by Duane Davis

Several years ago, after returning from a trip to the Far East, I was standing in line at a large regional bank waiting to exchange some left over Japanese Yen back into U.S. Dollars when an argument broke out between the lady in front of me and the bank teller. As the lady continued to raise her voice, I couldn’t help but to hear the reason for her complaint. “I was in this bank 8 weeks ago and I gave you $2,000 and you gave me back just over 240,000 Japanese Yen. I knew I wouldn’t spend all of that money, but I wanted to make sure that I had enough.” The lady went on to say, “As it turned out, I only spent half of this money and now I want my $1,000 back.” The teller, a nice young man in his early thirties, was trying to explain to the lady that the conversion rate of the Japanese Yen had gone up in the last 8 weeks and instead of getting back $1,000, she was only entitled to a little over $900.

As I listened patiently to their ‘discussion’, I was reminded how little most Americans understand about the value of one country’s currency vs. another and how much those values can change on a daily basis. This lady, as well as many others just like her, had the understanding that a dollar was basically worth about the same today as it was 2 months ago when it comes to exchanging it for the currency from another country. Oh sure, she’d probably heard on the 6 o’clock news that the stock market was up that day because of the weak dollar, but that kind of information never really meant that much to her. As far as she was concerned, if she gave the bank, $1,000 for some Japanese Yen 8 weeks ago, she wanted her $1,000 back.

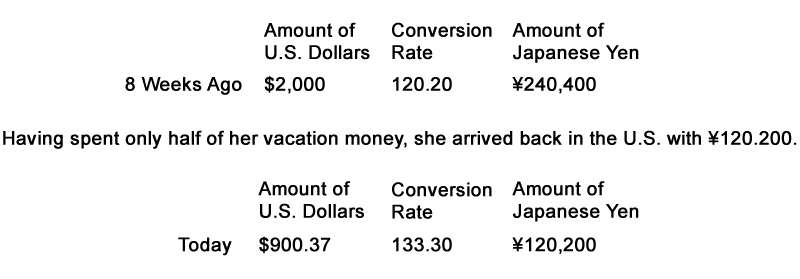

Let’s take a look at the arithmetic behind this lady’s frustration:

Before long, the manager of the bank came to the young tellers rescue and asked the lady to step into his office. It was now my turn in line and I felt very bad for the young man and I assured him that because I was also there to exchange some Japanese Yen for U.S. Dollars that I was already aware that I’d be receiving fewer dollars than what I paid. Although my trip was only about half of that of the lady, the strong Japanese Yen had its affect on my money as well.

Basically, when any foreign currency is strong, it converts back to fewer U.S. Dollars. Similarly, when a foreign currency is weak, it converts back to more U.S. Dollars.

The value of any country’s currency is based on how the rest of the world feels about that country’s economy. If a country’s economy is robust and healthy, then more and more banks and governments around the world will be placing ‘their’ money into that country’s economy. They can do that several ways, they can purchase stock in companies that are native to that country, they can purchase bonds (or notes) offered by that country or they can simply exchange ‘their’ money for that country’s money. Exchanging one currency for another is done very easily via the Foreign Exchange market (or Forex). Banks, governments, professional investors, traders and speculators conduct more than $1 Trillion in foreign currency transactions most every business day.

A country’s economy can be affected by many things such as their monetary policy (reflected primarily by their internal interest rate), political events, military events, inflation and unemployment. The simplest of these to follow are political and military events because they’re covered in the news each day. What are more difficult to assess are the non-political, non-military events. With the exception of interest rate changes (which are widely covered by the news media), most internal economic factors are somewhat difficult to track. As a result, it’s just not that easy for traders to really know the true health of a country’s economy.

Fundamental vs. Technical Analysis

Investors and traders that try to keep up with the health of a country’s economy are able to do so by constant assessment of economic reports that are released by the government. Trying to stay up with all of this can make anyone dizzy. It’s just not a pleasant way to trade.

A more effective way to trade is to look at a chart of how investors and traders around the world have valued a currency over the past week, the past month, the past year or maybe even the past 10 years. Investors and traders whose decisions come primarily from their analysis of a price chart are referred to as ‘technicians’. Most technicians have the opinion that all of the known fundamental data from the past is already reflected in the price chart. It’s a lot more fun to study price charts than it is to study economic reports.

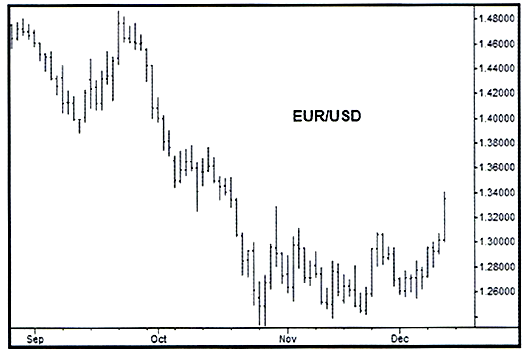

Below is a typical price chart for the Euro Currency vs. the U.S. Dollar:

Notice in this chart the letters “EUR/USD”. These letters are the symbol that is used by Forex traders when trading the Euro Currency against the US dollar. You may see the symbol with the slash “/” or without it.

It’s Thursday, December 11th 2008 and the EURUSD has enjoyed a remarkably strong day. As you look at this chart, is it your opinion that this market is likely to go up in the next several days or down? If you could trade this market from the comfort of your living room for as little as $10 and pay less than 30 cents for broker fees, would you be a buyer (because you feel that it’s going up from here) or a seller (because you feel that it’s going down)? Either way, if you’re right, your fun little trade could make you $100.

Recent Comments