilizing state-of-the-art technological advancements in trade recognition, send me an e-mail and I’ll be sure to get you all the information you need!

As always, please go to http://optionhotline.com to review how I traditionally apply artificial intelligence, technical signals, volatility analysis, and probability analysis to my options trades. And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments