The current market climate is creating a pattern in an exceptionally high number of stocks and ETFs. Keith Harwood sent a heads up on how to take advantage of this pattern with a trade that shines a spot light on where the real money is right now. Scroll down and take a look.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

From Keith Harwood of OptionHotline…

It’s been quoted many times, but for me, the one that sticks out to me is from a band named “Semisonic”, in their 1998 hit song titled “Closing Time”:

You don’t have to go home, but you can’t stay here.

My apologies if that song is now stuck in your head, but every time I see a market setup like we are seeing now, that particular song lyric immediately pops into my head. And it really doesn’t leave until we see that market move that gets the market away from “here”.

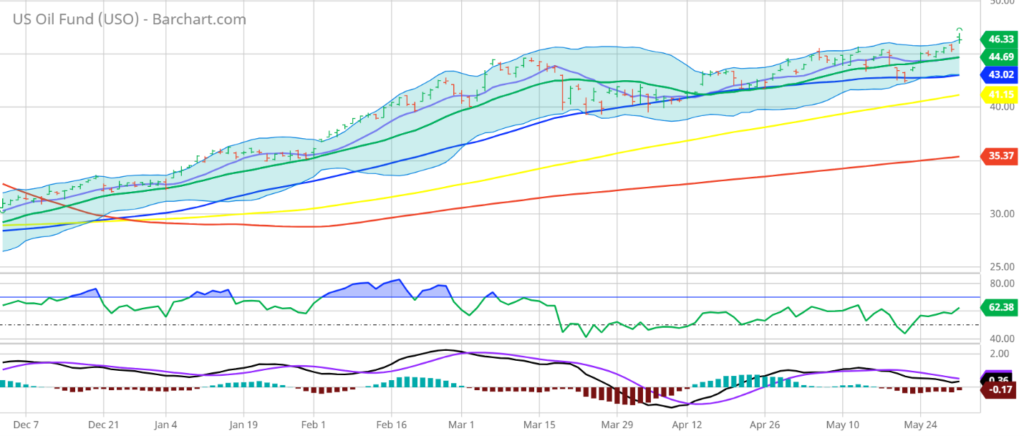

Now, you may be wondering exactly which part of the market I’m talking about when I reference this. But, perhaps to your and my surprise, it’s most of the market. Let’s start with the morning move in USO (US Oil Fund ETF) as we were testing all-time highs on Friday:

That certainly sets up a lot of trades with oil going to multi-year highs. Of course, if that move in oil doesn’t hold and it fades back into its range, we are also not staying here.

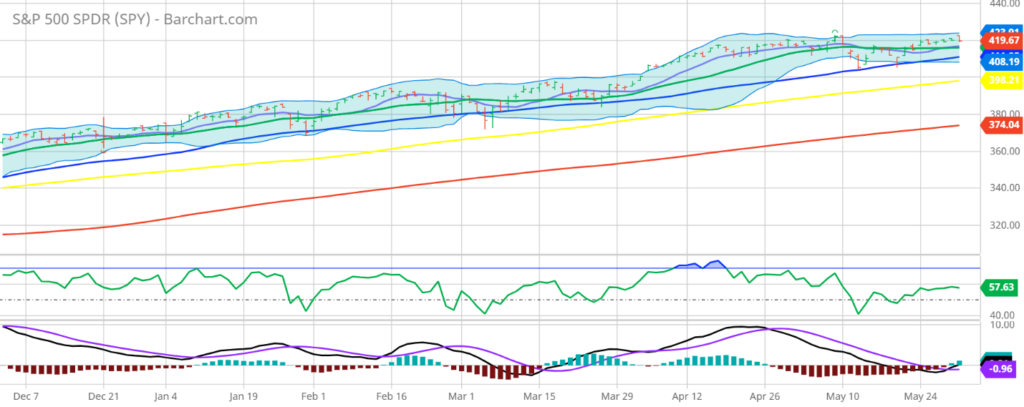

Next up, SPY (S&P 500 SPDR ETF):

Again, this ETF is sitting at highs. It hasn’t broken out to new highs like oil did, but it’s awfully close. When we are a matter of fractions of a percent away, I’m looking for ways to play for a massive new bull run, or a pullback to prior support (in this case, the 50-Day Moving Average, which is about 2% down from here). But I certainly don’t want to bet on this market staying here.

The list goes on and on. There are many sectors and stocks that have been sitting near highs. Some will make new highs and continue. Oil or the S&P 500 could both be in that camp. Some will simply fade back to support and then test the waters of entering a bearish trade. Oil or the S&P 500 could both be in that camp.

But, what’s most important to me is maximizing my leverage if the break out is confirmed and defining my risk if not. While a small drop in USO or SPY could be a decent money-maker, the real money is in buying out-of-the-money calls for the potentially explosive move. As long as I manage my risk the right way, that’s a trade I can certainly get excited about.

Importantly, there are many of these trades setting up in the market right now. It’s not just two of the biggest sectors in the world. There are some amazing leveraged opportunities available thanks to the market consolidation, and that’s what gets me excited about a time of year that’s most often a pretty boring trading environment: summer.

To all of those market setups that are seemingly relaxing with a cocktail and have been going nowhere for weeks:

So, finish your whiskey or beer… you don’t have to go home, but you can’t stay here.

Please take this chance to review how I apply technical signals to my options trades at https://optionhotline.com and if you have any questions, never hesitate to e-mail me.

Keith Harwood

Keith@optionhotline.com

Recent Comments