This misunderstanding about selecting a strike could prevent you from grabbing a big win.

Options are a great tool in a wild market like the one we are in. You can use them to boost leverage and manage risk. But often people make a mistake when selecting the strike price for their option. The strike is the price the option contract gives for the underlying asset. Often, people will look at this and think the asset has to get to that price for the option to be a winner. Say a stock is at $50. If you are buying a call (an option contract that will give you the right to buy that stock at the agreed strike price up til the expiration of the option) many will use technical analysis and charting to determine where they expect the stock to go and use that to select an option with a corresponding strike. Say the chart shows it is likely the stock will go to $60. The common approach may be to buy a call with a strike of $60. But there is another way to approach it that can offer a greater potential.

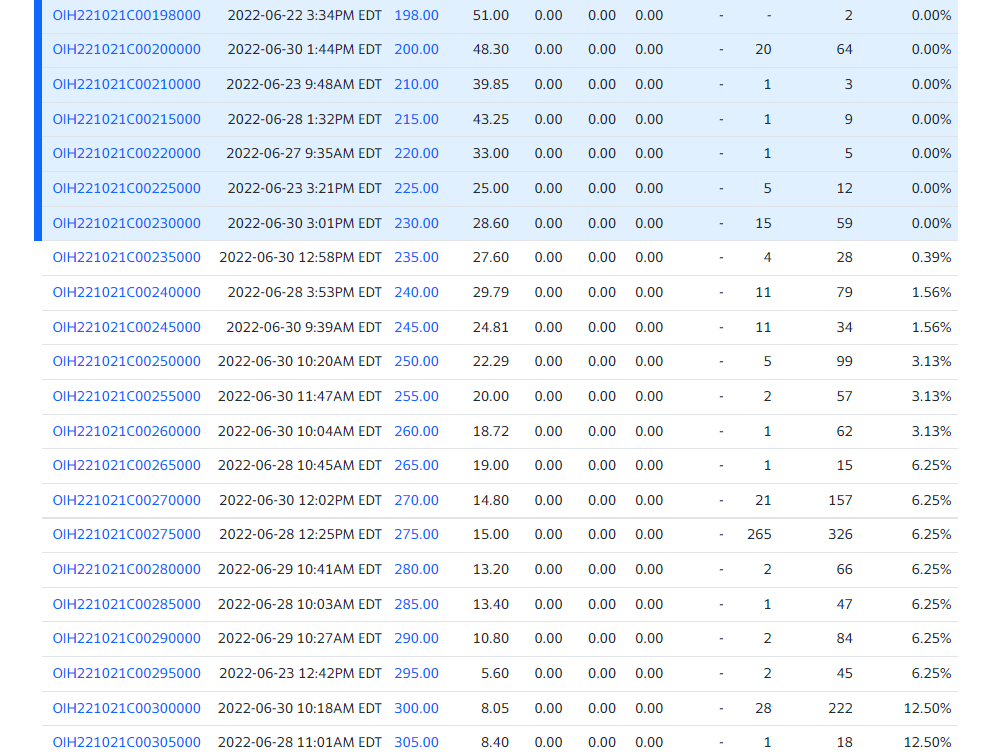

Take a look at the ETF that tracks oil OIH:

It is currently at about 232 and there is a strong argument that oil will go up as inflation lingers. Looking at the chart a potential point of resistance would be the recent low of 250 back in May. This would make 250 a strike that may be a good choice. But, if you look at longer term options the premiums show that there are some bargains at strike prices that may not be the first choice.

Take a look at the October option prices:

You can see that there is a 50% drop in the premium at 295. If the time frame were shorter, with a weekly options for example, it is unlikely that premium would really move much. But by giving the move more time to play out, that strike can be a potentially lucrative trade. Keep in mind, OIH doesn’t have to get to 295. If it makes a strong move in that direction, the demand for that 295 call will go up and so will the price. With the big gap in price to the 290 call, it could move up quickly.

Andy Chambers uses great strategies with long term options in his Market Propulsion approach. If you want to see how a little more in options premiums can offer much more in wins, check out his approach here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments