What to Watch for This Week

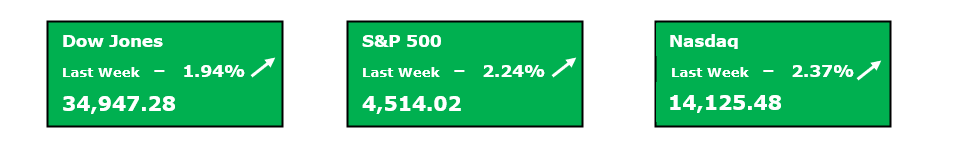

Investors believe they now see the path ahead much more clearly after last week’s cooler than expected CPI report. This report gave the markets confidence that the Fed has won the battle against inflation and will not pursue further hikes. This week is shortened as the markets will be closed on Thursday and will close early on Friday in observance of the Thanksgiving holiday. Despite the shortened week, investors will still receive a handful of key economic reports including updated U.S. Leading Economic Indicators & the new Initial jobless claims. Additionally, the Fed Minutes transcripts from their latest meeting will be made public.

- U.S. Leading Economic Indicators – On Monday morning, The Conference Board will release their November Leading Economic Indicators report. This report includes a variety of significant economic indicators and data that often serve as a good predictor of the U.S. economy’s trajectory. Ten main data points compiled by the Conference Board are conglomerated into an index called the Leading Economic Index (LEI), which in the past has served as a reliable recession indicator.

- In last month’s report, the LEI index posted its 18th consecutive monthly decline, dropping 0.7% from the previous month. October’s report expected on Monday is forecasted to post another 0.7% decline.

- Initial Jobless Claims – The Department of Labor provides a weekly report that records new Initial Jobless Claims in the U.S. Since troughing in September, initial claims have begun trending up, with the past four reports coming in higher than expected. Last week’s report was much higher than expected at 231K compared to an expectation of 220K. If Initial Jobless Claims continue to trend higher, this will put continued downward pressure on the U.S. Dollar & U.S. Treasury yields.

- Wednesday’s report is expected to show 229,000 new jobless claims, a slight decrease from the previous week’s report.

- Fed Minutes– On Tuesday afternoon investors will get their first chance to begin digesting the Fed Minutes from the latest FOMC meeting. After every FOMC meeting and decision, a few weeks later the Fed will release a transcript of their meeting so that investors can get a peek behind the curtain to see the reasoning that led to the recent policy decision. This look into the Fed’s rationale is closely watched as it can provide some helpful context into what the FOMC may do at their next meeting.

- If the Fed Minutes confirm that the committee plans to remain data-dependent at future meetings, this coupled with recent cooler than expected inflation data and softer economic data, should help solidify investors opinion that the committee will not raise the Fed Funds rate further.

Federal Reserve Watch

After last week’s lower than expected CPI print from October, the market seems to have confidence that the Fed has finished hiking rates in this cycle. We are expected to hear from at least one Fed President this week in addition to the Minutes from the latest Fed meeting being released. Despite the markets being convinced that this cycle’s rate hikes are over, most anticipate Fed messaging to remain hawkish.

- The CME Group now projects a 100.0% probability that at the next FOMC meeting the committee will opt to maintain the current target range between 5.25%-5.50%. Additionally, Fed Funds Futures are now indicating that the first rate cut could be as early as the Fed’s May meeting in ’24.

All About the Earnings

This week, investors will hear from the final ‘Magnificent 7’ company to reportas NVIDIA Corporation is set to report their earnings. Also, due to report their Q3 earnings this week is a mixed group of various retailers. Finally, the major industrial name, Deere & Company, is set to report their latest quarterly earnings.

- There is no question about what the most anticipated earnings report will be this week. On Tuesday after the market close, NVIDIA Corporation is expected to report their Q3 results. Given A.I. was a major theme in the market’s latest bullish run and NVDA is the biggest beneficiary of all things A.I., this will likely be the week’s most pivotal report.

- NVDA earnings are expected to come in at $3.01 EPS.

- Prior to the market open on Tuesday, a diverse basket of various retail ers are expected to post their latest Q3 results. Investors expect to hear from Lowe’s Companies, Inc., Best Buy Co., Inc., Dick’s Sporting Goods Inc., & American Eagle Outfitters, Inc. In addition to proving the performance of each company, these reports will be watched as they will provide some read-through into the current health of the U.S. consumer.

- LOW earnings are expected to come in at $3.05 EPS.

- BBY earnings are expected to come in at $1.19 EPS.DKS earnings are expected to come in at $2.43 EPS.

- AEO earnings are expected to come in at $0.48 EPS.

- Before the market opens on Wednesday, Deere & Company will report their third quarter earnings. DE shares have underperformed since mid-August. If DE can deliver strong earnings and communicate a bright outlook, this could help get the stock out of its current downtrend.

- DE earnings are expected to come in at $7.49 EPS.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments