ETFs or Exchange Traded Funds have become an extremely effective trading tool. They offer many advantages to a trader and provide accessibility to trading strategies that were difficult to accomplish for individual traders in the past. A key advantage is that they can provide the diversity of an entire sector vs trying to pick a single stock within that sector.

And options traders love ETFs. In fact, the most highly liquid options are in the SPY, the ETF that tracks the S&P 500.

There are a number of financial institutions that create and manage ETFs and as a result there are often multiple ETFs based on the same sector or group of assets. The important element to remember is that not all ETFs are created the same.

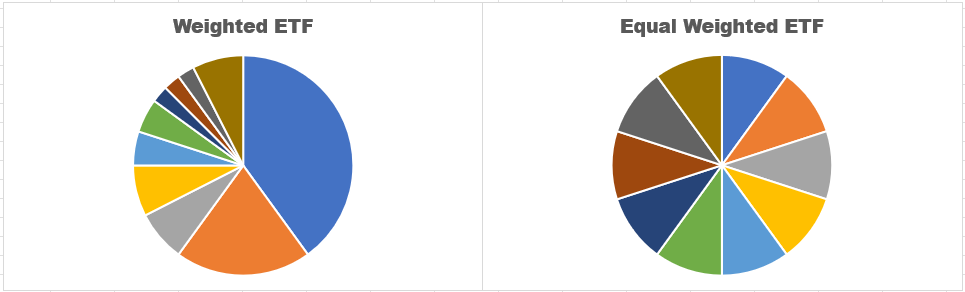

The two major types are Market Weighted and Equal Weighted. Market Weighted ETFs give more weight to stocks with larger market cap. If you have 10 stocks in an ETF, one may have a weight of 3 while others may have a value of less than one.

An Equal Weighted ETF made up of 10 stocks would give each stock a weight of 10.

Take a look at a chart of SPY, a Market Weighted ETF:

Because the elements of SPY with larger market caps will have a bigger influence on the price move, there is a tendency for these ETFs to jump a bit more if a heavy component has some type of big event.

Conversely, Equal Weighted ETFs will smooth out those bumps a bit. Another strategy that these two types of ETFs contribute to is that a heavy component of a Market Weighted ETF make be the first in the sector to move and pull the whole sector along with it. In this case the Market Weighted ETF may lead the Equal Weighted ETF and offer an opportunity to get in before the move happens.

Keith Harwood helped us understand these types of ETFs a lot better. If you want to see more of the ways he spots trades that many others miss, grab his Market Maker Cheat Sheet and get the edge the pro traders don’t want you to have.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments