When you start to trade it is common to over complicate your process. In all fairness, the market can seem very random and can break the very rules it seems to create. But traders who have been at this for awhile somehow manage to stay in the markets and keep most of their sanity. Most of it.

The trick to staying cool and focused in spite of an erratic market is to choose when to worry wisely. It is easy to get tunnel vision and lock in on one stock or two small of a time frame and miss the bigger picture. The pros have managed to find a way to tune out the noise and build systems with more concrete metrics that they use as alarms to determine when they need to worry.

Not unlike a moisture alarm in a basement will tell you if there is suddenly water on the floor. It would be painful to go in an unused area every hour to check so setting an alarm makes sure that you only worry when there is a problem.

One of the most effective and common tools traders use to decide when to take action are moving averages. Of all the traders I have spoken with (and it is a pretty large group of seasoned veterans) nearly every single one uses a moving average of some sort or some indicator based on moving averages.

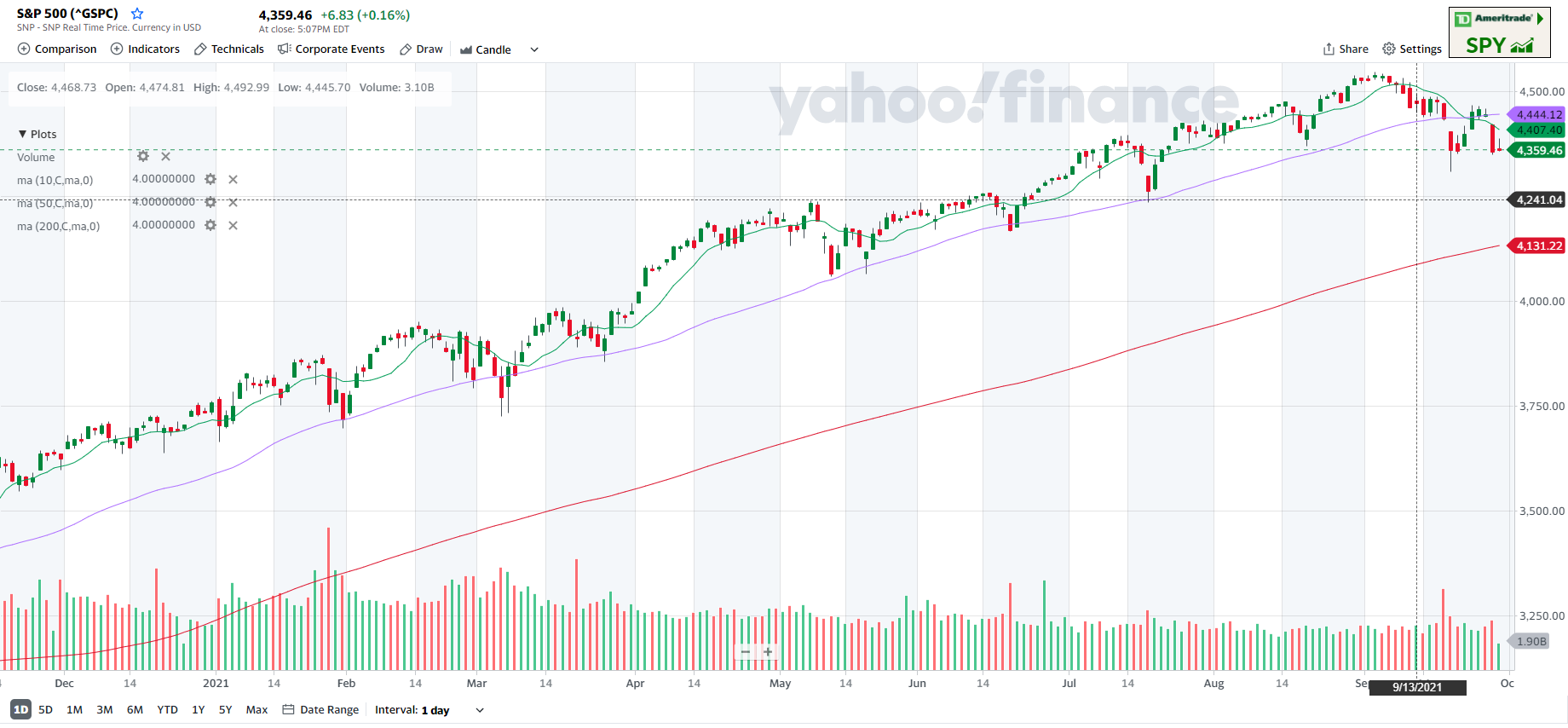

Simple Moving Averages are an easy way to look at how strongly a trend is moving in the current direction. Take a look at the current chart of the S&P:

By definition, the price is always close the Moving Averages with shorter time frames. The green line on the chart above is the 10 day Moving Average. When the price moves above or below that point it is an early indication of a change. The longer the time frame the more momentum it takes to move the price across the moving average. We can see above that the S&P is currently below the 50 day Moving Average which shows it has increased momentum to the downside. If the price gets pulled below the red line which is the 200 day Moving Average, that shows significant downside momentum.

These are not always exact predictors of what will come next, but they do help us visualize the trend and build trades that have a higher probability of moving in the direction we expect.

Don Fishback is highly recognized as an expert on determining the probability of the outcome of a trade. And while the science behind his approach has been developed over years of research, he has made the concept incredibly simple to understand and apply.

If you are looking for a great place to find tools and strategies that can boost your potential wins, his book Your Quick-Start Guide To Trading Options is the best I have read. Grab a copy here and see for yourself.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments