Spoiler alert: because it worked. What I think as a writer matters much less than what you think as a reader. In looking at year end stats for what articles were most read this past year I found some interesting data. The piece that got the most attention was on the very consistent pattern that has repeatedly played out in the S&P. It has been absolutely dependable and as a result, offered some very lucrative trades. You can read the article from July here.

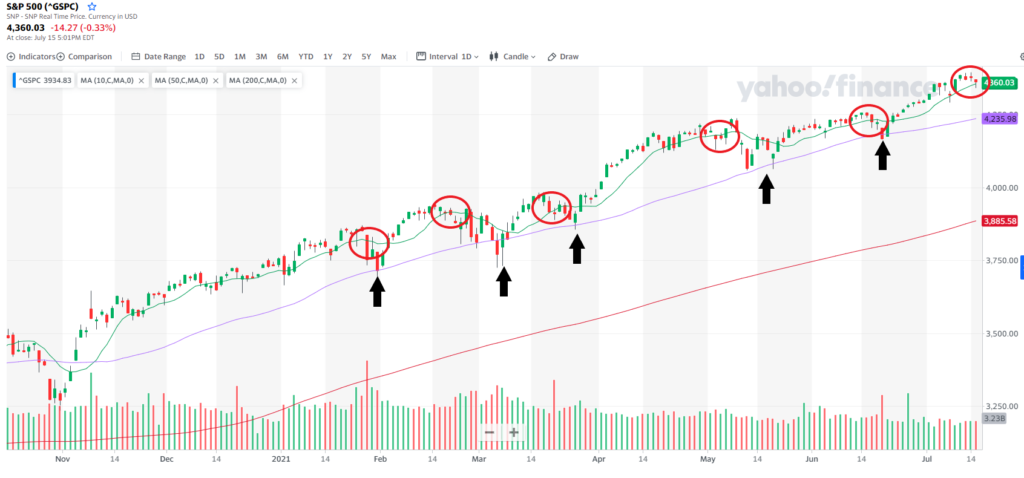

It is pretty clear why you all loved this article. Take a look at the chart we shared back then:

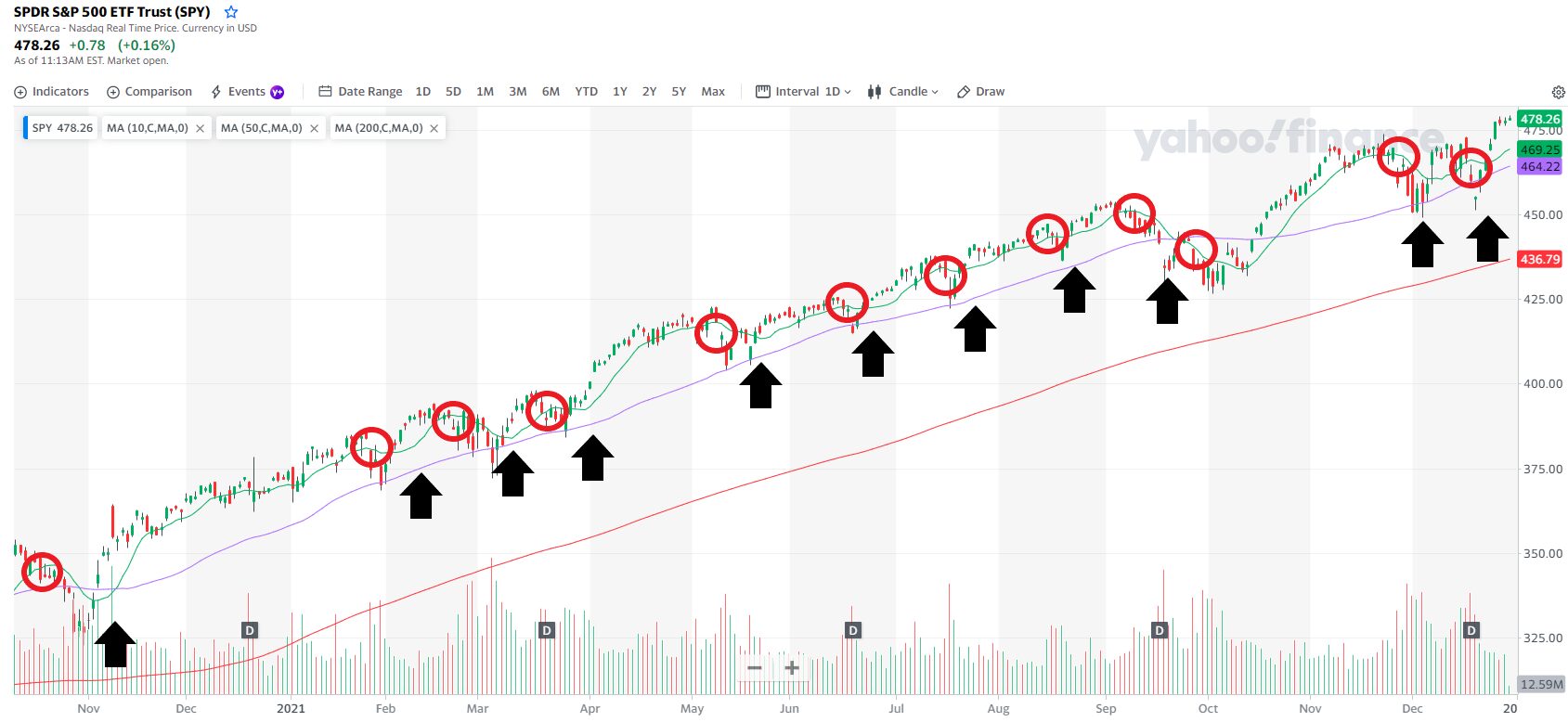

Now take a look at an updated version:

It is pretty clear by the additional red circles and black arrows that SPY, the ETF that tracks the S&P has an absolute love affair with its 50 day moving average. It telegraphs the smooch in each of the red circles by confirming a move below the 10 day moving average, rushes down to the 50, puckers up and then shoots back above the 10.

There are a couple exceptions and they might make you worry that it has missed the kiss and is going to fall flat on its face, but then it gets its footing and shoots back up.

Here are a couple things you can take away from this to add to your strategy for 2022.

- The SPY is current pretty extended above its 10 day moving average and got their quickly. That increases the probability it will snap back and head for the 50.

- We have seen one of the strongest years for the market in a long time. A lot of traders are holding out on taking gains to push the tax burden into the next year. That increases the odds of a sell off at the start of the new year.

- Now is a great time to find as much info as you can about how to trade the SPY.

Wendy Kirkland has been helping traders grab wins from SPY for years with her Smart Options Paycheck program. If you are looking for a great way to really transform your trading in the new year, this is definitely a good place to start. Check out a quick video on how it works here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments