All eyes are on the Fed this week, that is if they can peel away from the non stop coverage of Putin’s attack on Ukraine. The market is drinking uncertainty from a fire hose and the VIX is overflowing. Everyone keeps asking “What is Putin’s end game?” Another good question for us traders is “What is the market’s end game?”

The market will turn around at some point and go back up. It will bounce around wildly until it does that. Will the Fed meeting this week be the event that allows the market to find the bottom? Unlikely. But it could create an environment that will allow the market to find support. There is a sense that the conflict between Russia and the Ukraine will continue to cause the market to thrash until there is some sign of stability. Remember, markets were dropping before the conflict started so there is more to this current market climate than any one single factor.

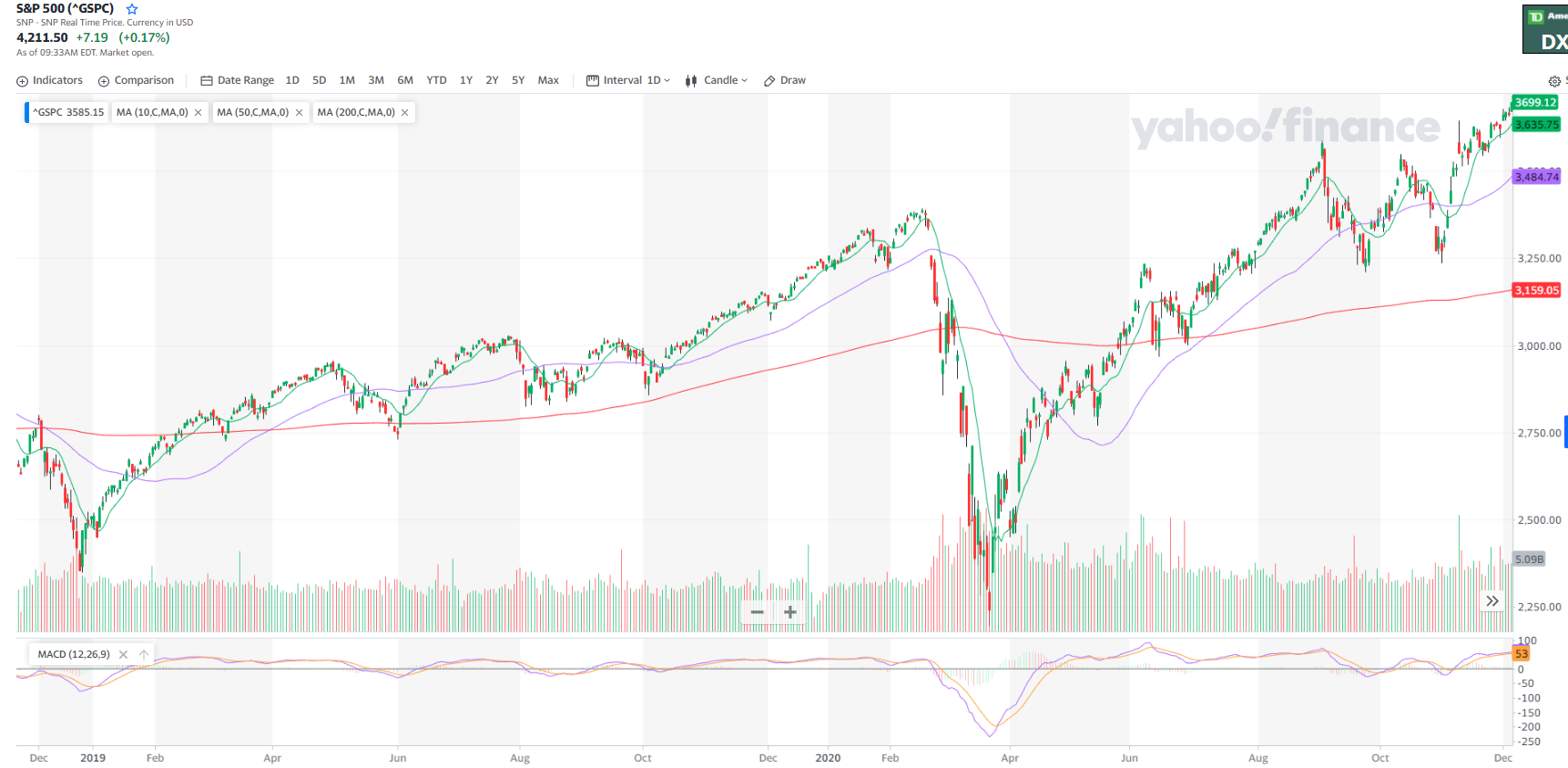

To find a smart way to spot the bottom and trade it, you don’t have to pinpoint the exact minute the market hits its lowest point. Take a look at the S&P from the COVID crash.

The exact bottom was about March 23rd. But you can clearly see that if you waited until a month later when the S&P crossed above its 50 day moving average there was still a LOT of gain to be had.

Expanding the time your positions have to play out can be a huge benefit. Andy Chambers built a method for his family and friends that took little time to trade and gave them the biggest possible window for those trades to pay off. If you want t see the key to his approach, click here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments